Remember Password

AXA Yacht and Boat Insurance Spain

Throw your worries overboard

We offer you the best insurance solutions for yachts and boats in Spain.

AXA adapts to the needs of its customers. In the process, service, expertise, and personalized service remain at the forefront.

Benefits at a glance:

- Legal liability insurance included in basic protection

- Extended liability insurance up to €1.5 million, including risks on land

- Boat hull insurance (including fire, theft, collision, etc.)

- Forces of nature

- Accessories, personal items, dinghies, and sails

- Personal accidents

- Legal protection

- Roadside assistance

In addition to legally mandated insurance services, we offer additional protection against the most common risks at sea, including shore excursions and overland transportation.

As the exclusive agency for AXA Yachting Solutions , we also offer insurance solutions for high-end boats and luxury yachts.

AXA Jet Ski Insurance

AXA third-pary liability insurance for professionals of the nautic sector

We can provide information about the great benefits of AXA Boat Insurance. Simply use our online form or arrange a personal consultation.

Request offer, request your quote now, the fields marked with * are mandatory, as they are necessary for issuing your offer.

- Street Number

- I have read and accept the privacy policy and terms of use.

- I have read and accept the privacy policy and I agree to receive commercial communications.

*Services according to the AXA insurance terms and conditions.

Nicht registrieren

The reCAPTCHA wasn't entered correctly.

Boat and Yacht

Yacht insurance in spain.

Good boat insurance or yacht insurance in Spain can seem a bit difficult. It is important to look carefully at the obligations and wishes in each situation.

“If I transport my boat by road, am I insured?”

Every boat is required to have third party liability insurance. In addition, breakdown assistance or cover for damage to your own boat or yacht is not an unnecessary luxury.

What is boat or yacht insurance for?

First of all, it is important to be covered for damage to third parties . (third party liability) This third party liability insurance is mandatory , just like with car insurance. And just like car insurance, you can opt for only third-party liability (Damage to third parties) or All Risk . With All Risk coverage you are well insured, including against damage to your own boat or yacht .

In addition, there is coverage for towing services in the event of a breakdown. Both on water and on land . Depending on the company, additional (car) insurance may be required for this.

Insurance during storage

Do you leave the boat in the harbour? Do you store it at home or at an (external) storage facility ? This is important to indicate when applying for insurance. In the event of theft, different coverage conditions apply in all cases. When you store a boat or yacht externally , you naturally want to be sure that it is properly insured . Our advice is therefore always: Always keep the insurance under your own management .

A special insurer for boat and yacht insurance

We at IFAR are independent and work with more than 20 leading insurers in Spain. In addition, one of them is the market leader in the field of boat and yacht insurance . We are happy to help you find insurance that meets all your requirements and wishes. Let us request and compare your quotes, free of charge and without obligation .

Professional

Official broker

We represent your interests

We make it safe

Enjoy Spain, we make it safe

IFAR is a registered insurance broker. For this, the strictest requirements must be met in Spain. This guarantees the treatment of your insurance at the highest quality level.

We work with more than 20 Spanish and international insurers. From this we choose the insurance with the best premiums for you per insurance. And if a company raises its premiums, we go to another. This way we keep your premiums low.

We make the translation for you in terms of language and regulations. You can email and call us in English. We answer your questions as clearly as possible. In fact, we simply arrange everything. This is how we make it as easy as possible for you.

A mortgage for your dream house in Spain turns out to be different than in the UK, USA or any other country. You will receive a Spanish brochure with everything you need to deliver and the highest interest rate because you are a foreigner. We only ask you what is needed, in English, and give you the best offer in no time.

Please ask your question

We want you to be able to work and live safely in Spain. We take care of all your insurance policies for you without having to pay more premiums.

Can we help you too? Ask your question here:

IFAR Barcelona

Rambla Catalunya 25 , Planta Pal 08007 Barcelona [email protected]

IFAR Madrid

Principe de Vergara 73 28006 Madrid [email protected]

IFAR Alicante

Calle Benlliure 2 03530 La Nucia, Alicante [email protected]

Useful links

- Emergencies

Follow us on social media

- © 2024 - IFAR

- General terms

- Privacy policy

Start saving on your Yacht and Boat Insurance

Get a Tailored Quote now

Excellent!

Hundreds of Happy Clients

Edward William, the stress free way to insurance.

We are the one stop shop for all of your marine insurance needs. Whether you are looking to insure a Bass Boat, Centre Console Boat, Sport-fishing Boat, Aluminium Fishing Boat, Walkaround Boat, Bowrider Boat, Pontoon Boat, Sailboat, Trawler Boat, Cabin Cruiser Boat, Fish & Ski Boat, Ski Boat, Wakeboard Boat, Jet Boat or any type of Personal Watercraft, including Ferro Cement and Classic Wooden Boats, we can offer you competitive quotations.

My boat insurance

Renew your policy, view and download your policy documents. See outstanding payments and pay online.

Login or sign up here

A boat insurance adapted to your needs

What ever your needs all our policies are tailor made to suit your individual requirements.

Find out more about boat insurances

Making a claim has never been easier

Simply click the below link and follow the guidelines.

Read our claim FAQs

Tremendous service!

"we want to thank you for your prompt and gracious method of dealing with this unfortunate situation. we are refreshed to see northernreef insurance has obvious good business practices, and we will be continuing our coverage in years to come.", read more reviews, why trust edward william.

Edward William is not led by a computer generated quotation system that says yes, no and how much, they have underwriters who using the authority granted to them by the insurance company look at each risk on its merit and charge the appropriate premium for the cover required.

Whether it is Ferro Cement, Classic Wooden or a Super Yacht, we will endeavour to find the right premium for you.

Rivers, Canals, Coasts or Oceans, if your boat floats on it we will cover it.

Whether it is pleasure use only or if boating is your business we can cover it.

Unlike some who are restricted by geographical limits at Edward William we deal with a range of Insurers who can cover your boat anywhere in the world.

Calculate your boat insurance to save money now!

* It will take you less than 2 minutes

Let´s calculate

Boat & Marine Insurance Specialists Spain & Europe for Expats in English.

Marine and boat insurance specialists - europe, www.boatinsuranceinspain.com - in english.

MARINE & BOAT INSURANCE IN SPAIN & EUROPE - ABOUT US.

www.boatinsuranceinspain.com is a website designed to provide clients with affordable Boat and Marine insurance for Expats in Spain, Portugal, Gibraltar, UK and Europe, including the Iberian Peninsula and the Balearic Islands, from one central online source. Our specialist boat insurance professionals are here to provide you with an exceptional personal service in English.

BOAT INSURANCE IN SPAIN, UK, GIBRALTAR, PORTUGAL & EUROPE IN ENGLISH

We do have multilingual staff to cover all languages spoken by Expats in all areas. As we specialise in providing all forms of insurance to the Expat community, English is our prime language. We understand that many Expats living in the areas we cover, do not speak the local language and need assistance with their insurance quotes or coverage.

WHAT IS BOAT INSURANCE? - EXPAT MARINE INSURANCE IN SPAIN.

Boat insurance coverage in spain..

Boat & Marine insurance in Spain is designed to cover any type of watercraft that can be used on water, whether for river or sea use. From small rubber dinghies and tenders, motor and speed boats, family cruisers and mega yachts, to professional skippers, rental boats, tourist businesses that rental boats in tourist areas. Spain, Gibraltar and Portugal are all predominantly surrounded by large expanses of water and have a huge contingent of assorted marine craft plying the waters.

CAN YOU INSURE BRITISH REGISTERED (SSR) BOATS AND WATERCRAFT IN SPAIN?

Yes, we can. We insure many SSR (Small ships Registered) boats from the UK. If you have brought a boat to Spain and it is not registered you will need to get some sort of registration for it to enable you to use your boat in Spanish waters. The Small Ships Register is a simple online registration process that costs about 25 GBP.

USING A BRITISH TRAILER TO TOW YOUR BOAT IN SPAIN.

If you bring your boat from the UK on a British boat trailer, you can legally use the trailer to tow your boat provided that the vehicle towing the boat is a British registered vehicle . If you are towing it behind a Spanish or other foreign registered vehicle, even if you put a matching Spanish number plate on the trailer, you are likely to get a hefty fine or even have the trailer and the boat on it, confiscated. Importing the British trailer is not much of an option as the costs of importing that trailer are likely to exceed the value of the trailer.

TOWING AND TRAILER INSURANCE IN SPAIN.

Insurance for your boat or any other trailer, if it does not exceed 750 kg, is normally included in our car insurance policies, along with the mandatory breakdown recovery insurance . If you don't have the mandatory breakdown recovery insurance on your UK plated vehicle, we can arrange that for you, as a separate policy. Our Car insurance policies automatically include breakdown insurance in Spain and Europe and are often cheaper than car insurance in the UK.

INSURANCE FOR BOAT & MARINE BUSINESSES AND MARINAS.

www.boatinsuranceinspain.com also cover all professional aspects of boating and marine insurances that will cover professional skippers, tugs and cargo vessels, RoRo container ships and cruise liners, and provide insurances for Marinas and workshops that deal with anything to do with the Marine industry including dive boats and scuba divers.

WHAT DOES BOAT INSURANCE COVER IN SPAIN?

Almost anything to do with boats can be covered. A lot will depend on the type of boat and whether it is for private, recreational or commercial use. Our team of professional boat insurance specialists will help you determine what is required legally and advise you as to the right type of boat insurance to have in Spain.

BOAT INSURANCE IN SPAIN FOR FIRE AND THEFT.

Protecting your boats and watercraft in Spain against fire and theft is imperative. If your boat was left in a Marina and caught fire it could cause extensive damage to your boat and many other boats in close proximity within the Marina. You may have it sat on a trailer in your driveway and come home to find it missing. Everything gone! Boat insurance would be there to help you mitigate any losses.

PUBLIC LIABILITY BOAT INSURANCE IN SPAIN .

Mandatory Public Liability insurance for your boat and passengers is required by law in Spain, regardless on the size of your boat. Public liability will protect you from any claims against you in the event of personal or bodily injury to passengers or the public.

VOLUNTARY PUBLIC LIABILITY INSURANCE FOR BOATS AND PLEASURE CRAFT IN SPAIN.

Voluntary public liability Insurance for boats is a contractual liability affecting owners of sports and leisure boats. It will cover you for towing water skiers and other craft and protects you from claims for personal injuries and any subsequent damage caused to third parties due to a collision, an impact or damage caused to maritime facilities like Marinas and ports.

INSURANCE THAT COVERS HULL DAMAGE TO YOUR BOAT.

This insurance will cover you for any damage caused to your boat and any other insured components such as any extras, platforms, towers, and equipment. It will also include any damage caused due to hazardous pollution, and any damages caused from trailering. Damages caused or due to coastal regattas is also included in Spanish territorial waters.

DAMAGE TO ENGINES, MASTS, RIGGING & MORE.

Our boat and Marine insurance in Spain will cover all damages to the hull, sails, engines, masts, auxiliary equipment, auxiliary craft, special fixtures and fittings, personal belongings and trailers.

PERSONAL BOAT AND MARINE COVER FOR ACCIDENTS.

Marine accidents ;-.

Cover for loss of life or bodily injuries of occupants while on-board the insured boat, or when boarding and/or disembarking from the insured vessel.

Death, permanent disability, medical and pharmaceutical assistance and funeral expenses, deposit of bail bonds and defence are also covered.

NAUTICAL ASSISTANCE AT SEA - INSURANCE IN SPAIN.

Nautical assistance can be covered under our Liberty Seguros Boat insurance policy in Spain and is an option that can be added. We would recommend adding the Nautical assistance insurance to your policy as the cost of recovering your boat, even if you are only a few hundred meters away from the Marina can be more than €600. Local Marinas may render assistance free to local members or Marina users free if you are not far away and you can reach them on a VHF radio. If you have to call Maritime rescue, expect a big charge if the rescue vessel has to come from anywhere else. Some Marinas are home to the rescue services and if called out, you will still get a bill.

SPANISH COASTGUARD - SALVAMENTO MARITIMO AND HOW TO CONTACT THEM.

The direct emergency number for the coastguard is 900 202 202. If you have a VHF radio, call on channel 16 or if there is a danger to life or an immediate emergency press the red distress button on your VHF radio and then try and call anyone on channel 16.

The emergency telephone number for the European Emergency Service is 112.

COMMERCIAL MARINE AND CARGO INSURANCE IN SPAIN.

Commercial shipping insurance is complex in nature with marine cargo and freight liability solutions to suit all customers. Marine cargo insurance wil cover goods on land, sea, air and storage, with the full coverage for risks of loss, damage and theft in transit to war and terrorism and liability insurance for freight forwarders, logistic companies and haulage companies.

Coverage for damages to other ships, cargo terminals, container terminals and platforms, ports and pipelines, hull, Marine Casualty and Marine Liability.

CANOE AND KAYAK INSURANCE IN SPAIN.

If you are looking for Canoe or Kayak insurance in Spain, we have a Personal Accident and Injury Insurance in Spain that will suit your needs. It will also cover you for a large number of other sporting activities, and also cover you for at home and for work related injuries.

JET SKI AND RIDER INSURANCE IN SPAIN.

Jet skis and small motorised jet boats are a very popular craft all around Spain. They are often available for hire or rent at most marinas and boating centres around Spain. Care should be taken to see what type of jet ski & rider insurance these hire and jet ski rental companies offer. Jet skis are very powerful machines and can be very expensive to replace and at high speeds can cause serious personal injury to you and your passengers.

Insurance cover for Jet Skis in Spain will include trailering,launching, theft, hull damage, total loss and sinking as well as civil and public liability with legal defence to cover any court case costs.

INSURING CHARTER BOATS, TOURIST BOATS AND FISHING BOATS IN SPAIN.

If you own a fishing boat or have a charter boat business whereby you rent the boats out to clients on a daily or weekly basis, for hire, with or without the driver or captain, you will need the compulsory insurance to provide protection for you and liability for your clients. Most of these services do require the correct licences and documentation to comply with Spanish regulations.

All the modern safety gear will be required, such as life jackets, life rafts and flares and must keep the originals of your insurance and registration documents on the boat at all times. If you are unable to produce these documents your boat could be impounded and you could be denounced and receive a fine. See boating in Spain for more details.

SPANISH BOAT LICENCES AND QUALIFICATIONS.

Don't worry if you don't have a boat licence in Spain. They are easily obtained by doing a short 1/2 or 1 day course at a registered RYA Training centre in Spain . Alternatively, if you speak fluent Spanish, some of the Spanish Marinas have training centres, so ask the Marina for information or check online.

COMPARE BOAT INSURANCE IN SPAIN.

There are no Boat or Marine insurance comparison websites online. This is because most of the Boat and Marine insurance Companies in Spain do not operate on similar platforms. www.boatinsuranceinspain.com are part of a Network of Insurance Companies, Boat Insurance Agents and Brokers that can quickly find you the best boat insurance to suit your needs.

BOAT INSURANCE HELP AND SUPPORT IN SPAIN.

If you have any questions with regard to boat and marine insurance in Spain, please feel free to contact us and we will do all we can to help you.

Updated April 2020 . Copyright www.boatinsuranceinspain.com

- AFFILIATE PROGRAM

- Accident and Injury Insurance Spain

- Apartment Insurance Spain

- Aviation Insurance Spain

- Beach Buggy Insurance Spain

- Bicycle Insurance Spain

- Breakdown recovery insurance Spain

- British Car Insurance Spain

- Buildings Insurance Spain

- Campervan Insurance Spain

- Car Dealer Warranty insurance Spain

- Car Insurance Spain

- Car Insurance quotes Spain

- Caravan Insurance Spain

- Cash Back Insurance Spain

- Castle insurance Spain

- Cat Insurance Spain.

- Cave House Insurance Spain

- Classic Car insurance Spain

- Commercial Insurance Spain

- Commercial Vehicle Insurance Spain

- Community Insurance Spain

- Consorcio Claims Spain

- Cremation Insurance Spain

- Cyber Insurance Spain

- Dangerous Dog Insurance Spain

- Dental health Insurance Spain

- Drone & RC insurance Spain

- Electric Scooter Insurance Spain

- Event Insurance Spain

- Farmers Insurance Spain

- 4 x 4 Insurance Spain

- Flood Insurance Spain

- Financial Services Spain

- Fishing & hunting Insurance Spain

- Funeral Plans

- FUNERALS DIRECT

- GAP Insurance Spain

- Golf Insurance Spain

- Goods in Transit Spain

- Green card Insurance Spain

- Harley Davidson Insurance Spain

- Health Insurance Spain

- Holiday Home Insurance Spain

- Home Insurance Spain

- House Insurance Spain

- Horse Insurance Spain

- Hotel Insurance Spain

- Hybrid Car Insurance Spain

- Jet Ski Insurance Spain

- Landlords insurance Spain

- Life Insurance Spain

- Marine & Boat Insurance Spain

- Medical Insurance Spain

- Mobility Scooter Insurance Spain

- Mortgage Protection Insurance Spain

- Motorcycle Insurance Spain

- Motorhome Insurance Spain

- Multi-Car Insurance Spain

- Occupational Injury Insurance Spain

- Over 50s insurance Spain

- Pet Insurance Spain

- Professional indemnity Spain

- Public Liability Insurance Spain

- Quad Insurance Spain

- Rental Property Insurance Spain

- Scuba Diving Insurance Spain

- Sports Car Insurance Spain

- Sports & leisure Insurance Spain

- Static Caravan Insurance Spain

- Traffic accident insurance Spain

- Trailer Insurance Spain

- Travel Insurance Spain

- Yacht Insurance Spain

- Villa Insurance Spain

- VIP House Insurance Spain

- Young Driver Insurance Spain

- Alien Abduction Insurance

- Insurance in Spain in English

- Liberty Insurance Spain

- Lobster Mobile in English

- Insurance for Pensioners Spain

- Money transfers

- Insurance Opportunities Spain

- Insurance Agents Costa Blanca

- Properties for sale in Spain.

- Emergency Numbers Liberty

- Emergency Numbers Spain

- CoronaVirus in Spain

- Insurance in Alicante Spain

- Insurance in Almeria Spain

- Insurance in Andalucia Spain

- Insurance in Barcelona Spain

- Insurance in Cartagena Spain

- Insurance Costa Blanca Spain

- Insurance Costa Brava Spain

- Insurance Costa Del Sol Spain

- Insurance Gran Canarias Spain

- Insurance Ibiza Spain

- Insurance Lanzarote Spain

- Insurance Malaga Spain

- Insurance in Mallorca Spain

- Insurance Madrid Spain

- Insurance Menorca Spain

- Insurance Orihuela Costa Spain

- Insurance Sotogrande Spain

- Insurance in Seville Spain

- Insurance in Portugal

- Insurance in Torrevieja Spain

- Insurance in Valencia Spain

- What is Pet Insurance

- More about Funeral Plans

Marine, Boat, jet ski & watercraft insurance in Spain and Europe.

Marine & boat insurance in spain , boat insurance for all foriegn and spanish registered vessels in spain, portugal & gibraltar..

.jpg)

Marine & Boat Insurance in English.

Pursuant to spanish royal decree 607/1999 of 16 april, you must hold civil liability insurance for any recreational boating ..

As we are sure you can imagine, with Spain virtually surrounded by water, boats play a major part of the Spanish and Expat culture. Every conceivable type of boat from the small inflatable dinghies to the larger commercial ferries and passenger ships ply the Mediterranean waters of our coastlines. There are hundreds of Marinas along these shores and although there is a relatively large fishing fleet, most of the water crafts tend to be for private use. Sailing yachts and speed boats can be seen bobbing about.

Most shoreline areas are cordoned off to pleasure craft during the tourist seasons to ensure the safety of swimmers. A large number of coastal towns have areas for rental boats, jet skis and private speed boats as well as a large variety of yachts. Small private marinas also provide facilities such as restaurants and bars which are regularly frequented by the locals and Expats alike. Having boat insurance is a legal requirement in Spain and you must ensure that you keep a copy on board at all times. The local Police or Guardia Civil regularly patrol the seas and the marinas and will regularly check your documentation, not just for insurance but for the correct boat documentation and safety equipment as well.

Gone are the days of anyone just being able to launch a boat and go out fishing. Regulations and inspections are the new format adopted by the local authorities and although they are allowing foreign registered boats to use these waters, they are tightening the regulations to ensure that all craft are seaworthy and have the correct documentation. www.insuranceinspain.com can provide you with all kinds of Boat and marine insurance, from small skiffs, rowing boats, canoes, small engine powered crafts, ski boats, jet skis, sailing dinghies, yachts, charter boats, rental boats and virtually anything that floats on water. So please give us a call on 0034 965 27 57 27 and we will be happy to discuss any of your marine insurance requirements and provide you with a quotation to suit your needs without any obligation. We are here to help, so please use our services.

.jpg)

The Advantages of Boat Insurance in Spain

- Mandatory civil liability insurance, with a sum insured limit of 336,566.78€.

- Death or bodily injuries to third parties: 120,200€ with a maximum limit per claim of 240,400€.

- Material damage and economic loss: 96,161€.

Plus all these benefits:

- Voluntary public liability insurance, which extends and complements the mandatory public liability insurance limits.

- Damage to the boat itself, covering: the hull, engine, sails, masts, auxiliary craft, special fixtures and equipment, personal belongings and trailer.

- Claim for damages, caused by third parties to the insured boat or to any of its occupants.

- Total theft of the boat and/or its auxiliary craft.

- Wreckage removal.

- Damage due to pollution risks.

- Damage due to coastal regattas in Spanish territorial waters.

- Accidents: loss of life or bodily injuries of occupants while on-board the insured boat or when boarding and/or disembarking from the insured boat are covered.

Cover includes:

- Death.

- Permanent disability.

- Medical and pharmaceutical assistance.

- Funeral expenses.

Basic Cover includes:

- Damage occurring to the hull, motor, sails, accessories, personal effects and trailer.

- Vandalism while on land.

- Total theft of the boat and/or auxiliary vessel.

- Removal of debris.

- Damage caused as a result of pollution hazards.

- Damage caused while engaged in coastal regattas.

- Damage when loading and unloading during transportation by land.

- Accidents to passengers/water-skiers/skipper: including cover for death, permanent disability, medical/pharmaceutical assistance and burial expenses.

- Claims for damages, deposit of bail bonds and defense.

- Nautical assistance.

Insuring Canoes, Kayaks and Paddleboards in Spain.

There are a variety of insurance covers available for Kayaks, canoes and paddleboards in Spain that will cover you for third party liability insurance, loss and theft, and personal accident and injury.

Insurance fo r personal accident and injury for using Kayaks, Canoes, Paddle-boards and other water craft and water based activities can be covered quite easily with our affordable sports and leisure insurance from as little as €79.43 a year.

Some of the activities included and covered under our sports and leisure insurance are:-

– Track and field, biathlon, triathlon, pentathlon.

– Basketball, handball, volleyball and beach volleyball.

– Hunting, including shooting and fishing.

– Cycling.

– Skiing and snow boarding on ski slopes.

– Football, indoor football, 7-a-side football, beach football and field hockey.

– Gymnastics, bodybuilding and weightlifting.

– Golf.

– Mountaineering.

– Swimming and water polo.

– Skating.

– Kayaking and rowing.

– Tennis, paddle, squash, badminton, table tennis and pelota.

– Surfing, windsurfing, water skiing and recreational sailing (on a sailboat, on a yacht or jet ski) up to 12 miles from the coast.

– Horse-riding.

– Scuba diving to up to a depth of 30 metres.

For more details visit https://www.insuranceinspain.com/sports-insurance-.html

Need a boat licence in Spain?

.jpg)

Then look no further. wwww.insuranceinspain.com have teamed up with www.seaschoolcostablanca.com to bring you an exciting day out in Altea to introduce you to the boating world and keep you legal with a Royal Yachting Association appointed representative to take your RYA boat licence examination and practical with on the water experience. Based in the spectacular bay of Altea, sea school costa blanca will bring the theory and skills and knowledge to safely and confidently handle powerboats in Spain. CLICK HERE for more details or call Dave Hill on 0034 622052938.

Boat Deliveries.

We often get asked if we know of any boat delivery companies. We do, and we can provide insurance to cover your boats, jetskis and any watercraft based in Spain or in the UK. We are hoping to provide a comprehensive list and provide the links for your information.

One of our personal recommendations for having your boat collected from the UK to Spain is https://www.furnishinspain.com/index.php/south-coast-removals They also do removals for lots of other things like furniture and if your moving to Spain, they are the people to contact.

SEASCHOOLCOSTABLANCA Can provide the moving or delivery of your boat from Marina to Marina along the Costa Blanca. So if you need to move your boat and don't fancy doing it yourself, then call Dave Hill on 0034 622052938 and i am sure he will be happy to provide a quote for the delivery service.

www.insuranceinspain.com are happy to discuss any of your marine insurance requirements as we insure many vessels in Spain from smalldinghies and tenders, to fully fledged ocean going yachts that travel the Mediterranean. Please call 965 27 57 27 in the first instance. Contact us on our website or online chat with us and one of our marine specialists.

Updated May 2020 Copyright www.insuranceinspain.com

Privacy Policy | Insurance in Spain © 2024 All rights reserved | Disclaimer Site Map

- Insurance In Spain

- Health Insurance

- Life Insurance

- Home Insurance

- Car Insurance

- Bike Insurance

- Travel Insurance

- Investments

- Boat Insurance

- Pet Insurance

- Funeral Cover

- Business Insurance

- Public Liability

- Accident Cover

- Van Insurance

- SEGURO DE VIDA

- Seguro de Decesos

- Seguro De Viaje

- Effective Visas

MARINE INSURANCE SPAIN

Marine & Boat Insurance Spain

As an owner of a pleasure craft, sports boat or jet ski, at the very least you must have insurance covering your legal liability. We can help with that and much more. Always great cover at great prices.

Plain sailing with efpg no matter what vessel or boat you have, we can help you in finding the best cover in Spain at competitive premiums.

Simply fill out one of our marine insurance forms below or give us a call today for some expert friendly advice on the best policy by English speaking advisers.

efpg - Here for what matters most!

Marine Insurance in Spain

Complete this form for a quote on your marine/ boat insurance in Spain. We will contact you with a price and your insurance options.

If you would prefer to get a rough price estimate, without giving all of your personal details at this stage, you can fill out the quick marine insurance form at the bottom of this page.

Please call us on the number below if you have any questions, or click on the WhatsApp icon to chat now.

☏ +34 951 81 80 01

efpg -Here for what matters most!

*This is not an automated quoting system. We take pride in our work and an adviser will search the market for the best options for you and send a personalised quote with the details provided in the form.*

* FIELDS ARE MANDATORY

Please note!

When you have selected the send button and you see a blank blue screen, please scroll up to see the confirmation message that your request has been sent.

Insurance In Spain In English

At efpg we work with Tree-Nation to help offset our carbon footprint as part of our going green campaign. So for every policy created at efpg we collaborate with Tree-Nation to plant a tree.

Clave DGSFP J-3795

The staff are always very responsive and helpful..

Robert Ditty

Asked for travel insurance quote.only quoted premium cover but when queried quoted for cover we required

Peter Haigh

Excellent professional but still very personal service, highly recommended!

Katya is fantastic, really helpful and quick to reply. both my husband and i organized our car insurance through efpg and highly recommend.

Lucy Collins

I have contracted with this company the life insurance, the treatment has been very good, they explained everything perfectly and they looked for the best option for me. Thank you for your help and your extraordinary service. Highly recommended for any insurance

Maria Angeles Hurtado

I got car and life insurance through EFPG. I have to say the service was first class. Thank you!

Jonathan McCashin

We would very much like to give Scarlett Humphreys 6 stars in the rating, but there are only 5 stars so…..☺️ Top service!! Pall and Alfa

pall Thorgeir Markan

Great service, Tamara arranged our new home insurance, all at a very good competitive price. Definitely recommend these guys!

Richard O'Halleron

It has been great to deal with such a professional organization. My temporary medical insurance and complex unusual travel insurance were handled smoothly with continued speedy responses by Katya to my many questions. Better service than any agency I experienced in Canada (20 years and Hong Kong (16 years)

Paul D. Reynolds

Very professional and easy to work with company. Everyone I dealt with there were friendly and very active in finding the best policy to fit my needs/situation. Would strongly recommend to any Ex Pat looking for insurance in Spain

Alex Robbins

My contact with the insurance agency Katya Shew was very good. She delivered what I expected in every aspect.

Martin Bäckström

Nice company to deal with. They do all our insurance. Handles things quick and for decent prices. Was able to offer me car insurance at half the price of what the big companies quoted. Very nice to be able to get things sorted in English.

Roy Kullick

Thank you for your kind and professional help, in helping to arrange a complicated travel insurance...

Jane van der Toorn Bligh

Junior Insurance Adviser at efpg Spain was excellent to deal with, Tamara was efficient and professional. Highly recommend efpg for expats in Spain that require obligatory car insurance but are driving on their overseas license for the first 6 months.

Fleur Morales

Very quick to get a quote and helpful. So far great service :)

Thanks very much for your help and advice, will recommend efpg to all my friends..

Fiona Humphreys

Positive: Professionalism, Quality, Responsiveness, Value

Scarlett was super helpful and quick to respond..

jaime Nanci-Barron

What a fantastic company! Everything is handled very professional. The lady Katya who has been handling my policies is fantastic! She excels in her work. I would definitely recommend this company! A massive 👍🏽's up!!

Random Videos - Local Guide

I found them very responsive and helpful, from the first request for the quote to issuing policy, to actually helping with approvals and claims for sudden and expensive op. I have dealt with Katya Shew and cannot praise her enough.

Elena Sanchez

THE HOUSE OF efpg

WE GET RESULTS

Efpg sl is part of the efpg group that was first founded in 2004..

COMPANY INFORMATION

European Financial Planning Group SL

Calle Altamira no 5

Edificio Ayala, local 27

Pueblo Nuevo

CONTACT DETAILS

+34 951 81 80 01

At efpg we work with Tree-Nation to help offset our carbon footprint as part of our going green campaign. So for every policy created at efpg we collaborate with Tree-Nation to plant a tree. To find out more about exactly how Tree-Nation is caring for our environment, visit -

TREE-NATION

© 2024 European Financial Planning Group.

All rights reserved.

FAQ | Privacy Policy | Terms Of Business

↓Stay In The Loop↓

EUROPEAN FINANCIAL Planning GROUP SL

Sailling & Motor Boat Insurance in Spain

C1 broker offers solutions to insure your yacht, sailboat, jet ski in spain, c1 broker boat insurance in spain yacht sailboat jet ski.

As an insurance broker, C1 Broker’s aim is to find the best insurance solutions for your boat, motorboat or jet-ski in Spain. Each boat and client has different needs, that is why we have a complete and specialised marine insurance portfolio, so that you can sail with peace of mind, protected from any unforeseen event or breakdown.

Ask us for a no obligation quote! We are sure to find the right solutions, competitive pricing, the best coverage and a top-quality after-sales and claims management service.

Get your boat insurance quote today!

At C1 Broker, Insurance Brokerage, we have several clients with pleasure boats in the ports of the Canary Islands, Balearic Islands and also in the Peninsula who have chosen us as a mediator for their nautical insurance. We offer a highly personalized service and inform the client of everything that can happen at sea and what are the best ways to insure their boat.

If you plan to insure your boat, it is a good idea to take into account several points that can help you choose the best insurance and the best coverage. We have also prepared this section for you on our website, which obviously does not dispense with personalized consultation. Each boat and each client has their specific needs and the solutions must be studied individually: only in this way can we guarantee that you have the correct coverage and that you are not paying for something you do not need, but that you have the correct coverage …

Boat insurance and its modalities

At c1 Broker, we have the insurance answer you need, with which you guarantee your safety at sea and the integrity of your boat. Navigate calmly, safe from any unforeseen event or breakdown. And when you go sailing, just enjoy the waves, the wind in your face and that horizon that always awaits you …

What you should expect from your boat insurance:

Assistance at sea 24 hours a day, 365 days a year

Automatic coverage up to 200 miles expandable with maximum protection.

Compensation for partial breakdowns at a new replacement value regardless of the age of the boat.

Possibility of contracting the English conditions (Institute Yacht Clauses) for all boats whose insured value exceeds € 20,000.

You can insure the actual value of the boat or the new value. Actual value insurance, is less complex and lowers the price of your premium.

You can contract with or without a deductible and choose from several deductible options.

There are basically two types of Civil Liability contracts in Marine Insurance

the obligatory one (only covers damages to third parties, up to the limit established by law – Royal Decree 607/1999 of April 16);

and the volunteer, who guarantees the damage of the boat. A deductible (that is, a deductible amount, payable by the insured) may be applied on voluntary insurance.

To deal with possible claims, it is necessary that the skipper who governs the boat is in possession of the corresponding title that enables him to do so (PNB, PER, etc.) and that he has passed all the inspections required by the competent authority and that he has the documentation necessary to navigate. The navigation radius covered by the policies is agreed upon in each one of them.

We only insure boats registered on the 7th list – which are intended for exclusively private and recreational use (with motor or sailing propulsion). We are not currently insuring boats used for other purposes (professional) such as fishing for sale to third parties, sports, etc …).

What values should be insured?

When taking out a marine insurance, the usual is to assign a value to the hull and keel; and another to the engines and/or to the sails, declaring them one by one. Normally, these values have to coincide with the replacement costs of such goods.

Also the time of contracting your policy it is very important not to forget which are each and every one of the gear and accessories that are not attached to the hull (except in the event that their insurance is not desired). This accessories could be your leisure fishing gear, GPS gear, Sound system, Special lighting system, Solar panels, BBQ gear, etc…

"Spanish Clauses" Vs. "English Clauses"

In addition, there is another distinction, which is applied depending on which are the applicable clauses or stipulations: the so-called “Spanish clauses” and the “English clauses”.

“English clauses” have a broader framework of guarantees, and were drawn up at the time by the Institute Yacht Clauses in London. The practical difference between the “Spanish clauses” and the “English clauses” is that the English ones allow you to agree on a value for a boat. The Spanish clauses don’t, they take the market value of the ship.

If the opportunity exists, it is always better to take out a marine insurance with English clauses.

At C1 Broker, we offer you the possibility of contracting the “Spanish clauses” or the English clauses (Institute Yacht Clauses) for all vessels whose insured value exceeds € 20,000.

Damages caused by the following contingencies are usually guaranteed: shipwreck, dumping (the action and effect of throwing cargoes and other things that weigh on the ship into the sea, when it is necessary to lighten it, so that it does not perish due to the storm), stranded, collision with a fixed or floating object, temporary, sinking that is not due to poor maintenance of the boat, theft in a guarded and closed place, and malicious acts of third parties. Among the notable coverage exclusions, it is worth mentioning -among others- the damage caused to the sails torn by the wind, detachment of outboard motors, faulty maintenance of the boat, purely mechanical breakdowns of all kinds, serious negligence, breakdowns produced when leaving the ship anchored in beaches or coves without assistance, etc … …

Let us also note that in the event of a total loss, caused by a breakdown covered in the policy, compensation is usually made by the market value, a deduction made from the value of remains, which will always remain in the possession of the insured. In the event that the accident occurs abroad, the insured can go to one of the breakdown certification entities (called Breakdown Commissioners -they are experts in the Transportation and Ships Branch-), who will take care of process the corresponding assessment and send it to the insurance company.

Choose the right insurance for your sailing or motor boat in Spain

When it comes to choosing the right Spanish boat insurance, it pays to choose a specialized broker who understands the unique covers of marine insurance. There are a number of things to consider when selecting a policy, from the type of boat you have to the activities you’ll be undertaking. It’s important to choose a broker who can provide tailored advice and find the right policy to suit your needs.

With so many options on the market, it’s essential to work with someone who understands the ins and outs of Spanish boat insurance. By doing your research and working with a specialist, you can be sure you’re getting the right cover for your needs.

A boat insurance is a specific insurance designed to cover damage caused in an accident at sea, river, harbours or marinas to pleasure boats such as motor boats / sailing boats, rowing boats, water motorbikes and jet-skis. Just like car insurance, boat insurance is compulsory in Spain, specifically the third party liability cover. Complementary cover such as maritime and shore assistance, own damage or theft, can be taken out additionally, to guarantee maximum peace of mind.

C1 Broker has various options for your boat insurance in Spain. Here are some of the coverages included in boat insurances:

- Public liability;

- Marine and shore assistance to the boat

- Damage to or theft of the boat (including accessories);

- Rescue expenses (including personal accidents to occupants);

Ask us for a no-obligation boat insurance quote!

Ship, a-hoy! We will contact you to offer you the best boat insurance in Spain:

Faq about boat insurance in spain, here you will find some answers about marine insurance in spain. but if you still can't find what you're looking for, send us a message through the form. we are happy to answer you.

According to Spanish Law 27/1992, of November 24, on State Ports and the Merchant Navy, it is mandatory to have proof of payment of the insurance premium for the current period on the boat. This document it will prove its validity, provided that contains at least the following specifications:

- The insurance company that underwrites the coverage.

- Sufficient identification of the insured vessel.

- The coverage period with indication of the date and time when its effects begin and end.

- The indication that it is the compulsory insurance coverage.

This documentation must be on board the boat. If it is required by the competent authorities and said documentation is not found on board, the policyholder will have five business days to justify the validity of the insurance before them. The navigation of leisure boats that are not insured in the established way, will suppose a serious infringement (Chapter III of Title IV of Law 27/1992, of November 24, on State Ports and Merchant Navy of Spain).

Boat insurance is mandatory in Spain and navigators must have compulsory public liability insurance. This compulsory insurance covers damages to people or property that might be caused by the boat. There are different types of boat insurance policies, so it is advisable to check with your insurer what is and is not covered by your policy.

Mandatory public liability in boat insurance is protection against damages that you may be held responsible for if you injure another person or damage their property while operating your boat. Boat insurance typically covers any liability arising from boat use. If you are found to be at fault for an accident, public liability insurance helps cover the cost of damages to other people or property. It also provide peace of mind in knowing that you are financially protected should something go wrong.

Ask us now for your free no obligation quote !

Choosing the right boat insurance in Spain can be a complex and confusing task. You want to make sure you’re adequately covered in case of an accident, but you don’t want to pay more than necessary. One way to choose the right boat insurance is to find a specialised broker, like C1 Broker, who understands marine policies inside and out. We have years of experience and we are able to help you choose a marine policy that meets your needs. We are also able to answer any questions you have about coverages and exclusions. In addition, we can provide guidance on what type of policy would be best for your particular situation:

- Advice on taking policies with English Clauses or Spanish Clauses

- We know well the different boat insurance policies available in the Spanish Market, and can recommend the right one for you: Allianz, Axa, Zurich, Mapfre, Liberty, etc…

By working with a C1 Broker, you can have peace of mind knowing that you’re getting the coverage you need at a price you can afford. Ask us now for your free no obligation quote !

It’s happened to the best of us boat owners. You’re out on the water, enjoying a peaceful day boat claims when all of a sudden, you hit something and your propeller is damaged. Often, the damage is caused by a rope or other debris that has become wound around the propeller. While it may seem like a minor accident, it can actually cause major damage to your boat’s engine. And, since most spanish clauses boat insurance policies exclude coverage for accidents caused by debris, you may be stuck with a hefty repair bill.

What about Yacht Clauses?

Yes! Many boat owners are surprised to learn that damage caused by a rope wound around the propeller is covered by Yacht Clauses Insurance. This type of accident is actually quite common, and it can be very costly to repair the damage. Fortunately, if you have insurance, you will not have to pay for the repairs out of your own pocket. Instead, you can simply file a boat claim with your insurance company. In most cases, the insurance company will reimburse you for the cost of the repairs. So, if you own a boat, be sure to purchase Yacht Clauses Insurance in order to protect yourself from expensive repairs in the event of an accident.

So, if you find yourself in this situation, be sure to take some deep breaths and remember that accidents happen. With a little bit of patience and perseverance, you’ll get your boat back in working order in no time. Ask us now for your free no obligation quote !

Yacht clauses are special provisions in marine insurance that cover your boat against specified perils.

English clauses or Yacht clauses usually provide more comprehensive coverage than standard marine insurance policies , and they typically allow policyholders to choose the value of the yacht to be insured.

Some yacht clauses also provide complete covers, which protect against all risks except those specifically excluded in the policy.

Whether you’re a yacht owner or a yacht charter company, it’s important to understand what yacht clauses are and how they can benefit you. By carefully selecting the right yacht clause for your needs, you can ensure that your investment is properly protected.

This may also interest you

The Importance of Knowing Processing Times for Auto Claims in Spain

When it comes to dealing with auto claims, uncertainty and anxiety are common emotions among drivers. However, understanding the deadlines and processes set by Spanish insurance law can make the difference between peace of mind and frustration. Spanish legislation establishes various deadlines and application dates for processing auto claims, emphasizing the importance of insured

Insurance e-Learning Institute in Spain awards C1 Broker the Adapted Insurer Seal of Approval

At C1 Broker we take the continuous training of our team very seriously. The world of insurance, its laws, standards, products, regulations and technological aspects are always changing, so it is important to provide quality training. The Insurance e-Learning Institute (Instituto E-learning del Seguro) is the main provider of our training plan. This year

Asisa Adapts to the Animal Welfare Law: Includes Civil Liability in its Pet Insurance Policies

Asisa has included civil liability cover in its pet insurance, complying with the Animal Welfare Act which requires civil liability insurance for dogs. Asisa Pets offers three coverage options: 150,000 euros, 200,000 euros 300.000 euros Adapting to the needs of pet owners. In the near future, Asisa plans to launch an exclusive pet

Insurance in Spain Calculator

Get a Quote Today!

Car Insurance

House insurance, health insurance, life insurance.

- Travel Insurance

Pet Insurance

Boat insurance, business insurance, c1 broker ®, insurance broker, we work with a selection of the best insurance companies in spain:.

Find out all about Insurance in Spain on our YouTube channel

Let's stay in touch.

Subscribe to our newsletter and get to know in firsthand all our news, campaigns, and videos on our youtube channel.

Insurances in Spain

- Health Insurance in Spain

- House Insurance in Spain

- Car Insurance in Spain

- Life Insurance in Spain

- Pet Insurance in Spain

- Legal Protection in Spain

- Boat Insurance in Spain

- Art Insurance in Spain

Insurances for Companies

- Business Insurance in Spain

- Hotel Insurance in Spain

- Condominium Insurance in Spain

- Fleet Insurance in Spain

- Cyber Risks in Spain

- Construction & Decennial Insurance

- Insurance for CEOs and Directors

- Other Insurances...

Get a Quote Today

- Car Insurance QUOTE

- House Insurance QUOTE

- Health Insurance QUOTE

- Pet Insurance QUOTE

- Life Insurance QUOTE

- Travel Insurance QUOTE

- Boat Insurance QUOTE

- Business Insurance QUOTE

- Claim Management in Spain

- Hotline Assistance Numbers

- Find a Workshop

- Report a Car Claim

- Report a House Claim

- Articles about Claims

- Online Payment

- Online Appointments

- Client Area

- Career - Jobs

- Insurance Franchises - Start your own Independent Insurance Agency Today!

- Youtube Channel

- Legal Information

- Terms & Conditions

- Privacy Policy

- ARSOL Rights

- SCD Regulations

- Anti-Corruption

- Whistleblowing

- Safelisting

- Insurance Broker Power of Attourney

- Legal Consent

- General Conditions

- Insurance in Tenerife

- Insurance in La Palma

- Insurance in Gran Canaria

- Insurance in Fuerteventura

- Insurance in Lanzarote

- Insurance in Torrevieja

- Insurance in Denia

- Insurance in La Marina - Elche

- Insurance in Mallorca

- Insurance in Ibiza

- Insurance in Portugal

Looking for something?

Find quickly the information or product by using our search tool:

Tel. (+34) 922 94 16 10

C1 Broker® es marca comercial de Wiseg Mediacion de Seguros SL, Correduría de Seguros, Clave DGSFP J-3790

C1 Broker © Derechos Reservados 2024

You need to load content from reCAPTCHA to submit the form. Please note that doing so will share data with third-party providers.

- (+34) 93 268 87 42

- (+34) 627 627 880

- Health +65 years old

- Legal Protection

- Default Tenant

- International Students

- Expatriation

- Store/Office

- All-risks Company

- Civil Liability

- Health Company

- Life Company

- Accident Company

- Communities / Buildings

- D&O Liability

- Decennial Liability

- Cyber Attack

- Construction All-Risks

- Declare a claim

- Ask for a Certificate

- Contract Modifications

- Insurance Glossary

- What’s a Broker?

- Collaborate

Boat Insurance in Spain

Boat insurance in spain.

Professionals dedicated to expatriate insurance, INOV Expat puts all of its expertise at your service to secure the boat insurance in Spain that best adapts to your needs . We are an insurance brokerage firm that has been working with the best insurance companies in the market since our foundation in 2004 to be able to offer you boat insurance that is “customised” for you at the best price. We will assist you with all phases of your boat insurance, answering all your questions and, above all, acting as your liaison to defend your interests against insurance companies in the event of a claim .We handle your claims in the language of your choice: English, French, Russian, Spanish or Portuguese. Don’t forget to ask for your quote and find the best boat insurance in Spain here

Basic, from

- Mandatory civil liability

- Legal defence

- Loss, damage and/or theft

- Environmental pollution damages

- Personal belongings and accessories

- Claims for damages

- Personal accidents

- On-water assistance

- Wreckage removal

- Voluntary civil liability

Complet, from

Information.

As with any vehicle, you must insure your boat. Natural disasters, sinking, vandalism, theft… Your insurance will cover you for all types of incidents at quay, while sailing or even during transport. With INOV, you can be sure you will receive a policy that adapts to your needs in addition to our assistance.

The premium for your boat insurance will depend on several factors, including:

- The type of boat

- Year of construction

- Number of passengers

- Propulsion system

- Number of engines

- The use of the boat

We recommend contacting us for more information and comparative quotes for a solution that adapts to your needs.

Which insurance do you need?

Boat insurance designed for expats

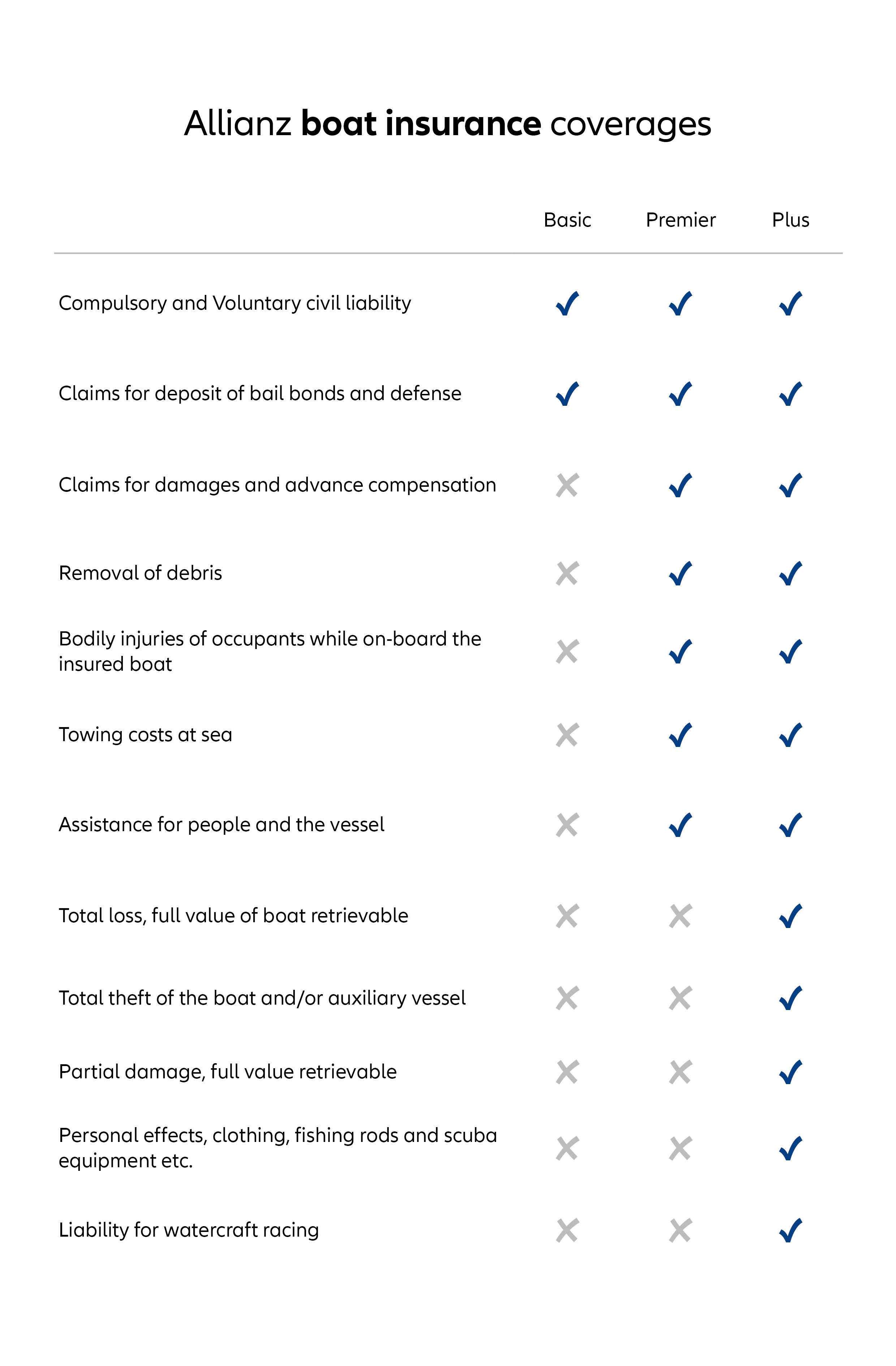

Allianz boat insurance.

- Comparison chart

Benefits of your boat insurance

Allianz covers towing costs to the nearest port

The insured value is the actual value of the boat

Costs of removing the debris off the boat in the event of running aground are covered

Your boat insurance at a glance.

- Mandatory civil liability

- Legal assistance

- Financial assistance

- Financial assistance for fire and theft

- Personal accident

- Reimbursement of towing expenses at sea

- Damage to the boat

- Advance compensation

- Total loss of boat and removal of debris

Contracting your boat insurance has never been easier

Frequently asked questions about boat insurance for expats.

Allianz boat insurance allows you to choose between the following two navigational territories:

Waters within Spain and Portugal:

- Reservoirs.

Waters within the European Union:

- Switzerland.

- Mediterranean Sea.

- Up to 200 miles from the Spanish, Portuguese, and French coastline to Calais.

- Crossings between the Iberian Peninsula and the Canary Islands.

If you still have questions about where you can travel with your boat, remember that Allianz advisors can answer all your questions.

Calculating insurance, whether the policy is for your health, car, home, boat, or any other type, depends on several circumstances. Allianz looks at several factors when calculating your premiums. Keep in mind that certain aspects will be assessed, such as:

- Condition of the boat.

- Age of the boats.

- How long you have had the special insurance policy for civil liability for a boat.

- Whether more than one person will take the boat out.

- Where the boat is moored.

To know exactly what the price of your insurance will be, remember that you can talk to an Allianz personal advisor who will be happy to help you and answer all of your questions.

Allianz boat insurance is tailored to safeguard recreational boats. Consequently, the intended usage of these boats is for personal pleasure and leisure pursuits, excluding boats engaged in commercial activities.

Other authorised uses for boats covered by this insurance include:

- Training boat.

- Surveillance.

- Maritime rescue.

- Boat rental with or without crew.

- Boats that participate in races ( regatas ) in Spain whose route is within 12 miles of the coast as well as in races between the Spanish peninsula and the Balearic or Canary Islands.

Save costs if you combine your boat insurance and home insurance

Manage your insurance all in one place, allianz helps to make your life easier, what can we help you with.

Leave us your phone number and we will get in touch with you

See details of your boat insurance, more insurance for you.

- Skip to main content

- Skip to secondary menu

- Skip to primary sidebar

- Skip to footer

SpainMadeSimple.com

Marine & Boat Insurance in Spain: COMPARE Cheapest Quotes

This article on marine insurance in Spain (more commonly known as boat insurance) is designed to help you get the lowest and cheapest quote for your water-based vessel such as yachts, power boats, motor-cruisers, windsurfers, dinghys and jet-skis.

While we are sure that you are obviously looking for the cheapest insurance that you can find, you should be thorough and check the small print of the policy.

There is no point having insurance and then finding out when it comes to claiming, that your coverage is not adequate.

Go to a Spanish broker who will get a number of different quotations on your behalf and then compare them to give you the cheapest possible price as well as more expensive options which may be more suitable for your circumstances.

Online Quotes for Marine Insurance

Save Money & Time - Get Your Online Quote Now...

Your Name and date of birth(required)

Your Email (required)

Telephone Number (required)

Please give us details of vessel to be insured:

1. We need the value in pounds or euros 2. Make and model 3. Year of craft 4. Flag 5. Your experience 6. Any no claims bonus and how many years 7. Where is the boat kept?

Please answer the question below as it helps us reduce spam submissions:

If you have filled in all the boxes above, please click the 'send' button below.

You should then see a message below which indicates your message was successfully sent.

The legal/privacy bit we have to put in – Note that you are using this form to submit your details to us so we can then compare the market and give you options for marine insurance. Our privacy notice at the footer of our website lets you know how we use your data and how to request removal. You don’t need to do anything other than fill in your details and let our brokers do the rest.

Who Offers Marine & Boat Insurance in Spain?

Use a price comparison website which will take your specifications and instantly search online and compare prices for the cheapest boat insurance.

Do take into consideration your language skills. If you are not fluent in Spanish then it is important to take out marine insurance with policy documents issued in English.

Many expats who live in Spain will have moved to one of the Costas (coasts) to enjoy the benefits of the sunshine and living close to the beaches and the sea.

Most expats looking for marine insurance or boat insurance will be on the Costa del Sol (especially Marbella, Puerto Banus, Benalmadena, Fuengirola, Torremolinos, Nerja & Malaga).

The Costa Blanca is also a popular area in which to own a boat as there are many marinas here (especially Alicante, Benidorm, Calpe, Moraira, Torrevieja).

Other popular areas for sailing and boating include the Costa Brava or the islands of Spain such as Tenerife, Lanzarote, Majorca/Mallorca, the Canary Islands and Menorca.

Naturally it makes sense to enjoy the unique surroundings Spain offers and as such many people will have bought or have considered buying a boat.

Boats don’t come cheap and so marine insurance is essential to protect yourself against the risks of boat ownership.

Where To Get Insurance

In many ways similar to taking out auto insurance or comparing car insurance, these are the typical questions you will be asked:

About you: name, address, your sailing experience, any no claims bonus, whether you have had any previous claims.

About your boat: vessel name, vessel flag, location of berth, value, make and model, hull, dimensions, build materials, engine (if applicable), fuel type, type of use i.e. pleasure/private use or business i.e. charter or rental and whether boat is to be taken out of Spanish waters.

Morgan Marine are a company providing insurance for Jet Skis, Super Yachts, Catamarans, Charter Boats, Commercial Boats and Speed Boats.

Policy Benefits:

- Third Party Liability £3,000,000.00

- Optional Cover for Water skiing and Towing of Toys. (Excluding stand-ups)

- Discounts allowed for RYA certificate holders.

- Discounts for Data-tagged crafts.

- Cover includes, Accidental Damage, Fire, Theft and Perils of the Sea.

- Highly competitive premiums

- Legal Cover – optional various levels available

- 30 days abroad

- Policies available to Ex-pats in France and Spain. Terms and Conditions apply.

Is Marine Insurance Compulsory?

Yes and no – due to increases in the amount of accidents and injuries, especially involving jet skis, the government has introduced compulsory third-party liability insurance.

The minimum amount this covers is approximately 325,000 Euros and it aims to cover personal injury claims.

Currently you don’t have to take out comprehensive cover – in other words you sail your boat at your risk if you don’t insure it.

You have to have the third-party liability but if your boat sinks then that is your loss should you choose to risk it.

If you need more help with other types of insurance in Spain then see our home page which contains many links to many different types of insurance coverage ( such as house insurance ) available for people living in the country of Spain.

One of the most popular water-based vessels in Spain is the jet ski which many people have taken up for recreation.

Although the jet ski does come under the category of marine and boat insurance we have received so many questions about jet-skis in Spain that we have created a special page just for jet ski insurance .

The Spanish word for jet ski is Moto Acuática . A jet ski also often is described as a PWC (personal water craft).

Business Name: Yachtsman marine insurance

Telephone: 966 260 484

Email: [email protected]

Type of Business: Boat insurance specialists

Towns or Areas Covered: Costa Blanca

Best Features:

Over 40 years as specialist marine insurers Cover holder at Lloyds Instant quotes and cover Policies tailored to suit individual requirements Fast, efficient service English Policy conditions

Main Description:

Yachtsman is an Irish Company with over 40 years’ experience as a marine insurance specialist providing security and peace of mind for the private boating sector.We pride ourselves on our excellent, friendly service and can tailor insurance policies to suit the individual insurance requirements of our clients. We insure all private boats from dinghies to mega yachts and cover can be arranged over the phone within minutes.

From: Yachtsman Seguros Náuticos

Business Name: Yachtsman Seguros Náuticos

Business Address: Marina of Denia. Building H, Ground floor 1, Port Dock, S/N, 03700 Dénia

Telephone: +34 966 260 484

Email: [email protected]

Type of Business: seguro de barco españa, compañía de seguros de barcos, seguro de embarcaciones españa, seguros para yates

Towns or Areas Covered: Alicante, Spain

seguro para motos de agua seguro veleros españa seguro de yates para veleros seguro veleros regatas seguro de regata de veleros seguro lanchas a motor seguro de yates para motor seguro neumáticas semirrigidas seguro para neumáticas semirrígidas seguro de vela ligera seguro de regata de vela seguro botes de lagos

¿Por qué elegir Yachtsman?

En Yachtsman nuestras primas son muy competitivas, nuestros servicios son personalizados y garantizamos que los siniestros se procesen rápidamente. Tenemos un procedimiento de alta online sin complicaciones, el cual le permitirá dar de alta el seguro de su barco fácilmente y asegurándose de estar cubierto estando navegando o atracado en su puerto.

Nuestro objetivo es garantizar una navegación segura. Dicha garantía es en base a nuestro plen conocimiento del sector de seguros nauticos en España.

Recent Quotes for Boat Insurance:

174’000 EUR pleasure and fishing motor boat Merry Fisher 795 serie 2, new, boat will be kept in the marina on Ibiza (San Antonio or Eulalia port)

About the Author

Mark Eastwood

Main author and owner of SpainMadeSimple.com which was started in 2004 when I first moved to Spain.

Spain Made Simple features expert advice on all aspects of moving to and living in Spain as well as useful tourist information and travel tips.

As well as my own articles we have many contributions from professionally qualified experts in varied occupations in Spain.

Thank you for visiting our website and if you would like to comment or contribute, we welcome this! Just type your message in the comments box at the bottom of the page.

Reader Interactions

July 20, 2021 at 12:43 pm

I need to reflag my 7.5m sailboat. Can I flag the boat outside of Europe?

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Official Pages

- Privacy Policy

- Terms & Conditions

- Cookie Policy (EU)

Yacht Dreaming

Boat Insurance: Protecting Your Yacht in Spain

Understanding Boat Insurance

Owning a yacht is a significant investment, both financially and emotionally. You have spent countless hours and resources on buying and maintaining your prized possession. It’s only reasonable to want to protect it against any unforeseen circumstances that could render all your efforts meaningless.

Boat insurance is a type of insurance policy designed to protect your watercraft and mitigate the financial risks associated with owning a yacht. It covers a wide range of risks, including damage to your vessel, theft, and liability claims arising from accidents or other incidents involving your yacht.

Having adequate boat insurance is particularly important if you plan on cruising in Spanish waters. The Mediterranean sea can be unpredictable, and you need to be prepared for any eventualities that may arise. In this article, we’ll take a comprehensive look at boat insurance in Spain and help you understand what you need to know to keep your yacht safe and insured.

What Does Boat Insurance Cover?

Boat insurance policies in Spain can vary significantly in terms of coverage and cost. However, most policies will offer the following types of coverage:

Damage or loss of the vessel: This coverage will foot the bill for any damage or loss of your yacht due to accidents, theft, vandalism, or natural disasters.

Liability coverage: This protects you against any legal or financial obligations that may arise from accidents or incidents involving your yacht. Liability coverage may include payment of medical expenses, property damage, and legal representation costs.

Personal accident coverage: This will cover you and your passengers in the event of an accident on board your vessel.

Pollution coverage: This policy protects you against any environmental damage or pollution caused by your yacht.

Types of Boat Insurance Policies

Boat insurance policies in Spain can be divided into two broad categories: third-party liability policies and comprehensive policies.

Third-party liability policies only cover you against legal or financial obligations arising from accidents or incidents involving your yacht. They won’t cover any damage or loss of your vessel. These policies can be cheaper than comprehensive policies, but they offer limited coverage, and you may end up paying more in the long run if anything happens to your yacht.

Comprehensive policies, on the other hand, offer all-inclusive coverage, including damage or loss of the vessel, liability coverage, personal accident coverage, and pollution coverage. Comprehensive policies can be expensive, but they provide peace of mind knowing that your yacht is fully protected.

Factors Affecting Boat Insurance Premiums

Several factors can affect the cost of your boat insurance premiums in Spain. Some of these factors include:

Age and condition of the vessel: Newer and well-maintained yachts are generally cheaper to insure than older and poorly maintained vessels.

The cruising area: The location where you want to sail your yacht can affect your premiums. For instance, if you plan on cruising in dangerous or high-risk areas, your premiums may be higher.

The type of vessel: The size, make, and model of your yacht can also affect your insurance premiums. Bigger and more expensive yachts are generally more expensive to insure.

The purpose of the yacht: The primary use of your yacht can also affect your premiums. If you plan on using your yacht for business or commercial purposes, your premiums may be higher.

Choosing the Right Insurance Provider

Choosing the right insurance provider is crucial to ensuring that you have adequate coverage for your yacht in Spain. Here are some factors to consider when looking for an insurance provider:

Reputation: Look for an insurance company with a good reputation and excellent customer service.

Coverage and deductibles: Make sure you understand the policy coverage and deductibles before you sign up for any policy.

Experience: Choose an insurance company with experience in insuring yachts and other marine vessels.

Cost: Compare the premiums and coverage offered by different insurers before making a decision.

Boat insurance is a necessary expense for any yacht owner in Spain. With the right coverage, you can protect your investment and enjoy your yachting experience without worry. Choose a reliable insurance provider, understand your policy coverage, and consider all the factors that affect your premiums to make an informed decision.

Boat Tours in Daytona Beach: The Ultimate Guide to Exploring the Waters

Boat Insurance in Queensland: Comparing Options and Understanding Coverage

© 2024 Yacht Dreaming

insurance fAQ

Is boat insurance required in spain.

Yes, since 1999 it has been mandatory to have the boat insured, as long as they are motor-powered or longer than 6 meters. In addition, most marinas ask for proof that you are up to date with the insurance payments to be able to dock a boat or yacht.

What are the benefits of having good boat insurance in Spain?

There are many benefits to having good boat insurance in Spain, including:

- Protection from financial losses in the event of an accident or other incident

- Peace of mind knowing that you are covered

- Access to discounts on marina fees and other services

- The ability to borrow money against the value of your boat

What are the different types of boat insurance policies available in Spain?

There are a variety of different boat insurance policies available in Spain, each with its own set of coverages. Some of the most common types of policies include:

- Liability insurance: This type of policy covers damage or injury caused by your boat to other people or property.

- Comprehensive insurance: This type of policy covers damage to your boat, regardless of who is at fault.

- Hull insurance: This type of policy covers damage to the hull of your boat.

- Medical insurance: This type of policy covers medical expenses for you and your passengers in the event of an accident.

How much does boat insurance cost in Spain?

The cost of boat insurance in Spain varies depending on a number of factors, including the type of boat, the value of the boat, and the level of coverage you choose. However, you can expect to pay anywhere from a few hundred euros to a few thousand euros per year for boat insurance.

How do I get boat insurance in Spain?

To get boat insurance in Spain, you can contact a number of different insurance companies. You can also compare quotes online. When comparing quotes, be sure to read the policy carefully to make sure you understand the coverages and exclusions.

Here are some additional tips for getting boat insurance in Spain:

- Get quotes from multiple insurers to get the best possible price.

- Make sure you understand the policy carefully before you sign it.

- Ask about any discounts that may be available to you.

- Keep your policy up-to-date with any changes to your boat or your needs.

Insurances for Yachts & Recreational Vessels in Spain

Spain has earned a reputation for being a maritime country. Each year many visitors stream in to visit the land and enjoy its sandy beaches and pristine waters. Sea lovers do so by enjoying life on board a yacht, a smaller boat or any other kind of recreational vessel.

The 7880 km of Spanish coastline and incredible weather conditions attract boat and yacht owners from around the world . Did you know that Spain is the second country in the world where more second-hand yachts are sold?

Sailing with your Yacht in Spain? Get Help with Your Insurance

Although there are some locations in Comunidad Valenciana, Balearic Islands – the heart of yacht charters in Spain – Andalucía and Cataluña where major ports like Marina Ibiza with 530 berths, Marina Port Vell in Barcelona, Puerto Banús in Málaga, Marina de Dènia in Alicante or Club de Mar in Mallorca can be crowded and cost more they are still attracting a lot of yachts and vessels every year.

Before the season is about to begin it is time to check that everything is ok with your yacht. Having the right yacht insurance policy at the right price and with needed coverages can help you avoid costly incidents both while berthing and mooring and out in the sea.

Basic Yacht Insurance Coverages

Yacht insurances can be very detailed and include many extras and covers. The idea is finding an insurance for your yacht that will match the value of your craft, your level of sailing experience and your mooring arrangements. You should consider if your current yacht insurance policy is offering:

- Spanish or English conditions

- third party liability and the amount covered because yacht accidents can be pretty expensive due to the nature of the vessels involved

- personal accident cover

- cover for the crew

- salvage and wreck costs covered

- lending the yacht to friends

- cover for failure of machinery

- hull insurance during winter storage

- benefits for mooring on a marina or storing your yacht ashore

- and many others …

As you probably already know there are infinite details to take care of when taking out a yacht insurance. That is why we at Cogesa Expats as expert insurance brokers can help you find your tailored yacht insurance to be ready before next season starts. Check out our professionalism and customer care by contacting us here or fill the form below and we will get in touch with you in short.

Get a Quote for Your Yacht Insurance

- I accept that the data provided by me in this form will be used by Cogesa Expats to send me a relevant insurance quote

Comments are closed.

Shall We Get in Touch with You?

BOAT INSURANCE

Why choose our insurance brokerage?

Best companies.

We work with the best insurance brands on the market.

PRICE-QUALITY RATIO