Oracle CEO wins deadly yacht raceJana Sanchez-Klein writes for the IDG News Service.

- December 29, 1998 - December 29, 1998 - December 25, 1998 |

|

( ) ( ) ( ) ( ) --> | | | | under which this service is provided to you.

Read our .

| Larry Ellison will control Paramount. His career spans software, Hollywood, and yacht racing.- Larry Ellison, the 80-year-old cofounder of Oracle, is one of the most interesting men in tech.

- Whether yacht racing, buying Hawaiian islands, or trash-talking competitors, he keeps it lively.

- N ow, he's one of the world's richest people with a net worth of about $157 billion.

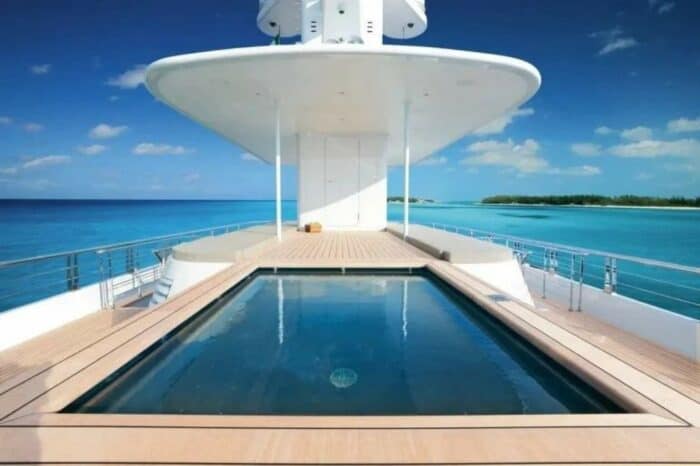

Larry Ellison is the founder and chief technology officer at software company Oracle. Now, he's also the world's sixth-richest man and has a net worth of $157 billion, according to the Bloomberg Billionaires Index . The billionaire's fortunes have surged by $14 billion thanks to spiking demand for generative AI. The windfall puts him ahead of tech execs like Google cofounder Sergey Brin and former Microsoft chief executive Steve Ballmer. The 80-year-old started Oracle in 1977, and decades later he's still one of the top dogs in Silicon Valley despite living in Hawaii full time — and owning an entire island. Ellison has also been a major investor in Tesla, Salesforce, and even reportedly had a seat on Apple's board of directors for a while. Outside the office, the billionaire boasts an impressive watch collection and indulges in hobbies like yacht racing. His children have made their own names in the film industry, and his son David Ellison is set to become the CEO of Paramount after its merger with his Skydance Media production company. Through some of Larry's entities, he will control Paramount, per a September filing. Here's a look at the life and career of Ellison so far. Lawrence Joseph Ellison was born in the Bronx on August 17, 1944, the son of a single mother named Florence Spellman. When he was 9 months old, Larry came down with pneumonia, Vanity Fair reported . His mom sent him to Chicago to live with his aunt and uncle, Lillian and Louis Ellison. Vanity Fair reported that Louis, his adoptive father, was a Russian immigrant who took the name "Ellison" in tribute to the place in which he entered the US: Ellis Island. Ellison is a college dropout. Ellison went to high school in Chicago's South Side before attending the University of Illinois at Urbana-Champaign. When his adoptive mother died during his second year at college, Ellison dropped out. He tried college again later at the University of Chicago but dropped out again after only one semester, Vanity Fair reported. In 1966, a 22-year-old Ellison moved to Berkeley, California — near what would become Silicon Valley and already the place where the tech industry was taking off. He made the trip from Chicago to California in a flashy turquoise Thunderbird that he thought would make an impression in his new life, Vanity Fair reported . Ellison bounced around from job to job, including stints at companies like Wells Fargo and the mainframe manufacturer Amdahl. Along the way, he learned computer and programming skills. In 1977, Ellison and partners Bob Miner and Ed Oates founded a new company, Software Development Laboratories. The company started with $2,000 of funding. Ellison and company were inspired by IBM computer scientist Edgar F. Codd's theories for a so-called relational database — a way for computer systems to store and access information, Britannican said . Nowadays, they're taken for granted, but in the '70s, they were a revolutionary idea.  The first version of the Oracle database was version 2 — there was no version 1. In 1979, the company renamed itself Relational Software Inc., and in 1982, it formally became Oracle Systems Corp., after its flagship product. In 1986, Oracle had its initial public offering, reporting revenue of $55 million. As one of the key drivers of the growing computer industry, Oracle grew fast. The company is responsible for providing the databases in which businesses track information that is crucial to their operations. Ellison became a billionaire at age 49. Now, he has a net worth of roughly $152 billion, according to Forbes, after racking up $50 billion in gains thanks to Oracle and Tesla stock. That makes him the seventh-richest person in the world. Still, in 1990, Oracle had to lay off 10% of its workforce, about 400 people, because of what Ellison later described as "an incredible business mistake." Oracle reported a loss of $36 million in September 1990 after admitting that it had miscalculated its revenue earlier that year, The New York Times reported . It didn't get the decade off to a great start. After adjusting for that error, Oracle was said to be close to bankruptcy . At the same time, rivals like Sybase were eating away at Oracle's market share. It took a few years, but by 1992, Ellison and Oracle managed to right the course with new employees and the popular Oracle7 database. Ellison is known for his willingness to trash-talk competitors. For much of the '90s, he and Oracle were locked in a public-relations battle with the competitor Informix, which went so far as to place a "Dinosaur Crossing" billboard outside Oracle's Silicon Valley offices at one point, Fortune reported in 1997. His financial success has led to some expensive hobbies. With Ellison as Oracle's major shareholder, his millions kept rolling in. He started to indulge in some expensive hobbies — including yacht racing. That's Ellison at the helm during a 1995 race. He also partly financed the BMW Oracle USA sailing team, which won the America's Cup in 2010, according to Bloomberg. Ellison was an early investor in Salesforce. In 1999, Ellison's protégé, Marc Benioff , left Oracle to work on a new startup called Salesforce.com. Ellison was an early investor, putting $2 million into his friend's new venture. When Benioff found out that Ellison had Oracle working on a direct competitor to Salesforce's product, he tried to force his mentor to quit Salesforce's board. Instead, Ellison forced Benioff to fire him — meaning Ellison kept his shares in Salesforce. Given that Salesforce is now a $267 billion company, Ellison personally profits even when his competitors do well. It has led to a love-hate relationship between the two executives that continues to this day, with the two taking shots at each other in the press. The dot-com boom of the late '90s benefited Oracle. All of those new dot-com companies needed databases, and Oracle was there to sell them. Although investors lost out in the dot-com crash, Oracle came out of it stronger due to its acquisitions and the demand for software solutions. With the coffers overflowing, Ellison was able to lead Oracle through a spending spree once the dot-com boom was over and prices were low. In 2005 , for example, Oracle snapped up the HR software provider PeopleSoft for $10.3 billion. And in 2010, Oracle completed its acquisition of Sun Microsystems, a server company that started at about the same time as Oracle, in 1982. That acquisition gave Oracle lots of key technology, including control over the popular MySQL database. Ellison has also spent lavishly over the years, so much so that his accountant, Philip Simon, once asked him to "budget and plan," according to Bloomberg. Ellison has expensive taste. Over the years he's built up an impressive collection of Richard Mille watches, an expert previously told BI. The timepieces start in the six-figure range and can go for over $1 million in some cases. In 2009, the billionaire purchased the Indian Wells tennis tournament for a reported $100 million, The Los Angeles Times reported. In 2010, Ellison signed the Giving Pledge. By signing the pledge, Ellison promised to donate 95% of his fortune before he dies. And in May 2016, Ellison donated $200 million to a cancer treatment center at the University of Southern California, Forbes reported. Starting in the 2010s, Ellison started to take more of a back seat at Oracle, handing more responsibilities to trusted lieutenants, like Mark Hurd and Safra Catz, then Oracle's copresidents. Ellison hired Hurd, a former CEO of HP, in 2010, Inc reported. Catz has made a reputation for herself among analysts for what they describe as brilliant business strategy. But Ellison's spending didn't slow down. In 2012, he bought 98% of the Hawaiian island of Lanai. Ellison founded a startup called Sensei in 2016 that does hydroponic farming and owns a wellness retreat on Lanai. He also purchased Hawaiian budget airline Island Air in 2014, before selling a controlling interest in the airline two years later after it struggled financially. In 2014, Ellison officially stepped down as Oracle CEO. Ellison handed control over to Hurd and Catz, who became co-CEOs. Ellison now serves as the company's chairman and chief technology officer. Following Hurd's death in 2019, Catz became the sole CEO. In 2016, Ellison scored a personal coup: the purchase of NetSuite. Back in 1998, Ellison had made a $125 million investment in ex-Oracle exec Evan Goldberg's startup business-management software firm, NetSuite. It ended up working out well for Ellison when NetSuite CEO Zach Nelson negotiated the sale of the company to Oracle for $9.3 billion , netting Ellison a cool $3.5 billion in cash for his stake. NetSuite investor T. Rowe Price tried to block the deal , citing Ellison's conflict of interest, but the sale closed in November 2016. He's used his billions in a variety of ways: he invested in educational platform maker Leapfrog Enterprises and was an early investor in the ill-fated blood-testing company Theranos. Ellison has held shares in some of the most recognizable companies, one of which was the infamous blood-testing company Theranos, founded by Elizabeth Holmes . It had a promising future until its flaws were exposed and Holmes received a prison sentence. When Steve Jobs returned to Apple as CEO back in 1997, he asked Ellison to sit on the board. Ellison served for a while, but felt that he couldn't devote the time and left in 2002, according to Forbes . Compensation for his role was an option to buy about 70,000 shares, which would've amounted to about $1 million at the time of his departure. Ellison owns homes on the East and West coasts as part of a multibillion-dollar real-estate portfolio. Ellison reportedly owns the Astor Beechwood Mansion in Newport, Rhode Island, and a home in Malibu. Ellison also has houses in Palm Beach, Florida and more in a multibillion-dollar real-estate portfolio. Both of his two children work in the film industry. His daughter, Megan, is an Oscar-nominated film producer and the founder of Annapurna Pictures. The company has produced films like "Zero Dark Thirty" and "American Hustle." Ellison's son, David, is also in the film business. His company, Skydance Media, has produced movies like "Terminator: Dark Fate" and films in the "Mission: Impossible" franchise. After months of discussions in 2024, Skydance Media and Paramount agreed to a deal , creating "New Paramount," which David will be CEO of. He has plans to "improve profitability, foster stability and independence for creators, and enable more investment in faster growing digital platforms," the companies said. Ellison has a reputation as an international, jet-setting playboy. Ellison has been married and divorced four times. He's most recently dated Nikita Kahn, a model and actress. Ellison was one of the few tech leaders who had a friendly relationship with former President Donald Trump. Ellison said publicly that he supported Trump and wants him to do well, and hosted a Trump fundraiser at his Rancho Mirage home in February, though he did not attend . The fundraiser caused an outcry among Oracle employees, who started a petition asking senior Oracle leadership to stand up to Ellison. Catz, the CEO of Oracle, also had close ties to the Trump administration, having served on Trump's transition team. Ellison and Trump remained close during Trump's time in office and reportedly spoke on the phone about possible coronavirus treatments. Trump also supported Oracle's bid to buy TikTok , calling Oracle a "great company." In December 2018, Ellison joined the board of directors at Tesla, where he's been a major investor. Earlier in 2018, Ellison described Tesla CEO Elon Musk as a "close friend," and defended him from critics. When Musk acquired Twitter — now X — in 2022, Ellison offered to invest $1 billion. Musk went on to help Ellison reset his forgotten password, biographer Walter Isaacson wrote . In December 2020, Ellison revealed that he moved to Lanai full-time. The announcement came after Oracle decided to move its headquarters to Austin, leading Oracle employees to ask Ellison if he planned to move to Texas too. "The answer is no," Ellison wrote in a company-wide email. "I've moved to the state of Hawaii and I'll be using the power of Zoom to work from the island of Lanai." He signed the email: "Mahalo, Larry." He left Tesla's board in August 2022. In a proxy filing in June 2022, the electric vehicle maker revealed that Ellison would be leaving the board. Since then, he and Musk have appeared to maintain their close relationship. Oracle had a record-breaking 2023, and cemented itself in the new age of artificial intelligence. Oracle's shares continued to hit records, CNBC reported. The company proved that it's not going any where any time soon. In 2023, Oracle backed OpenAI rival Cohere. Oracle joined other tech giants, like Salesforce, in backing the tech startup in June 2023. It began offering generative AI to its clients based on tech made by Cohere . "Cohere and Oracle are working together to make it very, very easy for enterprise customers to train their own specialized large language models while protecting the privacy of their training data," Ellison previously said. Oracle announced in April that it would be moving its headquarters to Nashville, Tennessee. Despite its big move to Austin only four years ago, Ellison said that Oracle is planning to move its world headquarters to Nashville, Tennessee. In April 2024, the exec announced that Oracle has plans for a "huge campus" in Nashville that will one day serve as the software giant's world headquarters. The company relocated from the San Francisco area to Austin, Texas in 2020. "It's the center of the industry we're most concerned about, which is the healthcare industry," Ellison said at the Oracle Health Summit in Nashville, CNBC reported . Ellison's wealth jumped $14 billion after record earnings from Oracle. Oracle's cloud applications business saw its shares spike by 13% in June 2024 after the company posted strong annual earnings due to demand for generative AI, Fortune reported . Ellison, who now serves as Oracle's CTO and owns about 40% of the company's cloud sector, got a $14 billion boost to his fortune. The company also announced a partnership with AI startup Cohere , enabling its enterprise customers to build their own generative AI apps. "Cohere and Oracle are working together to make it very, very easy for enterprise customers to train their own specialized large language models while protecting the privacy of their training data," Ellison said during the company's earnings call. Ellison to control Paramount as its majority shareholder Ellison is set to become the controlling shareholder of Paramount following its merger with Skydance Media, a company founded by his son, David Ellison . Pinnacle Media, Larry Ellison's investment firm, will acquire 77.5% of the voting interest currently held by Shari Redstone , according to a filing with the Federal Communications Commission. This move effectively transfers control of Paramount from Redstone to Ellison. While David Ellison has been named Paramount's new CEO and may retain some autonomy in the role, the FCC filing reveals that his father will hold ultimate authority as the primary shareholder and will likely retain significant decision-making power, Brian Quinn, a Boston College Law School professor, told the New York Times . The deal, valued at $8 billion , includes major assets like CBS and MTV. RedBird Capital Partners, a private-equity firm backing Skydance, will acquire some voting rights, but Larry Ellison will retain the largest stake. He plays a sizable role in the entertainment industry, including cameos in movies such as "Iron Man 2" and through the financial backing of his children's ventures, including his daughter Megan Ellison's Annapurna Pictures. Matt Weinberger and Taylor Nicole Rogers contributed to an earlier version of this story. Correction: May 7, 2024 — An earlier version of this story misstated Larry Ellison's role at Oracle. He's the chief technology officer, not the CEO.  We need your support todayIndependent journalism is more important than ever. Vox is here to explain this unprecedented election cycle and help you understand the larger stakes. We will break down where the candidates stand on major issues, from economic policy to immigration, foreign policy, criminal justice, and abortion. We’ll answer your biggest questions, and we’ll explain what matters — and why. This timely and essential task, however, is expensive to produce. We rely on readers like you to fund our journalism. Will you support our work and become a Vox Member today? Larry Ellison is stepping down as Oracle CEO. Here's how he got so rich.by Timothy B. Lee  Billionaire software mogul Larry Ellison announced today that he’s stepping down as the CEO of the company he founded and has led for 37 years. If you’re like most people, you probably have only the vaguest idea why Oracle is an important company and why Ellison is so rich. Read on for details. What is Oracle?Oracle, founded in the late 1970s and based in Silicon Valley, is one of the world’s biggest enterprise software companies. It sells a line of software products that help large and medium-sized companies manage their operations. Oracle is best known for its database product, which it has sold since the late 1970s. Oracle was founded at a time when database products — and, for that matter, software companies — were a relatively new concept. Oracle quickly established itself as one of the world’s most popular database products, and as the information technology sector grew, Oracle grew with it. In the last decade, a series of acquisitions has helped Oracle evolve from a database company to a more general enterprise software company: - In 2004, after a brutal takeover battle , Oracle acquired PeopleSoft , which sold a range of enterprise software products — such as software to manage human resources, supply chains, customer support, and other functions.

- The next year, Oracle acquired Siebel Systems , another company that produces software for big companies.

- In 2008, Oracle bought yet another enterprise software company, BEA Systems .

- In 2010, Oracle acquired Sun Microsystems, which is best known as the creator of the Java programming language, but also produced an operating system, database, and other software and hardware products.

The result: Oracle is now a massive conglomerate that sells a broad range of software products and services to large companies. Thanks to the Sun acquisition, the company also produces some computer hardware. In 2013, Oracle had revenues of $37 billion and profits of $11 billion. For comparison, that same year, Google had revenues of $60 billion and profits of $13 billion.  Oracle's campus in Silicon Valley. ( Håkan Dahlström ) These products sound really boring, and I don’t know anyone who uses them. How does Oracle make so much money?Selling software to big companies is really, really lucrative. Oracle will make extensive modifications to its products to serve the needs of individual customers In fact, Oracle isn’t even the biggest company in what’s called the enterprise IT industry. IBM, the company that basically invented the enterprise IT market in the 1960s, had revenues of almost $100 billion in 2013, though it posted a net loss for the year of $16 billion. HP had revenues of $113 billion and profits of $5 billion. SAP earned about $4 billion in profits on revenues of around $22 billion. The enterprise software market is a lot different than the market for conventional packaged software products that you might be familiar with. Microsoft can create a single version of Microsoft Office and sell millions of largely identical copies to customers around the world. In contrast, enterprise software tends to be much more customized. Big companies want software that’s precisely tailored to their needs. Often this means that a company like Oracle will make extensive modifications to its products to serve the needs of individual customers. One consequence of this is that there’s a tremendous amount of vendor lock-in in the enterprise software market. Once a company has signed up to use IBM, HP, Oracle, or SAP software, they tend to continue using it for years or even decades. Typically, they’ll sign long-term service contracts, in which the software vendor provides service and support in exchange for regular payments. Because they do so much custom software work (and because selling to large companies requires a large sales force), enterprise software companies tend to have large workforces. Oracle employed 122,000 people in 2013. The same year, IBM had 431,000 employees, HP had 317,000, and SAP had 66,000. For comparison, Google, which generates almost twice as much revenue as Oracle, has less than half as many employees: 52,000. Creating web-based consumer software isn’t nearly as labor-intensive. Who is Larry Ellison? Larry Ellison's yacht in 2010. (DEAN TREML/AFP/Getty Images) Until this week, Larry Ellison was Oracle’s founder and CEO. His management of Oracle has made him one of the richest people on the planet, with an estimated net worth of about $50 billion. A college dropout, Ellison worked on a variety of software projects in the 1970s. At the time, computer scientists were developing a new concept called a relational database — a separate computer program that would help organize information and respond to queries about it. Recognizing the potential demand for a commercial database product, he founded the company that became Oracle in 1977. By the 1990s, he was a billionaire, and he became known for his lavish lifestyle. Until he sold it in 2010, he owned one of the ten largest yachts in the world . Ellison leads one of the best sailing teams in the country. He has been married and divorced four times. Ellison owns 98 percent of the island of Lanai, the sixth-largest of the Hawaiian islands, which he purchased in 2012 for a rumored $300 million. Why is Ellison stepping down as CEO?Ellison recently turned 70 years old, and he says the change is part of Oracle’s succession planning process. He’s going to become Oracle’s chairman and will continue to work on Oracle’s technology. Who is replacing him? Oracle has chosen an unorthodox arrangement to replace Ellison. The company will have two people who will both carry the title of CEO.  Mark Hurd (Justin Sullivan/Getty Images) Mark Hurd, 57, was the CEO of HP from 2005 to 2010. He resigned from that job after a woman accused him of sexual harassment . HP’s board concluded that the sexual harassment charges were unsubstantiated, but they found evidence that he had misreported expenses related to the woman, a misuse of company funds. Hurd was hired by Oracle a few weeks later. Hurd will run Oracle’s service and sales divisions.  Safra Catz (KIMIHIRO HOSHINO/AFP/Getty Images) Safra Catz, 52, has been at Oracle since 1999. She was previously in banking. She will oversee Oracle’s manufacturing, finance, and legal divisions. Ellison will continue leading Oracle’s engineering team. What was Oracle’s biggest claim to fame?Oracle was an early pioneer in the market for a technology called relational databases. A database is software that manages large amounts of data and facilitates efficient queries. It’s not something ordinary users interact with, but it’s an important part of almost every large software project. Most complex websites are based on databases, as are the computer systems of banks, insurance companies, airlines, and other companies. A relational database is a database that organizes data into tables with well-defined columns. The predictable structure of a relational database allows users to perform queries using something called the structured query language (SQL — both “S-Q-L” and “sequel” are acceptable pronunciations). Here is an example SQL query: select name from customers where zip_code = ‘55121’This SQL query tells a relational database to open the “customers” table and return a list of all the names of customers who live in zip code 55121. More complex SQL queries can perform complex comparisons and can combine data from multiple tables. In addition to the value of being able to perform complex queries, relational databases are also used because they are engineered to be highly reliable. When programs try to organize large amounts of information themselves, they’re more likely to make mistakes that lead to data loss, which a database where data is already organized can avoid. Demand for relational database software surged in the 1980s and 1990s, and Oracle grew into a large and profitable company. Are there alternatives to Oracle’s database?Yes, a number of other companies and organizations create competing databases. IBM's DB2 database has been a major Oracle competitor since the 1980s. Microsoft sells a database called SQL Server. There are also a number of open source database products. Until recently, one of the most popular was called MySQL. The company behind MySQL was acquired by Sun in 2008, which in turn was acquired by Oracle in 2010. Still, because MySQL is open source, users can use the product without paying Oracle for it. In recent years, the open-source PostgreSQL database has been growing in popularity. The constantly-falling cost of computer software may prove to be a challenge for Oracle In the last five years, there’s been a trend away from relational databases. As websites have gotten larger, programmers have found that traditional SQL database become a bottleneck — it’s just not possible to organize data from hundreds of thousands of users into a single table. To solve this problem, a new generation of database products don’t organize data into regular tables at all. They use simpler storage techniques that make it easier to distribute data storage across thousands of servers. One downside of this technique is that the these programs don’t support all the functions of SQL — for this reason, they’re sometimes called “NoSQL databases” — but they allow websites like Facebook, Google, and Twitter to handling trillions of data points from hundreds of millions of users. One of the most popular NoSQL databases is MongoDB . What challenges will Hurd and Catz face?In the long run, the constantly-falling cost of computer software may prove to be a challenge for Oracle. The company made its fortune by selling its proprietary database product for thousands of dollars per customer. Many companies continue to do that — and will likely continue to do so for many years to come. But the increasing sophistication of free alternatives, not to mention the shift to non-SQL alternative models, is going to make it difficult to attract new customers. Other parts of Oracle’s business face similar challenges. A growing number of companies may choose to rent computing power from cloud computing services offered by Amazon or Microsoft instead of buying dedicated servers manufactured by Oracle’s hardware division. The open source software company Red Hat offers a free operating system and other free software that serve the same purpose as many Oracle products. Still, the stickiness of the corporate IT market means that Oracle is likely to enjoy healthy revenues for many years to come. Large companies need a ton of custom work done on their software, and they tend to turn to established brands like Oracle to do it. That will provide plenty of work for Oracle even if some of its product lines are commoditized. Most Popular- There’s a fix for AI-generated essays. Why aren’t we using it?

- Did Brittany Mahomes’s Donald Trump support put her on the outs with Taylor Swift?

- Conservatives are shocked — shocked! — that Tucker Carlson is soft on Nazis

- The hidden reason why your power bill is so high

- America’s love affair with the increasingly weird Kennedys

Today, ExplainedUnderstand the world with a daily explainer plus the most compelling stories of the day.  This is the title for the native ad More in Technology What does Nvidia’s massive stock sell-off tell us about the economy?  Inside Gen Alpha’s relationship with tech.  The largest mass transit system in the United States is overdue for an upgrade.  TikTok probably can’t teach you to game the financial system like a rich person, but it might teach you crime.  EVs help reduce greenhouse emissions. But too many used gas-guzzlers could make that impossible.  February?! Until February?!?! Boeing slip leaves astronauts in limbo. Ellison recounts deadly yacht raceOracle's CEO recounts last month's perilous Sydney to Hobart race--and he says filmmakers have expressed interest. The Oracle chief executive and avid yacht racer today said that filmmakers have approached him about making a movie depicting his experience winning--and surviving--the lethal Sydney to Hobart Yacht Race last month. Ellison declined to elaborate on the film interest, which he acknowledged following a lunchtime address to the St. Francis Yacht Club here. Ellison, owner and skipper of the 80-foot Sayonara, found himself in serious trouble when a forecasted storm turned into a hurricane last month. Six sailors from other vessels lost their lives in the disaster. Forty-four of the 115 boats that began the race completed it. In today's remarks, Ellison gave a riveting account of his recent battle with nature. Ellison's talk elicited gasps and sympathetic groans from his audience of yachting enthusiasts as the database magnate chronicled with precise technical detail the force of the gales, the height and angle of the waves, and the lengthening inventory of sails and other vital yacht hardware destroyed in what Ellison described as a full-fledged hurricane. The standing-room only address benefited the American Red Cross , which is raising money for the families of the six drowned sailors. Shortly after emerging from the eye of the storm, the Sayonara was hoisted on waves so steep that the vessel repeatedly found itself in several-seconds-long free falls above the churning sea. Ellison recounted seeing crew members suspended in mid-air before being dashed back to the decks. One of Ellison's two dozen crew members went overboard without his harness, but managed to climb back on. Ellison's crew emerged from the storm whole but battered. Injuries included broken feet, ribs, and knees. Ellison was seasick for the second time in his life, he said, and vomited more times than he could count. For three days he stopped eating, and for the last of these he stopped drinking water as well. "I'm an acrobatic pilot, so I'm used to funny things happening in my inner ear," Ellison said. "But boy was I sick." In response to a question from the audience, Ellison acknowledged that he thought he might die in the storm, though the exigencies of the moment prevented him from dwelling on the prospect. "A stupid way to die" "What a stupid way to die," Ellison said he thought at the time. "At least the professionals are being paid for this. I was paying to be there, so I felt especially stupid." Ellison and the other racers expected stormy weather, which he said was routine for the Tasman Sea at that time of year. But nobody has forecast a hurricane, he said. Ellison praised the 71 boats that withdrew from the race rather than complete it. "This is not what sailboat racing is supposed to be about," Ellison said. Ellison's next scheduled yacht race is the U.K.'s Fastnet, which he will sail with fellow yacht racer Ted Turner. - Skip to Nav

- Skip to Main

- Skip to Footer

- Saved Articles

- Newsletters

Oracle Founder Larry Ellison Owns an Island Full of Cats, Doesn't Want to Talk About ItPlease try again  Larry Ellison, the man who co-founded Oracle (the second-largest software company in the world, one whose name you may notice on a handful of local stadiums, boat races, and such) is arguably the closest thing the Bay Area has to a Rockefeller. In May, Forbes listed him as the third wealthiest human in America and the fifth-wealthiest human in the world , with an estimated net worth of $54.3 billion to his name. What does he do with all that money? Well, he's given some of it to Harvard, donated to hospitals, and helped fund the Israel Defense Forces. He also owns several airplanes, including multiple military aircraft, and a handful of the world's largest yachts. He's been called the world's most avid trophy-home buyer (we tried counting how many houses he actually has for the purposes of this post, but quickly grew tired and gave up. It's more than 40. One is a villa in Japan). What we didn't know about Ellison until this week: Like Dr. Evil, Freddie Mercury, and Taylor Swift before him, the Bay Area's resident plutocrat is really into cats. Over at Buzzfeed , SF writer Andrew Dalton paid a visit to Lana'i, Hawaii's sixth-largest island, 97 percent of which Ellison purchased in 2012. (He doesn't own the airstrip, the public school, and a handful of fields.) What he does own is some 425 feral cats, all residents of the Lana'i Animal Rescue Center, which exists on 3.5 acres of Ellison-managed land. Though the ranch was founded in 2008, before Ellison bought the island, the facility now receives veterinary and accounting support from the Peninsula Humane Society in Burlingame. The whole piece is well worth a read -- the pictures alone are amazing -- but our favorite part is that the unabashedly ostentatious Ellison has no desire to acknowledge his feline-philia. Although he has yet to visit the sanctuary himself, Ellison’s relationship with his own cats was remarkable enough to deserve two mentions in his 1997 biography The Difference Between God and Larry Ellison (subtitle: “God Doesn’t Think He’s Larry Ellison”). Ellison’s biographer, journalist Mike Wilson, relays a story told to him by Ellison’s first wife, Adda Quinn. When Ellison’s cat Yitzhak died, Quinn said, he “took off two weeks in mourning. He was nonfunctional.” In another anecdote, Ellison tells Wilson he once returned home to find out his cat Clio died while he was out of town on business. Ellison had the cat’s body exhumed so she could be buried under her favorite tree. When BuzzFeed News reached out to Ellison for comment about his feelings towards felines, especially those on Lana’i, an Oracle rep declined to comment. What gives, Larry? If you somehow don't think it's macho to come out as cat person, you're sorely mistaken -- even the New York Times says it's okay now . All in all, it just seems uncharacteristic for a guy who doesn't seem embarrassed about constantly and blatantly overcompensating for something owning a boat so big he can't dock it anywhere .  Thanks for signing up for the newsletter. - Newsletters

- Account Activating this button will toggle the display of additional content Account Sign out

How to Play Basketball Like a Tech TycoonReivax / Flickr (Creative Commons) The very rich play basketball differently from you and me. At least, Oracle co-founder and CEO Larry Ellison does. In an article naming Ellison as a possible suitor for the Los Angeles Clippers, the Wall Street Journal dropped the following tidbit about the tech tycoon’s recreational habits : The Oracle chief has had basketball courts on at least two of his yachts, said Tom Ehman, who handles America’s Cup matters for Mr. Ellison. He said Mr. Ellison liked to relax by shooting hoops on these courts, and has had someone in a powerboat following the yacht to retrieve balls that go overboard. Apparently I do not understand being uber-rich at all, because I would have thought it’d be easier just to bring along some spare basketballs. But then I guess you wouldn’t get the satisfaction of barking, “Smithers, fetch me that roundball!” every time you laid another brick. Let it not be said, though, that Ellison is wasteful: The basketball court on his yacht The Rising Sun— reportedly the world’s 10th-largest yacht —conveniently doubles as a helipad. Ellison, by the way, took in a cool $78.4 million in compensation last year for his stewardship of the world’s second-largest software vendor —more than twice as much as any other CEO in America, according to Equilar . He also owns 98 percent of the Hawaiian island of Lanai . Previously in Slate : - Oracle Finally Deigns to Fix Java After Months of Silence

- Hawaiians Wish Bill Gates Had Bought Lanai, Not Larry Ellison

- All Hail the Billionaire-Funded, Cheat-Tastic America’s Cup Victors

- Google CEO Is Tired of Rivals, Laws, Wants to Start His Own Country

The Palace Coup at the Magic KingdomThe inside story of how Bob Iger undermined and outmaneuvered Bob Chapek, his chosen successor, and returned to power at Disney. Credit... Philip Cheung for The New York Times Supported by  By James B. Stewart and Brooks Barnes - Sept. 8, 2024 Updated 10:51 a.m. ET