Royal Navy Ship HMS Trent Seizes Cocaine Worth £40 Million In The Caribbean Sea

Seafarers Hospital Society Launches Pilot Project To Support Women At Sea

Hydrocell Launches The First Hydrogen-Powered Boat

Indian Port Workers Call Off Strike After Agreeing To New Wage Settlement

What is Marine Insurance?

A simple definition of insurance would be “Protection against future loss.” Marine insurance is another variant of the general term ‘insurance’ and, as the name suggests, is provided to ships, shipyards, marinas, offshore installations and floating equipment.

Independent owners can avail of insurance facilities for their watercraft (PWC), megayachts, yachts, and pleasure craft. Some boat insurance coverages include wreck removal and salvage without additional hull coverage costs.

Most importantly, cargo insurance provides coverage to cargo loaded onto ships or vessels during the transportation process.

Different types of coverage options offer protection to various kinds and sizes of ships, depending on the shipping routes taken.

Insurance policies are well-laid-out contracts that both parties must abide by. A policy ensures the vessel is against common risks, such as property damage, theft, collision, explosion, capsizing, etc.

Marine Liability Insurance/P&I, or protection and indemnity, protects third-party liabilities that shipowners and companies are exposed to during their operations. It is indemnity and not liability coverage. It includes coverage for injuries, illnesses, and loss of life caused by operating the vessel. Medical expenditures, damage to other vessels, collision and related expenses are also covered.

Many types of marine insurance and marine insurance companies with years of experience and expertise offer different coverage plans.

Some inland marine insurance providers provide coverage for goods in transit, even when they have reached land and are taken to storage and logistics facilities.

Marine insurance coverage is essential because, through marine insurance, ship owners and transporters can be sure of claiming damages, especially considering the mode of transportation used.

Of the four modes of transport—road, rail, air, and water—the latter most worries the transporters. Not only do natural occurrences have the potential to harm the cargo and the vessel, but other incidents and attributes could cause a huge loss in the financial casket of the transporter and the shipping corporation.

Incidents like piracy and possibilities like cross-border shoot-outs also pose a significant threat to water shipments. Therefore, to avoid any loss because of such events and happenings, it is always beneficial to have a backup, such as marine insurance, in the interest of the corporation and the transporter.

Another important aspect of having marine insurance is that a transporter can choose the insurance plan according to the size of his ship, the routes that his ship takes to transport the cargo, and many other minor points that could significantly affect the transporter.

Also, since various plans and policies indicate covering not just the cargo but also the vessel, the transporter can choose and avail of the best policy that suits his business.

However, as much as marine insurance provides a fair claim to transporters and corporations, it has to be understood that the trickiest and strictest insurance areas when the insurance commenced – i.e. from the 17th century onwards.

While dealing with the scope and range of marine insurance , a ship’s captain must follow a rigid protocol regarding the route and time taken for the cargo and the vessel to reach the intended destination port.

If there is any discrepancy or violation in terms of the route taken, i.e. if the captain varies or digresses in his route from the one originally intended as a part of the ship’s course, then even if there is any mishap occurring to the vessel or the cargo, the insurance claim will be rejected entirely without any possibility of the claim being reimbursed to the claimant at some future date after a few tough negotiations.

Therefore, it becomes essential that a ship’s captain consider the prescribed routes to avoid a failed insurance contract due to an accidental loss caused by a deviation in the path. This would encourage caution on the captain’s part and reduce the possibility of losing essential insurance claims due to inadvertence and negligence.

Marine insurance is a haven for shipping corporations and transporters because it helps to reduce financial loss due to the loss of critical cargo. Also, it helps to establish the duty, dedication, and straightforwardness of the insurance companies toward the transporting companies and the receiving parties.

You might also like to read

- Different Types of Marine Insurance & Marine Insurance Policies

- Marine Insurance for Piracy Attacks: Necessities and Benefits

- The Importance of Marine Insurance Brokers

- What is Marine Cargo Insurance and How to Get One?

Disclaimer : The information contained in this website is for general information purposes only. While we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

Do you have info to share with us ? Suggest a correction

About Author

Raunek Kantharia is a marine engineer turned maritime writer and entrepreneur. After a brief stint at the sea, he founded Marine Insight in 2010. Apart from managing Marine Insight, he also writes for a number of maritime magazines and websites.

Read More Articles By This Author >

Daily Maritime News, Straight To Your Inbox

Sign Up To Get Daily Newsletters

Join over 60k+ people who read our daily newsletters

By subscribing, you agree to our Privacy Policy and may receive occasional deal communications; you can unsubscribe anytime.

BE THE FIRST TO COMMENT

i like the information you give on media

A very informative post. Marine insurance is important in case of import and export of goods which is an integral part of the economy. By compensating against the loss of goods and ship, the policy helps exporters and importers bear any losses incurred during transit.

i liked it so mush but can you write about it is polices ,please!!

Leave a Reply

Your email address will not be published. Required fields are marked *

Subscribe to Marine Insight Daily Newsletter

" * " indicates required fields

Marine Engineering

Marine Engine Air Compressor Marine Boiler Oily Water Separator Marine Electrical Ship Generator Ship Stabilizer

Nautical Science

Mooring Bridge Watchkeeping Ship Manoeuvring Nautical Charts Anchoring Nautical Equipment Shipboard Guidelines

Explore

Free Maritime eBooks Premium Maritime eBooks Marine Safety Financial Planning Marine Careers Maritime Law Ship Dry Dock

Shipping News Maritime Reports Videos Maritime Piracy Offshore Safety Of Life At Sea (SOLAS) MARPOL

- Yachting for beginners

- Owning a yacht

- Motor Yachts

- Sailing Yacht

- Indian Ocean

- Mediterranean

- Buying or Selling a Yacht

- Yachting Events

- FAQ – Luxury Yacht Charter

- FAQ – Buying a Yacht

- FAQ – Sell your Yacht

- How Much Does It Cost To Charter A Luxury Yacht?

- All our Blog Post & News

Yacht Insurance: The Definitive Owner’s Guide

A sailing vessel’s indemnification liability coverage is provided through yacht insurance, and it covers any damage to the yacht’s body, property destruction of others, and private property damage aboard the vessel. This insurance may also cover gas supply, towing, and help if your boat gets stuck, depending on the insurance company.

Understanding The Two Parts of Yacht Insurance

Hull insurance.

Hull insurance is a direct and all-risk insurance policy that covers damage and includes an agreed amount of hull insurance. The amount settlement is done when the policy is drawn up, and the payment is in full in the event of a total loss. In addition, there’s the possibility of replacement costs insurance for partial losses. Still, sails, batteries, canvas outboards, and sometimes outdrives aren’t covered and are instead at risk of depreciation.

Indemnity and protection (P&I)

Protection and indemnity (P&I) insurance provides the most comprehensive insurance coverages for liability. Because maritime law is unique, you must have coverages specifically designed to protect you from risk-taking situations. P&I will cover any judgments against you and pay to defend you in admiralty courts.

What are the factors that can influence your yacht insurance?

Insurers consider many factors when deciding whether to offer a policy.

Almost any vessel can be insured – for a price. You should consider the following to make sure the policy you buy meets your needs:

- Age of the vessel

- Value (make sure you consider depreciation over the years of the value of your yacht)

- Speed/Power

- Type of vessel (Sailing, motor, Inboard, Outboard, utility, cruiser, offshore fishing boat)

- Custom built (boats without serial numbers can be tricky to insure)

- Location of use (which ocean are you planning to locate your boat. Make sure you let your insurance know whenever this changes over the months!)

What does yacht insurance usually cover?

Usually, the yacht insurance covers:

Liability protection: the bare minimum insurance

Property damage liability pays for damage to another person’s property caused by the accident you commit. You are covered if your yacht causes damage to individuals or damages other ships, docks, or buildings. Remember that harm or damage might occur due to direct contact with your boat or events induced by your yacht, such as during heavy wakes. In most cases, boat liability insurance covers you against covered claims and litigation involving settlements and legal expenses. To ensure that you have the right coverage, talk to your advisor regarding your needs and potential dangers.

Hull and machinery coverage

Hull insurance will cover any physical injury to your boat, including motors, trailers and equipment, and even accessories in many instances. Damage from wind and fire are typical claim types.

Uninsured boater coverage

Indemnifies bodily injured passengers of the insured watercraft who suffer injuries due to the uninsured owner of a different vessel.

Search and rescue

The maximum amount is $10,000 for costs that an insured incurs to a government entity like the United States Coast Guard (USCG), which provides emergency assistance and is covered at absolutely no cost.

Marine environmental damage and pollution coverage

This protection is available up to $10,000 in penalties and fines in the event of marine environmental damage as per the policy’s conditions. This coverage is added to the insurance company’s liability and OPA limit.

Agreed value coverage or actual cash value coverage

A cash value policy offers lower coverage than an agreed value insurance policy, however, generally with a lower cost. ACV policies provide coverage up to the value of the vessel. ACV policy would protect up to the price of the market for the boat if there was a complete loss, including depreciation and conditions of the vessel when it suffered the loss.

Crew medical and personal coverage

Reasonable medical and related costs are covered for all onboard passengers leaving or boarding the vessel. These benefits are granted per person instead of per event.

If your vessel gets damaged by accident, collision insurance is an optional insurance policy that covers the cost of fixing and replacing the damaged part with less deductible.

Sinking and wreck removal

Insurance for boats generally can cover sinking. However, there are some critical policy limitations. In general, insurance for boats should protect your boat if it sinks due to any covered risk. The policy could reimburse you for the cost of salvage or removal.

What is usually excluded from yacht insurance policies or comes as an extra?

War coverage

Damages caused by acts of war can turn out to be too great to insure, making the repayment too astronomical to be true.

Hurricane insurance

Your boat insurance provider may be able to pay for damages to your vessel caused by wind and hail from a storm in the event of a hurricane unless stated explicitly in the policy. Contact your boat insurance provider to find out what coverage you have during a storm.

Marine life encounters

Most insurance for boats doesn’t provide coverage for marine-related damage such as sharks, whales, and many other species. If you frequently sail in water full of marine creatures, it is possible to discuss a supplemental insurance policy with your insurance provider.

Insects and mold

The majority of yacht insurance policies do not cover insects and mold. It is essential to take the necessary steps to safeguard yourself against any pests on your vessel. So, this means that you must wash, drain, and dry your boat’s equipment after use.

Toys and PWC onboard

The PWC onboard may need to have a separate insurance policy as it is an expensive purchase.

Negligence or criminal acts

No insurance company is accountable for paying for the illegal actions of other people. Damage or loss due to reckless negligence and incompetence is also not acceptable.

Most insurance coverage for boats won’t cover certain events, such as racing on a yacht. Suppose you plan to use your boat to compete. In that case, you might want to consult your insurance representative about supplemental insurance, precisely the possibility of additional liability insurance if there’s a crash in the course.

Kidnapping and ransom

Because of the high stakes involved – human life and assets such as vessels and cargo — as well as the criminal character and challenging legal context, resolving a hijacking or abduction for ransom is a difficult task. Hence, kidnapping and ransom are not included in yacht insurance.

What do you need to know before picking a yacht insurance policy?

When evaluating physical damage cover, the most significant question is whether the insurance is focused on “agreed value” or “actual cash value” damage payout. If there is a complete loss, most agreed value coverage covers the amount shown on the insurance contract. After depreciation, you will receive compensation.

The actual cash value coverage offers protection up to the vessel’s present market worth at the moment of complete loss, after depreciation and the deductibles.

Although the coverage is smaller in an actual cash value insurance than in agreed value insurance, the policy is generally inexpensive.

The next thing you want to consider while choosing your insurance is the deductible and premium.

The amount you self-insure in the case of a loss is your yacht insurance deductibles. Put another way, it is the amount you spend on claims before your insurance comes in.

The next is premium. Choose insurance that can fit your budget to pay your premium on time without fail.

Another thing to consider is the Intended cruising area. Some policies put restrictions or have a defined area while cruising. So, choose an insurance policy that suits your cruising area so that in case of mishaps, you can get coverage.

Yacht Insurance Requirements

Is yacht insurance mandatory?

While it’s not usually a legal necessity, it is always a good idea. It’s unlikely to cost much, but it might save you a lot of money in a disaster. Even if you or your captain are the finest sailor on the planet, you must consider what would happen if someone else collides with your yacht.

Changing weather may damage your boat, yet you usually have little control over it. Fortunately, most yacht insurance policies aren’t too costly, and the modest additional cost may provide comfort while cruising on the sea.

Does the bank require insurance while you finance the yacht?

Yes, your bank may require proof of yacht insurance if you want to finance the yacht.

Do ports and marinas need your yacht insurance?

For utilizing their facilities, numerous ports and marinas will need you to have boat insurance.

Does renting the yacht require insurance?

If you intend to rent out your yacht, you must have coverage to safeguard your asset, and yacht insurance can be highly beneficial. If you want to rent your yacht, you must get boat insurance to protect yourself from liability hazards, and the insurance covers the majority of liability concerns.

Read also : The yacht charter experience ladder

How much does a yacht insurance cost?

Usually, yacht insurance costs between 1% and 5% percent of the yacht’s value. For instance, you may spend around $2,500 annually to insure a boat worth $100,000.

However, similar to other types of insurance, the cost of your boat insurance depends on you and your vessel. The higher the value of a boat, the greater the insurance cost. Yacht insurance is often costlier than floating insurance since yachts are more expensive. High-powered boats are riskier. Thus, insurance companies consider the kind of engine (inboard or outboard, amount of horsepower, and so on).

How can I lower my yacht insurance cost?

Here are a few steps that you can take to lower your insurance cost.

Limit the cruising area of your yacht

There are navigational restrictions in marine rules, meaning you may only sail inside a specified region. The premiums will be less the smaller and securer the area is.

Have good training and driving records

Insurance companies are interested in your expertise on the water. The completion of a boating course demonstrates proficiency, which reduces your risk. Most insurance companies would consider boating lessons, but they may even provide a rate reduction. Contact your agent to determine whether safety-related boating classes impact your premium rates.

Lower the liability limits

Most insurance companies will require your credit score to establish suitable premiums. Maintaining a good credit score has several advantages, including cheaper insurance prices. To lower your liability limits, consider working on your credit score.

Pick a higher deductible to reduce the premium of your insurance

A greater deductible implies that the policyholder will be responsible for a percentage of the claim, hence decreasing the occurrence of claims. You choose to pay a part of the claim by raising your deductibles out of your cash, and the company will eagerly reduce your premium.

Choose seasonal insurance during the offseason

Fire, theft, vandalism, and winter storms can all cause significant damage and financial burden. You won’t be insured for any winter tragedy that strikes your yacht during the off-season if you don’t have insurance. You’ll be responsible for possibly astronomical expenditures.

Pick a modern boat rather than an old one

A new yacht will cost less to insure than an older one. This is because older ones are susceptible to acquiring defects, while newer ones are not. Further, you can take several steps to improve your yacht’s safety, contributing to lowering your cost. Like, installing an autonomous fire control system may decrease the danger of fire damage and make you eligible for a premium reduction. Additionally, safety devices like radar, depth finders, first aid kits, GPS, emergency kits, and EPIRBs may reduce the danger.

Our advice to find the best insurance broker at the best cost for a yacht

Avoid using your home and car insurer for yachts above 27”.

Usually, boat insurance is meant for vessels less than 26 feet long. Yachts are generally longer than 27 feet, have far more powerful engines, and cost more than smaller vessels.

Yachts typically go greater distances and deeper seas, transport more passengers, need a crew and have several equipment and personal possessions. These variables result in distinct risk exposures and need particular insurance policies, coverage choices, and deductibles.

Maritime law governs rather than state or federal law in deeper seas, which may be more complex. If your boat has a crew, you might be obliged to have Harbor workers and Longshoreman’s covers.

Partnering with an advisor who knows the worth of your boat and how you intend to use your boat can assist you in getting the necessary coverage for any potential catastrophes. You will also need specific insurance coverage if you own a high-performance boat due to the increased risk.

Pick a trustable company with expertise in marine insurance

You can choose your regular insurance provider to get your marine insurance. There are several maritime governing rules when you decide to sail on the sea or plan to sail overseas. Additionally, it is essential to engage with a provider that has a deep understanding of boat and yacht coverage. This is vital at the time of insurance application and in the severe case of a claim.

Special needs might require custom policies

If you have any special needs, additional coverage choices are available for medical costs, private possessions, the boat’s transportation equipment, and more that may be added to any plan. However, that relies on the type of insurance provider you choose.

Optional coverage extensions:

- Trip disruption

- Private property

- Trailer Coverage

- Towing and Emergency Roadside Service

- Uninsured Watercraft

- Individual Liability

Get an experienced yacht broker to help you navigate policies.

You may have 100 policies in front of you and many lucrative offers claiming several things. Yet, making the right insurance takes time and a better understanding of all the coverage. So, an experienced broker can help you navigate all these policies and select one that fits your budget and particular situation.

The best companies for yacht insurance

Many insurance firms provide boat insurance at affordable prices. Shop around to ensure that you receive the necessary information to make an educated selection. Also, there are several websites that offer evaluations of various insurance providers and are excellent starting points for your study.

Communicate with other sailors; determine which aspects they value and why. You would be in a position to make the most excellent option for your requirements when you analyze the services of various companies.

Being on the ocean is a feeling of serenity, tranquility, and impending new experiences. So, this is an encounter you want to go on forever. Further, your sailing boat is a significant investment. Hence, consider having your luxury boat insured to cherish the best of life and keep your investment safe.

Don’t take chances with your yacht, act now and ensure a safe and worry-free sailing experience

Now that you understand the importance of yacht insurance, don’t wait any longer to protect your valuable asset. Contact us today to get a quote and secure peace of mind on the water. Our team of experts will guide you through the process and help you choose the best coverage for your needs.

Frequently Asked Questions

All ship and yacht owners are obliged to have marine insurance, mainly when the vessels will be utilized for commercial or transit reasons and move people, labor, or goods overseas.

our yacht insurance usually protects your yacht against frequent dangers such as drowning, storm, fire, collisions, and theft. You may also be protected by boat insurance if you accidentally harm somebody or destroy their property. Your coverage may cover the following boat components: machinery, attached equipment, hull.

The exclusions from yacht insurance policies include: criminal actions of others, insect infestations, lack of due diligence on the part of the assured or managers, common wear and tear, loss resulting from delay, and intentional wrongdoing by the captain or crew.

The typical cost of boat coverage is between $200 and $500 per year. However, insurance may cost between 1 and 5 percent of the boat’s worth for a yacht or sailboat. For instance, you may spend around $2,500 annually to insure a boat worth $100,000.

Sailboat owners often spend between $250 and $1,500 annually to protect their yachts. This price varies depending on various criteria, including insurance type and insurance amounts, and sailboats usually are less costly to cover than powerboats.

Annual insurance on the yacht will range at roughly 1.5 percent of the boat’s value. The cost to insure a catamaran depends on hull valuation, location, and the boat’s operation.

The insurance coverage of a mega yacht or a super yacht can be around $240,000.

To reduce the cost of yacht insurance, you can take the following steps: installing safety equipment, demonstrating better boat riding skills by undertaking a boating course, considering your deductibles, limiting your sailing area or working on credit scores.

Hull relates to the vessel’s body. The insurance will cover unexpected damage or loss to the boat anywhere inside the policy’s specified maritime boundaries.

Usually, classic boat insurance is provided by specialized insurance firms who specialize or have experience in protecting classic and antique vessels. For covering your old boat, get a quotation from a specialized insurer and verify that your policy provides the protection you want for a sense of security.

Luxury Yacht Charters in Croatia : Our Guide

Mediterranean islands: our ultimate guide, you might also like.

What differentiates a yacht from a superyacht or a mega yacht?

Chartering Requirements and Regulations: A Guide for Boat Owners

What are the Fastest Cruising Catamaran on the Market?

- Agent Directory

- Company Directory

Find an Independent Agent

- Get Matched with an Agent

- Agent Directory by State

Find an Insurance Company

- Get Matched with a Company

- Company Directory by State

What type of insurance do you need?

- Business Insurance

- Home, Auto & Personal Insurance

- Life & Annuities

By Coverage Type

- Commercial Auto Insurance

- Professional Liability Insurance

- Small Business Insurance

- Business Umbrella Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Business Owners Policy

- Builders Risk Insurance

- Cyber Liability Insurance

- Surety Business Bonds

- Inland Marine Insurance

- Employers Liability Insurance

- Employment Practices Liability Insurance

- Environmental Liability Insurance

- Errors and Omissions Insurance

- Insurance Coverage & Advice by State

- See more ...

By Business Type

- Retail Store

- Agriculture & Forestry

- Construction

- Manufacturing

- Wholesale Trade

- Retail Trade

- Transportation & Warehousing

- Information Industry

- Finance & Insurance

- Real Estate

- Scientific & Technical Services

Auto & Vehicle Insurance

- Car Insurance

- Motorcycle Insurance

- Boat Insurance

- RV / Motorhome Insurance

- ATV Insurance

- Snowmobile Insurance

- Personal Watercraft Insurance

- Collectible Auto Insurance

- Umbrella Insurance

Home & Property Insurance

- Homeowners Insurance

- Condo Insurance

- Farm Insurance

- Landlord Insurance

- Renters Insurance

- Mobile Home Insurance

- Contents Insurance

- Vacant Land Insurance

- Flood Insurance

Other Insurance

- Life Insurance

- Long Term Care Insurance

- Disability Insurance

- Health Insurance

- Special Event Insurance

- Short-term / Sharing Insurance

Insurance Solutions & Resources

- Compare Car Insurance

- Compare Home Insurance

Yacht Insurance

Finding the perfect coverage has never been easier.

Insurance doesn’t have to be boring. That’s why we hired Sara East to be our BA insurance writer. Maggie specializes in making mundane subjects hella-entertaining.

Yachts are a luxurious way to be on the water, but owning a yacht means having the right insurance in the event of damage or being destroyed. Because of their price, repair or replacement is likely to be very expensive making the proper coverage crucial for boat owners.

Before using your yacht, an independent agent can work with you to create a customized yacht insurance policy to your specific watercraft, its value, and how you use it.

Boating Statistics

No one likes to think about the dangers of boating, but accidents can happen and it's best to be prepared in the event that you face unexpected hardship. Whether you hit another boater, have an incident with a passenger, or your boat is damaged while being transported or docked, lots of things can lead to a financial headache for you.

Here are some statistics about boating accidents.

- Cabin motorboats, which include yachts, accounted for 14% of all boating accidents

- Only about 20% of all boaters who drowned were on vessels larger than 21 feet

- Operator inattention was cited as the leading cause of accidents involving cabin motorboats

What Is Yacht Insurance and What Does It Cover?

Yacht insurance is a specialized type of boat insurance for luxury boats. Yachts can be used for personal as well as commercial use, so insurance policies must be created to accommodate each of those needs.

While yachts, like most boats, depreciate over time, they still generally have a much higher than average value. Because of their high values, a standard boat insurance policy may not provide enough coverage for your vessel.

The components of yacht insurance are similar to standard boat insurance coverage.

- Bodily injury and property damage liability: Covers the costs associated with injuries or property damage you cause to another person, as well as legal fees. If the liability limits in your yacht insurance policy are not adequate to protect your assets from a lawsuit, you may want to consider buying an umbrella liability policy , which provides a much higher liability limit.

- Collision coverage: Pays for damage to your boat after a collision with another boat or object.

- Comprehensive coverage: Covers non-collision damage or loss, including theft, fire, vandalism, or damage caused by an object other than another boat.

Additional yacht insurance options to consider

- Uninsured/underinsured boaters insurance: Covers any damage or injuries from an accident with an uninsured or underinsured boater. Since boat insurance is rarely required by law, if you have a significant amount invested in a vessel, this is a good insurance option to discuss with your agent.

- Medical payments coverage: Covers medical expenses and funeral expenses for anyone on that is injured, entering, leaving or while on your boat.

- Equipment and personal effects coverage: Pay to repair or replace damaged or lost items such as gear, fishing equipment, cameras, and other personal belongings.

An independent agent can work with you to determine the appropriate coverage for your needs. Because these agents work with multiple insurance companies, they can help protect all of your interests with a broad range of insurance coverage, all from one agency office.

Is Yacht Insurance Different from Standard Boat Insurance?

Yacht insurance provides similar types of coverage as standard boat insurance . However, yachts have some specific differences from standard boats, and yacht owners generally need certain protection that regular boat insurance does not provide.

For example, a yacht policy tends to restrict hauling on a trailer to only a few hundred miles, while boat insurance tends to provide coverage for trailering over longer distances.

Also, deductibles for yacht policies are very flexible, instead of having set amounts like $250, $500 or $1,000. In addition, yacht policies can include coverage for raising and removing a sunken yacht, while boat policies generally do not include this coverage.

Is Yacht Insurance Required?

Yacht insurance is not typically required by state law. However, sailboats often do have insurance requirements. So, if you have a sailing yacht, insurance may be required by law.

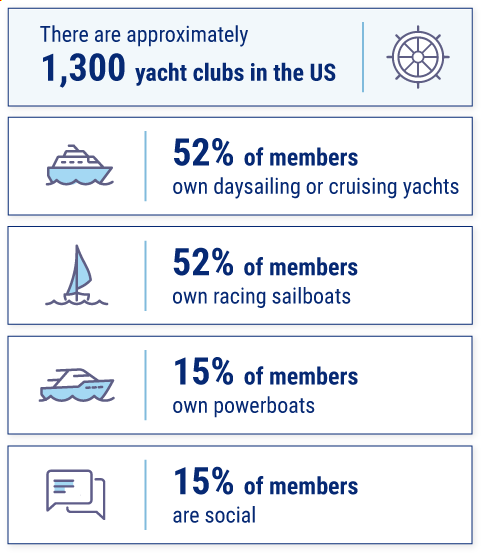

Yacht club membership statistics

You will also need to buy insurance to protect your investment in your vessel if you finance the purchase of your yacht through a lender.

Many marinas require that you have insurance in order to slip your boat at the marina. Check your local marina's guidelines, and be sure to learn about your state’s laws and regulations.

Do I Need Yacht Insurance?

A yacht can range in price from $300,000 to several million dollars. Purchasing one is a big investment and having the ability to insure your investment can ease your mind if there's an accident or your yacht needs repairs or replacement.

Insuring your yacht is also not just about the boat. In the event that an injured party files a liability claim against you, you will want to have enough coverage in place to protect your boat, home, savings, investments, and future income.

Assessing your financial situation will help you to determine how much yacht insurance you need.

Save on Boat Insurance

Our independent agents shop around to find you the best coverage.

How an Independent Insurance Agent Can Help with Yacht Insurance

A local independent agent will talk with you, free of charge, to learn about your yacht and insurance needs. They'll gather multiple quotes for you from several different companies and help you compare options and rates. Your agent can assist you with every aspect of your insurance and will be your point of contact if you need to file a claim.

An independent agent can help to prevent gaps in coverage that leave you exposed to risk. You will know you are getting the right coverage for your needs, and that you are not paying for any unnecessary coverage.

https://www.ussailing.org/wp-content/uploads/2018/01/Demographics2010.pdf

- Frank Magazine

- Denison History

- Virtual Tours

- Alaskan Yachts

- Azimut Yachts

- Back Cove Yachts

- Beneteau Yachts

- Benetti Superyachts

- Bertram Yachts

- Boston Whaler

- Broward Yachts

- Buddy Davis Sportfish

- Burger Yachts

- Cabo Yachts

- Carver Motoryachts

- Center Console

- Chris-Craft Yachts

- Cruisers Yachts

- DeFever Trawlers

- Dufour Sailboats

- Fairline Yachts

- Feadship Yachts

- Ferretti Yachts

- Formula Yachts

- Fountaine Pajot Cats

- Grady-White

- Grand Banks Trawlers

- Hargrave Yachts

- Hatteras Yachts

- Hinckley Picnic Boats

- Horizon Yachts

- Hydra-Sports

- Intrepid Boats

- Jarrett Bay Sportfish

- Jeanneau Yachts

- Kadey-Krogen Trawlers

- Lazzara Yachts

- Lekker Boats

- Luhrs Sportfish

- Marlow Yachts

- Maritimo Yachts

- Marquis Yachts

- McKinna Motoryachts

- Meridian Yachts

- Midnight Express

- Mochi Craft

- Neptunus Motoryachts

- Nordhavn Trawlers

- Nordic Tugs

- Ocean Alexander Yachts

- Offshore Yachts

- Oyster Sailing Yachts

- Pacific Mariner Yachts

- Palmer Johnson Yachts

- Pershing Yachts

- Prestige Yachts

- Princess Yachts

- Pursuit Yachts

- Riva Yachts

- Riviera Yachts

- Sabre Downeast

- San Lorenzo Yachts

- Sea Ray Boats

- SeaVee Central Consoles

- Selene Trawlers

- Scout Yachts

- Sunseeker Yachts

- Tiara Yachts

- Trinity Superyachts

- Viking Yachts

- Westport Yachts

Yacht Insurance [Complete Guide]

![yacht insurance define Yacht Insurance [Complete Guide]](https://cdn.denisonyachtsales.com/wp-content/uploads/2020/03/YachtInsuranceH.jpg)

March 11, 2020 11:55 am

For the yacht owner , insurance is a necessity. Superyachts present a unique risk, as the yacht itself is highly valuable, and additionally, the nature of operations onboard requires the crew to be protected. This class of risk is serviced by specialized underwriters, who use contract forms that have been developed explicitly for this market. Previous papers in this series have provided insight into the yacht purchase and charter processes , maritime compliance , and costs of ownership . This next article will outline some of the principle types of insurance for yachts as well as some other “things to think about” for owners considering their options for insurance.

Property Insurance (Hull & Machinery)

The property value risk is known in maritime insurance parlance as “Hull and Machinery”, often reduced simply to “hull”.

Hull Insurance – Hull insurance is provided to the value of the yacht and underwriters will look for proof of that value before providing the insurance. Other operational provisions will be expected by the underwriter to be in place as conditions of the policy. Such provisions may include items such as a tender-towing plan, severe weather (hurricane) plan, or a yacht management contract.

Yacht Insurance Premiums – In years past, there was a parametric relationship between premium and value, which made it easy to estimate premium based on the value and little other information. With the recent spate of heavy losses, however, insurance providers are now taking a much more actuarial view of the risk, reviewing operational and cruising plans prior to providing a premium quote.

Learn More About:

- • Getting Underwriter Approval

- • Determining Yacht Insurance Premiums

- • Insuring Valuable Items Onboard

- • Warranties + Conditions Precedent

Liability Insurance (Protection & Indemnity)

Liability insurance in marine terms is known as “Protection & Indemnity”, shortened to “P&I”.

P&I Insurance – P&I insurance in merchant maritime trade is often provided by “mutual” clubs which aggregate risk and provide extremely high (typically $500 million) limits for limited premium. Mutual members are advised that additional “calls” may be required if there is a heavy loss. For yacht owners, however, P&I club level of coverage (that $500 million) is available on non-mutual, fixed-premium terms and with very small deductibles.

- • Statutory Insurance Requirements

- • P&I Club Benefits

- • What Liability Insurance Covers

Crew Medical Insurance

Insurance policies are available to provide medical insurance to crew. Policies may be tailored to the requirements of internationally domiciled crew on yachts that travel internationally or may be specifically designed to meet the needs of a U.S. national crew which stay predominantly in the U.S., meeting the requirements of the Affordable Care Act.

- • Standards for Crew Employment

- • Yacht Owner Obligations to the MLC

Additional Insurances for Yacht Owners

The hull, P&I and crew medical insurance elements discussed above comprise a basic level of cover which may satisfy most yacht owners. Additional cover extensions which are specific to certain risks are also available:

Charter Insurance – Owners that offer their yacht to the charter market will want to insure themselves against the contractual risks that arise from the use of the yacht by the charterer. Most underwriters will allow such use up to a limit, but owners are advised to check the terms of their policy.

Freight, Demurrage and Defense (FD&D) – This coverage responds to approved legal costs of the vessel owner arising out of contract disputes. This is for disputes that fall outside of P&I* (P&I responds to bodily injury and property damage caused by the legal liability of the vessel owner).

Kidnap & Ransom (K&R) – Widely available and known to persons of high net worth, K&R policies are available as extensions to yacht insurance.

Cyber-Extortion – The new frontier of yacht insurance, cyber-management operational policies and insurance policies are provided to protect owners from associated risks.

- • Legal Expenses Coverage

- • Cyber-Extortion

- • Employment Practices Insurance

- • Yacht Repair + Maintenance Considerations

Insurance Claims

Yacht owners place insurance and pay premiums for a reason, to be made whole in the case of an incident that causes loss. Yacht owners should not be afraid of informing their insurer of a potential claim; the involvement of the insurer’s legal and survey team will very often result in no claim being needed, or at the least will forestall a long and difficult battle of technical repair and ongoing legal involvement.

In the case of any incident which may become an insurance claim, yacht owners and their representatives will be well-advised to ensure that the insurance is informed, that they are familiar with any loss adjusting surveyor appointed by their insurance, and that, if necessary, they also appoint an independent adjuster who will work alongside the insurance-appointed surveyor to represent the owner’s interests.

Looking for more details?

Receive the complete Yacht Insurance Guide including:

- • Premiums + Deductibles

- • Underwriter Roles

- • Additional Yacht Insurances

This should not be considered a complete guide. For a better understanding of superyacht services, contact Ben Farnborough . 1

Latest News

NEWS | August 23, 2024

Cocktails & canapés at 37th america’s cup [s/y seaquell].

Cocktails & Canapés at 37th America’s Cup [S/Y SEAQUELL] Thursday, August 29th | 19:00-21:00 Denison Yachting cordially invites you to an evening of cocktails and canapés aboard the Sailing Yacht SEAQUELL during the 37th America’s Cup Round Robins at Port Forum. Enjoy a relaxed gathering on board, set against

Newport International Boat Show [Brokerage Boats On Display]

Newport International Boat Show [Brokerage Boats On Display] Thursday-Sunday | September 12-15, 2024 Denison invites you to view a number of available brokerage boats at the 2024 Newport International Boat Show. The Newport International Boat Show, set for September 12-15, 2024, in Newport, Rhode Island, is one of

NEWS | August 19, 2024

85′ azimut 2006 sold by florent moranzoni [eva].

85′ Azimut 2006 Sold by Florent Moranzoni [EVA] EVA, an 85′ (26.82m) Azimut built in 2006, was sold by Florent Moranzoni, who represented the Seller. Special thanks to James von Eiberg of Bluebnc, who represented the Buyer. EVA can accommodate ten guests in four comfortable cabins, including a

Table of Content

- What is Marine Insurance

Marine Insurance Act 1963

- How Marine Insurance works

Types of Marine Insurance

- Which clauses cover Marine Insurance

Difference between Fire Insurance & Marine Insurance

Explore Drip Capital’s Innovative Trade Financing Solutions

13 July 2021

Marine Insurance | Meaning, Types, Benefits & Coverage

What is marine insurance.

Marine insurance refers to a contract of indemnity. It is an assurance that the goods dispatched from the country of origin to the land of destination are insured. Marine insurance covers the loss/damage of ships, cargo, terminals, and includes any other means of transport by which goods are transferred, acquired, or held between the points of origin and the final destination.

The term originated when parties began to ship goods via sea. Despite what the name implies, marine insurance applies to all modes of transportation of goods. For instance, when goods are shipped by air, the insurance is known as the contract of marine cargo insurance.

Importance of Marine Insurance

Marine insurance is required in many import-export trade proceedings. Admitting the terms, both parties are liable for the payment of goods under insurance. However, the subject matter of marine insurance goes beyond contractual obligations, and there are several valid arguments necessary for buying it before dispatching the export cargo.

Goods in transit need to be insured by one of the three parties:-

- The Forwarding Agent

- The Exporter

- The Importer

Also, it can be taken by anyone involved in the transit of goods.

Also Read: Role of a Freight Forwarder | Functions, Duties & more

Where to get Marine Insurance?

The process to purchase marine insurance in India is easy. The country’s geographical position allows many banks and financial institutions to provide marine insurance.

The Marine Insurance Act, in India, came into existence in 1963. As per section three of the act, any time the term ‘marine insurance’ is used, expressed or even extended for the insuring of goods against loss or damage, the insurer will be at risk to bear the charges. The insurer will consider all the certainty of goods in case of misfortune sustained during marine ventures.

Principles of Marine Insurance

Principle of Good faith - Parties demand absolute trust on the part of both; the insurer and the guaranteed.

Principle of Proximate Cause - The proximate cause is not adjacent in time; also, it is inefficient. Nevertheless, it is the definitive and adequate cause of loss.

Principle of Insurable Interest - Any object presented as a marine risk and the assured covering the insurance of goods - both should have legal relevance. Also, a series is devoted called 'Incoterms' to respectfully assign the insurance of goods to each party.

Principle of Indemnity - The insurance extended to the parties will only be applicable up to the loss. The parties can't buy insurance to gain profits. If they do, they won't get more than the actual loss.

Principle of Contribution - Sometimes, the risk coverage for goods has more than one insurer. In such cases, the amount has to be fairly distributed amongst the insurers.

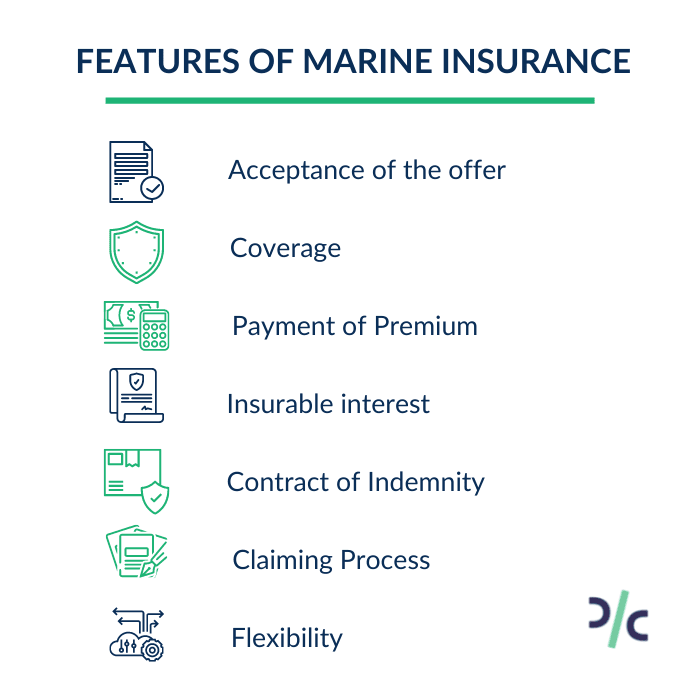

Features of Marine Insurance

How Marine Insurance works?

Marine insurance best transfers the liability of the goods from the parties and intermediaries involved to the insurance company. The legal liability of the intermediaries handling the goods is limited to begin with. The exporter, instead of bearing the sole responsibility of the goods, can buy an insurance policy and get maritime insurance coverage for the exported goods against any possible loss or damage.

The carrier of the goods, be it the airline or the shipping company, may bear the cost of damages and losses to the goods while on board. However, the compensation agreed upon is mostly on a ‘per package’ or ‘per consignment’ basis. The coverage so provided may not be sufficient to cover the cost of the goods shipped. Therefore, exporters prefer to ship their products after getting it insured the same with an insurance company.

The Scope of Marine insurance is necessary to meet the contractual obligations of exports. To align with agreements such as cost insurance and freight (CIF) or carriage and insurance paid (CIP) , the exporter needs to take marine insurance to protect the buyer’s or their bank’s interest and honor the contractual obligation. Similarly, in the case of Delivered Duty Unpaid (DDU) and Delivered Duty Paid (DDP) terms, the seller may not be obligated to insure the goods, although in practice they generally do.

To get marine insurance and avoid insurance claims, ensure the following:

Packing of goods should be done keeping in mind their safety during loading and unloading

Packing should be good enough to withstand natural hazards to the best extent possible

Keep in mind the possibility of clumsy handling or theft when packing goods.

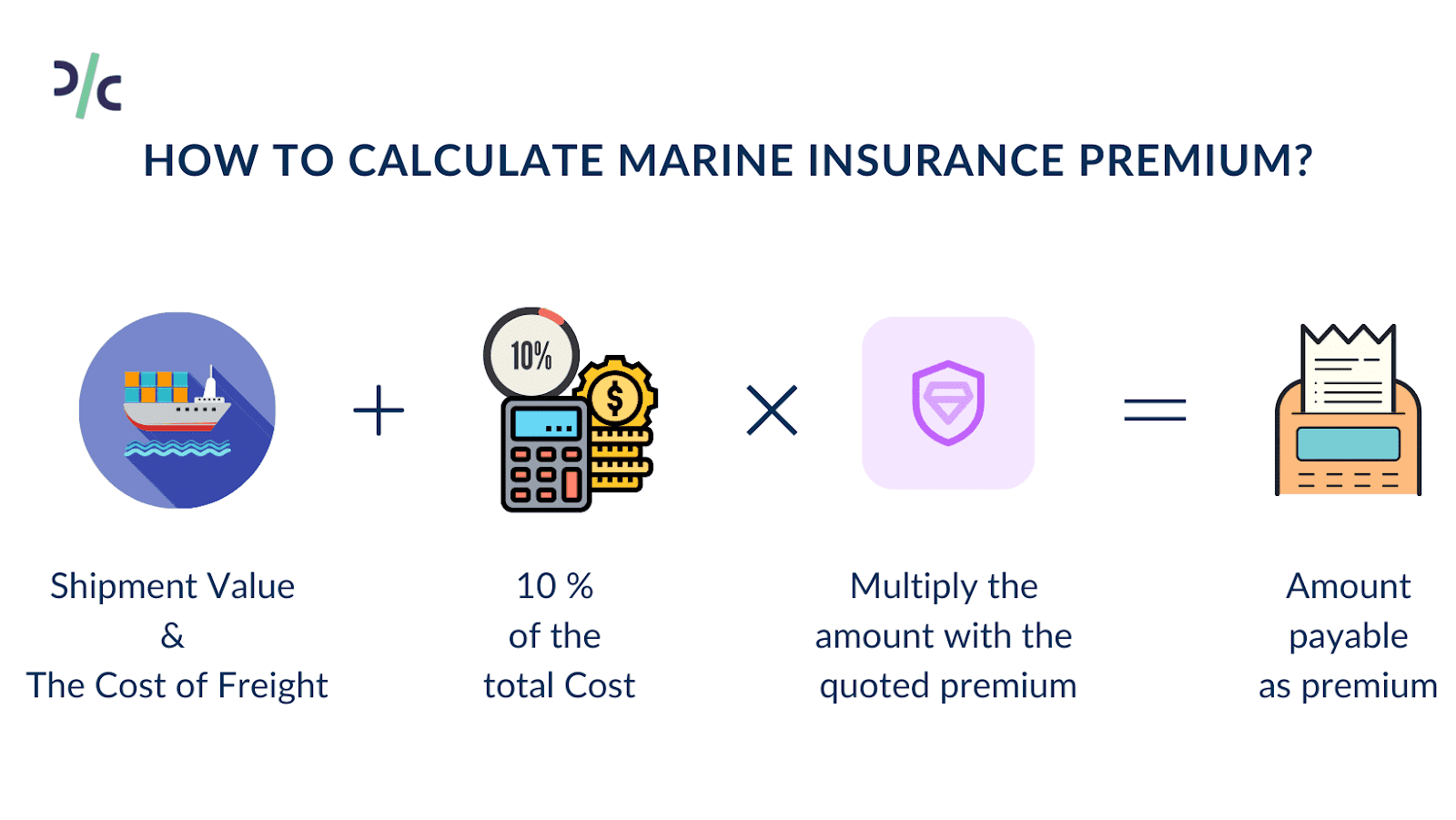

How to calculate Marine Insurance Premium?

Freight Insurance

Liability insurance, hull insurance, marine cargo insurance.

In freight insurance, for example, if the goods are damaged in transit, the operator would lose freight receivables & so the insurance will be provided on compensation for loss of freight.

Marine Liability insurance is where compensation is bought to provide any liability occurring on account of a ship crashing or colliding.

Hull Insurance covers the hull & torso of the transportation vehicle. It covers the transportation against damages and accidents.

Marine cargo policy refers to the insurance of goods dispatched from the country of origin to the country of destination.

Types of Marine Insurance policies

- Floating Policy

- Voyage Policy

- Time Policy

- Mixed Policy

- Named Policy

- Port Risk Policy

- Fleet Policy

- Single Vessel Policy

- Blanket Policy

Floating policy

Floating in Marine Insurance policy, large exporters may opt for an open policy, also known as a blanket policy, instead of taking insurance separately for each shipment. An open policy is a one-time insurance that provides insurance cover against all shipments made during the agreed period, often a year. The exporter may need to declare periodically (say, once a month) the detail of all shipments made during the period, type of goods, modes of transport, destinations, etc.

Voyage policy

A specific policy can be taken for a single lot or consignment only. The exporter needs to purchase insurance cover every time a shipment is sent overseas. The drawback is that extra effort and time is involved each time an exporter sends a consignment. With open policies, on the other hand, shipments are insured automatically.

Time policy

Time policy in marine insurance is generally issued for a year’s period. One can issue for more than a year or they may extend to complete a specific voyage. But it is normally for a fixed period. Also under marine insurance in India, time policy can be issued only once a year.

Mixed policy

Mixed policy is a mixture of two policies i.e Voyage policy and Time policy.

Named policy

Named policy is one of the most popular policies in marine insurance policy. The name of the ship is mentioned in the insurance document, stating the policy issued is in the name of the ship.

Port Risk policy

It is a policy taken to ensure the safety of the ship when it is stationed in a port.

Fleet policy

Several ships belonging to the company/owner are covered under one policy. Where it has the advantage of covering even the old ships. Also the policy is a time based policy.

Single Vessel policy

In single vessel policy only one vessel is covered under marine insurance policy.

Blanket policy

In this policy, the owner has to pay the maximum protection amount at the time of buying the policy.

Which clauses cover Marine Insurance?

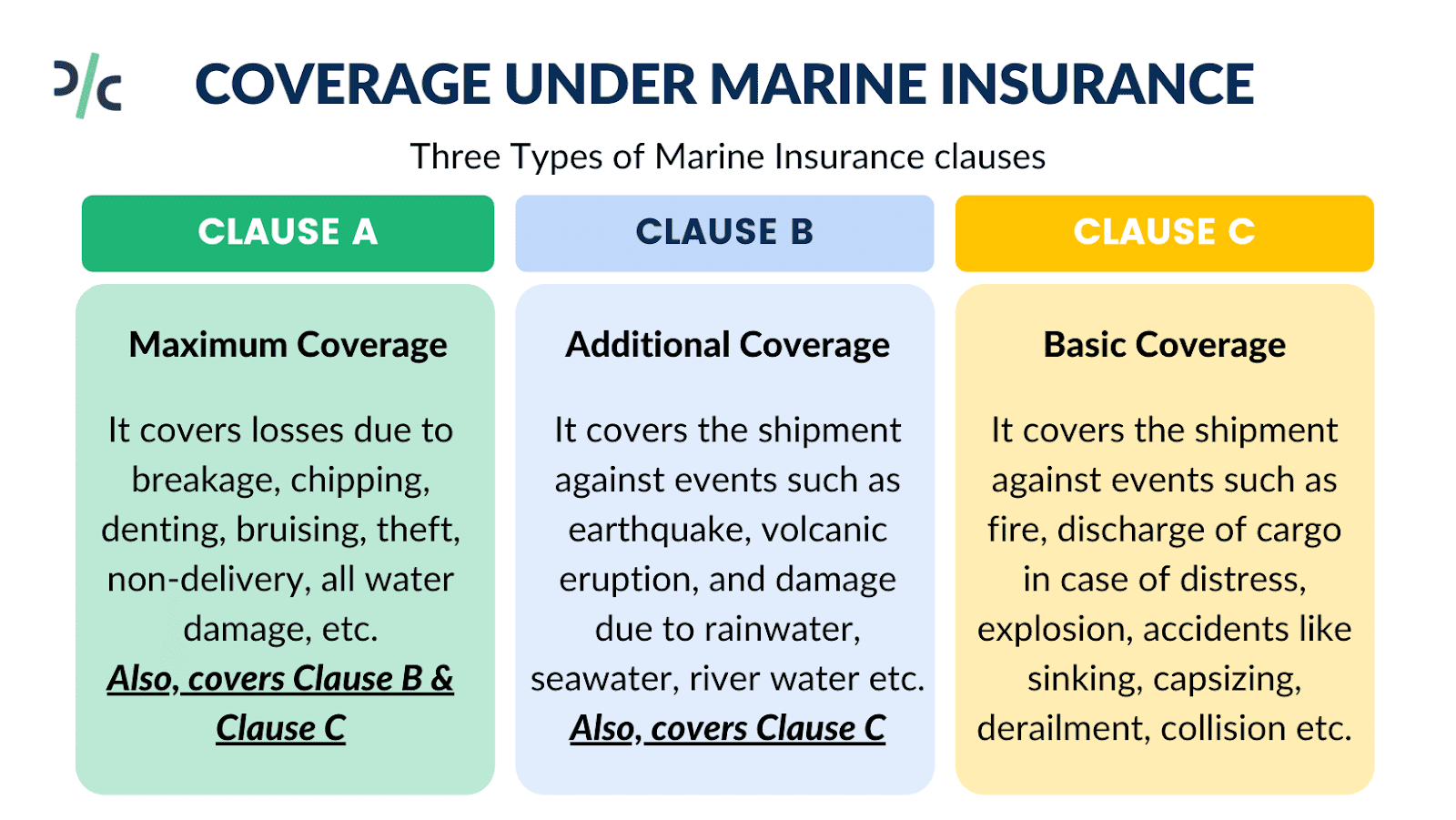

The Maritime insurance coverage provided by marine insurance can be understood by going through the risks handled by the insurance policies loaded with various marine insurance clauses:

Institute Cargo Clause C provides basic coverage and includes a restricted list of risk covers. It covers the shipment against events such as fire, discharge of cargo in case of distress, explosion, accidents like sinking, capsizing, derailment, collision, etc.

Institute Cargo clause B offers an additional layer of protection. Not only does it include all the risk covers provided under Clause C, but it also covers the shipment against events such as earthquake, volcanic eruption, and damage due to rainwater, seawater, river water, etc., and loss to package overboard or during loading and unloading.

Institute Cargo Clause A provides maximum coverage as it covers all risk of loss or damage to the goods. Apart from the risks covered under Clauses B and C, it also covers losses due to breakage, chipping, denting, bruising, theft, non-delivery, all water damage, etc.

Risks such as wars, strikes, riots, and civil commotions are not covered under the institute cargo clauses. However, the insurer may provide this cover on payment of additional marine insurance premium.

So in terms & conditions of marine insurance coverage, these three types of marine insurance clauses: Institute Cargo Clauses A, B, and C. Clause A provides maximum coverage, Clause C provides basic risk coverage.

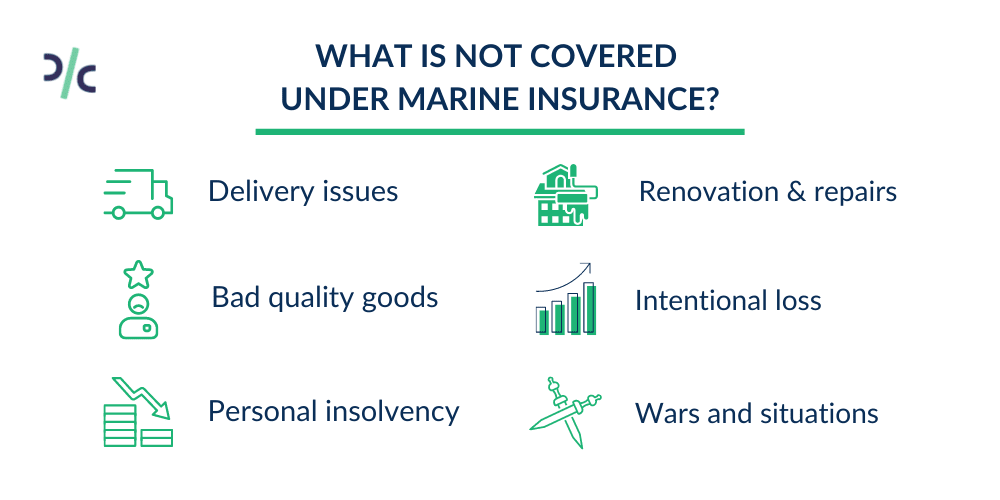

What is not covered under Marine Insurance?

Fire insurance is an insurance that covers the risk of fire. The subject matter is any physical asset or property. The moral responsibility is an important condition here. There is no expected profit margin in terms of fire insurance. The insurable interest must be present before taking the policy and also at the time of loss.

Whereas, the Functions of Marine insurance is one that encompasses risks associated with the sea. The subject matter is the ship, freight or cargo. It does not consist of any clause related to the moral responsibility of the cargo owner or the ship. 10 to 15% profit margin is expected in terms of marine insurance. Also in marine insurance the insurable interest must be only at the time of loss.

- How International Ocean Freight Shipping Works?

- Shipper's Letter of Instruction | Meaning, Format & more

- FCL and LCL | Meaning & Difference

- Procedure & Charges for LCL Shipments

- Demurrage - Meaning & Charges in Shipping

- How CBM is calculated in Shipping?

- 24 Types of Containers used in International Shipping

Avani Ghangurde

Senior associate, public relations at drip capital.

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used in accordance with and for the purposes set out in our Privacy Policy and acknowledge that your have read, understood and consented to all terms and conditions therein.

Connect with us!

What is Marine Insurance? Types & Policies

What is Marine Insurance?

According to Marine Insurance Act, 1906 :

“ An agreement whereby the insurer undertakes to indemnify the assured, in the manner and to the extent thereby agreed, against incidental to marine adventure. It may cover loss or damage to vessels, cargo or freight. ”

Marine insurance is a type of insurance that provides compensation for losses or damages of ships, cargo, terminals, depots , and any transport by which the property is transferred, acquired, or held between the points of origin and the final destination.

Ships, cargo vessels, terminals, and any other mode of transportation in which products are transferred or acquired between multiple points of origin and their eventual destination are covered by marine insurance .

This trip coverage protects shipping businesses and couriers against expensive potential losses while transporting goods by water by providing protection against transportation-related damages. The phrase was coined when parties began shipping products by sea. Marine insurance covers all means of cargo transportation, despite its name.

Also read: What is Outer Port Limit?

Transporters can choose coverage options specific to their trade, which is a significant aspect of maritime insurance. Shipping companies can select a plan that is tailored to their needs due to the variations of coverage requirements. Depending on the size of the ship and the routes covered, different insurances are available to provide coverage.

Ships, cargo, terminals, and any transport by which property is transferred, acquired, or held between the original locations and the final destinations are all covered by marine insurance. Cargo insurance is a subset of marine insurance, which also covers onshore and offshore exposed property (container terminals, ports, oil platforms, and pipelines), as well as Hull, Marine Casualty, and Marine Liability. Shipping insurance is required when products are shipped by mail or courier.

Features of a Marine Insurance Policy

The loss or damage of ships, cargo, terminals, and any other mode of transport by which property is transferred, acquired, or held between the points of origin and the final destination is covered by a marine insurance contract.

Cargo insurance is a sub-branch of maritime insurance that also includes property that is exposed to the elements on the coast and offshore. Container terminals, ports, oil platforms, pipelines, hulls, maritime casualty, and marine liability are a few examples. Shipping insurance is utilized when goods are shipped through mail or courier. The Marine Insurance Act of 1963 covers any type of insurance in a marine contract.

Marine insurance has rigorous policy requirements. Insurance policies are well-defined contracts. Slight differences or infractions might result in claims being rejected. Therefore insurer guidelines should always be followed. When it comes to reimbursing claims, policy providers stick to strict guidelines, and straying from the path could result in a loss of coverage for a costly claim. With this in mind, it’s critical to understand your policy’s features and requirements to ensure you’re covered.

The agreement and policy will be void unless there is an insurable interest. Anyone whose goods are being transported by sea and who could be harmed has an insurable stake in it. The insurer accepts the contract once the contractual agreement has been strictly followed and a proposal for the assured has been made. If the policy has not been issued individually, it can be derived from a contract.

How does Marine Insurance work?

Marine cargo insurance is a form of property insurance that protects goods while they are being shipped. Certain risks linked with transportation by sea, air, or inland rivers might result in property losses while in transit.

Marine cargo insurance protects commodities and modes of transportation from damage caused by weather, piracy, improper loading or unloading of cargoes, and other factors. This insurance is mostly for international shipments, and it will cover the items from the time they leave the seller’s warehouse until they arrive at the buyer’s warehouse.

Damages and losses to the products while onboard may be covered by the carrier of the goods, whether it be an airline or a shipping business. However, compensation is usually agreed upon on a “per package” or “per consignment” basis. It’s possible that the coverage given won’t be enough to cover the cost of the products transported. As a result, exporters prefer to send their goods after having them insured by an insurance firm.

Also read: Top Container Terminal Operators in the World

Types of Marine Insurances

Different kinds of marine insurance are as follows:

Hull Insurance

This policy covers the vessel of transportation against damages and accidents. The policy covers the hull and torso of the transportation vehicle, like a ship, as well as the different articles present in the vessel.

Machinery Insurance

Machinery Breakdown Insurance provides cover against sudden and unforeseen physical loss or damage to the insured machinery. Machinery to be covered under this policy will include factory production machinery, workshop machinery, generators, industrial lathes, drills, compressors, etc.

Protection & Indemnity (P&I) Insurance

The primary purpose of P&I insurance is to provide policyholders with protection against personal injury, illness, and death claims from the crew, passengers, and so forth. P&I insurance also covers things like Liability claims as a result of a collision, Removal of the wreck.

Liability Insurance

Liability insurance is a type of insurance in which compensation is bought to provide any liability occurring on account of a ship crashing or colliding.

Freight, Demurrage & Defence (FD&D) Insurance

Freight Demurrage and Defense (FD&D) is legal costs insurance. The insured member obtains legal support and covers for legal costs up to USD 5 million in relation to disputes, arising from owning and operating a vessel, that fall outside other insurance covers.

Freight Insurance

To transfer the goods from one port to another, the amount paid to the owner of the ship is called freight. The payment of such freight can be made in two ways: either in advance or after the ship reaches its destination safely.

Freight insurance offers and provides protection to merchant vessels’ corporations. It stands for the chance of losing money in the form of freight, in case the cargo is lost due to the ship meeting in an accident.

Marine Cargo Insurance

Marine cargo insurance is also known as cargo insurance. It covers physical damage or loss of your goods while in transit by land, sea, and air. It also offers considerable opportunities and cost advantages if managed correctly. If the cargo is ruined, the owner gets the indemnity from the insurance company.

Also read: What is a straddle carrier?

Types of Marine insurance policies

There are various types of marine insurance policies also which are offered by the insurance companies in order to help the clients to select the best insurance policy.

Different types of marine insurance policies are as follows:

Voyage Policy

A voyage policy is that kind of marine insurance policy which is valid for a particular voyage. It covers the risk from the port of departure up to the port of destination. This type of policy is considered useful for cargo. The insurance company gives indemnity for damage of any property of the insured during the period of the voyage. The liability of the insurer continues during the landing and re-shipping of the goods. The policy ends when the ship reaches the port of arrival. This type of policy is purchased generally for cargo.

Time Policy

This policy is issued for a fixed period of time. The policy is generally taken for one year although it may be less than one year. This policy is commonly used for hull insurance than for cargo insurance. The ship is insured for a fixed period irrespective of voyages.

Mixed Policy

The joint form of voyage policy and time policy is called mixed policy. This policy is generally used for ship insurance.

Open or unvalued policy

In this policy, the value of the cargo and consignment is not put down in the policy beforehand. The value thus left to be decided later on is called the unvalued or open policy. The insurable value of the policy includes the price of the insured’s property, investment price, incidental expenditure, and all the expenditure as well. The unvalued policy is not used in practice so much. This policy is used only in freight insurance.

Valued Policy

This policy is the opposite of the unvalued policy. In this policy, the value of the cargo and consignment is ascertained and mentioned in the policy document beforehand, thus, making clear the value of the reimbursements in case of any loss to the cargo and consignment.

Port Risk Policy

This policy is taken out in order to ensure the safety of the ship while it is stationed in the port. It covers the risks when a ship is anchored in the port. This policy is taken in order to protect the vessel that is portside for a long period of time. Coverage terminates as soon as the vessel leaves the port.

Wage Policy

Wage policy is one where there are no fixed terms of reimbursements mentioned. This is a policy held by a person who does not have an insurable interest in the insured subject. He simply bets or gambles with the underwriter. The policy is not enforced by law.

Floating Policy

The floating policy is also called the declaration policy . This policy is useful for the merchant who delivers cargo regularly. When a person ships goods regularly in a particular geographical area, he will have to purchase a marine policy every time. It involves a lot of time and formalities.

He purchases a policy for a lump sum amount without mentioning the value of goods and name of the ship, etc. it is the agreement between the insurer and insured that the insured declares a number of goods on the basis of shipment documents.

Named Policy

This policy is issued by mentioning the name of the ship and the price of the cargo. The named policy has been receiving popularity in marine insurance.

Block Policy

It is the policy that takes the risk in the block that is from sea route and land route. It does not only protect from the risk of the marine route but also covers the risks that occurred on the land too. It is a very useful policy for landlocked countries.

Marine insurance policy is a necessity for both importers and exporters who deal in the domestic and international transfer of goods. Such a policy provides comprehensive cover for risks, from the time the shipment leaves the seller’s warehouse and reaches its destination, which is usually the buyer’s warehouse.

Similar Posts

Interesting Facts About Java Sea

The Java Sea is located between the islands of Indonesia. It is a shallow and extensive sea on the Sunda shelf. Java sea has a long history and its geographical importance is well known because of the Battle of the Java Sea. Interesting Facts About Java Sea There are some fascinating facts about the Java…

Wonder of the Seas Deck Plan

In 2022, the world saw another engineering marvel – Wonder of the Seas – Royal Caribbean International’s flagship. The cruise is a triumph of maritime engineering and luxury. Constructed at the Chantiers de l’Atlantique shipyard in Saint-Nazaire, France, this vessel represents the pinnacle of cruise ship innovation. Pics courtesy: https://www.royalcaribbean.com/ Wonder of the Seas Features…

Boat Vs Ship

Boat vs Ship. What’s the difference between a boat and a ship? After all, both – boat or ship can be used to ferry people and cargo. If this question has also bugged you, this article will try to make the difference clear to you. Archaeological excavations have led to the discovery of log boats…

St. Lawrence Seaway: A Vital Waterway For Canada & USA

St. Lawrence Seaway is a full-fledged waterway system that includes locks, channels, and canals that connects the Great Lakes to the Atlantic Ocean. Its length is 2,342-miles or 3,768-kilometer and is a major trade shipping route for both Canada and the USA. It came into use in 1959. There is a long history related to…

Best Anti-Seizure Compounds Used in Ships

Anti-seizure compounds prevent seizure of metals parts in ships and vessels due to marine growth, corrosion, and caustic environment on ship hulls. Common Anti-Seizure Compositions in Maritime Applications Anti-seizure compounds, also known as antifouling coatings, play a vital role in preventing marine fouling or growth on ship hulls. 1) Copper-Based Compounds Coatings based on Copper-Based…

What Is The Hull Of A Ship?

The following article discusses the hull of a ship, what it is, how it is made, and what it means for the building of a ship. It also talks about how the hull of the ship is built by carrying out several mathematical calculations and taking into consideration, several other factors. What is the hull…

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish. Read More

- Search Search Please fill out this field.

- Personal Finance

Boat Owners' Insurance: What It is, How it Works, Example

:max_bytes(150000):strip_icc():format(webp)/jason_mugshot__jason_fernando-5bfc261946e0fb00260a1cea.jpg)

Investopedia / Theresa Chiechi

What Is Boat Owners' Insurance?

As its name suggests, boat owners’ insurance is a type of insurance that protects owners of boats. It is similar to automobile insurance in that it protects the owner from claims relating to the physical damage of their vehicle, or to injuries or death caused in the operation of that vehicle.

Prospective insurance buyers should carefully consider the terms of their boat owners’ insurance policy, because the coverage and costs can vary substantially depending on the insurer and the type of boat being insured.

Key Takeaways

- Boat owners’ insurance is a type of insurance policy protecting boat owners.

- It covers theft, damage, or loss of the items stored on a boat, as well as physical damage to the boat itself.

- Boat owners’ insurance may not cover certain items, however, such as the cost of towing a boat if it becomes damaged while on the water.

How Boat Owners' Insurance Works

Fundamentally, boat owners’ insurance functions based on the same basic principles as other more familiar types of insurance. In exchange for a series of monthly insurance premiums , the insurer agrees to assume the liability for a range of potential risks associated with owning or operating a boat. In the case of boat owners’ insurance, these could include risks such as physical damage to the boat, the loss or theft of items stored on the boat, or the injury or death of its passengers or third parties.

Boat owners can purchase boat owners’ insurance for many different types of boats, such as yachts, sailboats, and even houseboats. The coverage provided in the policy will be tailored to the boat’s value and likely usage. For instance, a houseboat owner might wish to insure against their home being damaged or destroyed, but may not need to insure against accidents while operating the boat if the houseboat is permanently kept stationary. A yacht owner, on the other hand, would likely want to ensure against both types of risk while also protecting against third-party liability .

Boat owners’ insurance can also cover the items needed to operate the boat safely, such as life vests, oars, and anchors. Additional coverage could also extend to electronic equipment, such as televisions, global positioning systems (GPS), and radio equipment. Any personal items kept in the boat could also be covered under a general category for theft or loss of personal property, similar to those found in a standard home insurance policy .

Real-World Example of Boat Owners' Insurance

When shopping for boat owners’ insurance , it is important to closely consider what types of expenses will be covered under the policy. For instance, many policies will not pay for the cost of transporting a boat if it has been damaged or destroyed. In other words, the policy would cover the cost of replacing the boat, but not the cost of towing or salvaging the debris. In the past, the Coast Guard would offer assistance with towing, but this has since been restricted to situations where passengers may be at risk or when there is no alternative. Commercial marine towing companies can charge $150 per hour or more for towing services, so this cost must be planned for if it is not covered under a boat owners’ insurance policy.

Another factor worth considering is personal liability. In 2018, for instance, a boating accident in Minnesota brought this issue to national attention when a boat passenger was maimed in an accident only to discover that she was not covered by the boat owner’s insurance policy. Unlike automobile liability insurance, where everyone in the vehicle is covered, boating insurance does not necessarily cover the passengers. Boat owners can remedy this by purchasing medical riders , which are a form of supplemental insurance that can be purchased for passengers. However, these policies can be expensive and tend to have relatively low coverage limits, such as $10,000 per claim.

MLive. " Boat Talk: When You Can Be Charged for Receiving Help on the Water ."

Minnesota Public Radio. " Minnesota Woman Pushes for Boat Insurance Law After Accident ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-717167601-14799758ec5949a598581cc5cd35b705.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- To save this word, you'll need to log in. Log In

ma rine insurance

Legal definition of marine insurance, dictionary entries near marine insurance.

margin stock

marine insurance

Cite this Entry

“Marine insurance.” Merriam-Webster.com Legal Dictionary , Merriam-Webster, https://www.merriam-webster.com/legal/marine%20insurance. Accessed 31 Aug. 2024.

Subscribe to America's largest dictionary and get thousands more definitions and advanced search—ad free!

Can you solve 4 words at once?

Word of the day.

See Definitions and Examples »

Get Word of the Day daily email!

Popular in Grammar & Usage

Plural and possessive names: a guide, 31 useful rhetorical devices, more commonly misspelled words, why does english have so many silent letters, your vs. you're: how to use them correctly, popular in wordplay, 8 words for lesser-known musical instruments, it's a scorcher words for the summer heat, 7 shakespearean insults to make life more interesting, birds say the darndest things, 10 words from taylor swift songs (merriam's version), games & quizzes.

About Chubb: About Chubb

About Chubb: About Chubb in the U.S.

About Chubb: Careers

About Chubb: Citizenship

About Chubb: Investors

About Chubb: News

Claims: Claims

Claims: Claims Difference

Claims: Claims Resources

Claims: Report a Claim

Login / Pay My Bill: Login for Business

Login / Pay My Bill: Login for Individuals

Login / Pay My Bill: QuickPay for Businesses

Login / Pay My Bill: QuickPay for Individuals

Login / Pay My Bill: APT for Travel Advisors

Contact Us: Contact Us

Contact Us: Global Offices

- File a claim

- Get a quote

Boat Insurance

We offer some of the most seaworthy coverage and services available.

Our Masterpiece Boat and Masterpiece Boat Select policies are designed for all types of pleasure boats 35 feet and less, as well as Personal Watercraft (PWCs) vessels like waverunners and jet skis. We provide exceptional boat insurance with tailored protection, competitive rates, along with valuable features to protect both boat owners and their vessels.

Chubb Masterpiece® Boats & Yachts Coverage Highlights

Total Loss Settlement

We pay the entire agreed amount, with no deductible, for a total loss. With our Masterpiece Boat Select policy, eligible vessels can receive Replacement Cost coverage up to 120% of the vessel’s insured amount.

Partial Loss Settlement

With our Masterpiece Boat Select policy, the repair or replacement of covered property is paid for without deduction for depreciation on most partial losses.

Liability Protection

Limits of coverage to suit your personal needs, including: legal defense costs, pollution liability coverage as required by the Oil Pollution Act of 1990, and wreck removal.

Medical Payments

Reasonable medical and related expenses are included for all those onboard, boarding or leaving the covered vessel. These benefits are provided on a per occurrence basis. Increased limits are available.

Uninsured/Underinsured Boater Coverage

Coverage for bodily injury to persons aboard the insured watercraft who are injured by an uninsured owner or operator of another vessel.

Longshore and Harbor Workers’ Compensation Act (LHWCA)

When liability coverage is purchased, coverage is automatically provided for those employed aboard the vessel who are within the jurisdiction of the LHWCA.

Personal Property & Fishing Equipment Coverage

Protection is automatically included for the clothing, personal effects and fishing gear of the boat owner and their guests. Optional higher limits are available.

Emergency Towing & Assistance

We automatically include this coverage with optional higher limits available.

Trailer Coverage

Trailers are automatically covered up to the policy limit. Increased limits are available.

Precautionary Measures

Coverage up to the policy limit for the reasonable costs incurred to haul, fuel, or dock the insured watercraft endangered by a covered peril

Coverage for Marinas as Additional Insured

Marinas, yacht clubs and similar facilities where clients keep their vessels are included as Additional Insureds.

75% of boating accidents occur on clear days with good visibility.

Chubb offers some of the most comprehensive protection and services available rain or shine.

*Source: 2016 Recreational Boating Statistics, United States Coast Guard

Masterpiece® Recreational Marine Insurance Brochure

Your client’s guide to watercraft protection. Make sure they’re protected, with the right coverage, so they can relax on and off the water.

Related Coverage

Protect your yacht with superior protection from Chubb.

We help you stay ahead — and informed with these helpful tips and tricks

This information is descriptive only. All products may not be available in all jurisdictions. Coverage is subject to the language of the policies as issued.

Find an Agent

Speak to an independent agent about your insurance needs.

- MyNewMarkets.com

- Claims Journal

- Insurance Journal TV

- Academy of Insurance

- Carrier Management

Featured Stories

- US P/C Industry Posts H1 Underwriting Profit

- Georgia Court Says Lyft Can Sue State Farm

Current Magazine

- Read Online

Sunken Superyacht Likely to Cost Insurers at Least $150 Million, Experts Say