Jamaican\Canadian Billionaire Michael Lee-Chin Mega Yacht Sold for US$362 Million

After announcing months ago that his luxurious yacht was up for sale, Michael Lee-Chin finally got an offer he did not let pass. Based on numerous reports, the AHPO mega yacht was sold for US$362 million, which equates to a US$62 million profit for the billionaire.

The buyer of the super yacht is Pro Hockey billionaire turned businessman Patrick Dovigi. Moran Yacht & Ship represented both the seller and the buyer on the sale of AHPO, which was arranged by both sides of the deal. US$355 million was the asking price for the Lürssen superyacht measuring 378 feet.

In addition to the vessel’s massive structure, it features many breathtaking amenities, including a gigantic IMAX cinema, a duplex owner’s suite, a Turkish Hammam, two helipads, and a winter garden.

The vessel can accommodate a large group of nearly twenty people with over 20 crew members. Aside from the eight staterooms on the yacht, it also has a large gym fully equipped for full-body exercises. The stunning superyacht was renamed Lady Jorgia following the completion of the brokerage deal.

RELATED: Lee Chin’s Ahpo Superyacht Selling for US$355 Million

According to reports, Michael Lee-Chin purchased the A hpo mega yacht in December 2021.

Months ago, it was revealed that the Jamaican\Canadian billionaire was looking to auction off some of his prized possessions.

RELATED: Lee Chin now valued at US$1.5 Billion by Forbes

RELATED: Michael Lee-Chin Shares Message Encouraging Risk-Taking to Achieve Success – See Post

Discover more from YARDHYPE

Subscribe to get the latest posts to your email.

Type your email…

Leave a Reply Cancel reply

- Latest News

- North & East

- Environment

- International

- Social Love

- Horse Racing

- World Champs

- Commonwealth Games

- FIFA World Cup 2022

- Art & Culture

- Tuesday Style

- Food Awards

- JOL Takes Style Out

- Design Week JA

- Black Friday

- Relationships

- Motor Vehicles

- Place an Ad

- Jobs & Careers

- Study Centre

- Jnr Study Centre

- Supplements

- Entertainment

- Career & Education

- Classifieds

- Design Week

Lee-Chin selling yacht

Michael Lee-Chin is selling his Ahpo superyacht for US$355 million ($55.03 billion) as the Jamaican-Canadian billionaire continues to offload more of his assets.

The 377.6-foot superyacht was delivered in December 2021 after being built by German shipbuilder Lürssen. According to luxurylaunches.com , the asset has been listed for a US$55-million premium to the US$300-million purchase price. The yacht has a capacity for 16 passengers and has a crew of 36 people.

The sale of Lee-Chin’s yacht is one in a string of disposals to have taken place since the COVID-19 pandemic in March 2020. Lee-Chin, through AIC (Barbados) Limited, sold CVM Television Limited in September 2022 to Verticast Media Group at an undisclosed price. This was preceded by the sale of Reggae Beach, St Mary, to MJR Real Estate Holdings Limited which is managed by Barita Investments Limited. That 250-acre property was reportedly valued at US$50 million ($7.75 billion).

First Rock Real Estate Investments Limited disclosed to the Jamaica Stock Exchange last July that it was part of a consortium seeking to acquire both the property and operating entity Medical Associates Hospital and Medical Centre. Portland Holdings Limited lists Medical Associates as being an acquisition/investment in July 2006. It’s unknown if Lee-Chin has sold any other assets.

Lee-Chin has expressed interest in promoting nuclear technology following a memorandum of understanding with the Canadian Nuclear Laboratories in November 2022. This is based on the applications in medicine and energy production.

However, Lee-Chin’s asset sales also coincide with the lack of cashflow from his most prized Jamaican jewel, NCB Financial Group Limited (NCBFG), which has only paid a $0.50 dividend or $648.07 million since March 2020. While it has continued to grow its asset base to a historic $2.11 trillion or US$13.69 billion, its stock price has not fared as well since then. The stock which peaked at $249 on July 22, 2019 has since hit a new 52-week low of $72.01. That’s the lowest NCBFG has traded for since July 2017.

This has put pressure on different AIC and Portland entities that borrow against the NCBFG stock. An example can be with the Portland (Barbados) Limited US$5-million fixed rate secured notes issued in August 2021. The security attached to the notes was pledged ordinary shares of NCBFG — that is 1.50 times the outstanding principal. The term sheet referenced the issuer agreeing to place in reserve additional NCBFG shares, with the market value equating to 0.25 times.

This was at a time when NCBFG’s share price was trading around $133.15 and closed at $78.45 on Tuesday, a 41 per cent drop.

With no dividends paid by NCBFG since May 2021 there was no dividend income going to the interest reserve account held with the trustee. Tranche A of the secured notes had a tenure of three years, and five years for tranche B, with the interest rates on both notes fixed between 6.25 to 6.75 per cent.

This means that some related entities are likely to have been impacted by the absence of dividends, which used to be paid quarterly before the pandemic. NCBFG is currently strengthening its capital base to prepare for regulatory changes facing its core Jamaican bank and Trinidadian insurance arm.

HOUSE RULES

- We welcome reader comments on the top stories of the day. Some comments may be republished on the website or in the newspaper; email addresses will not be published.

- Please understand that comments are moderated and it is not always possible to publish all that have been submitted. We will, however, try to publish comments that are representative of all received.

- We ask that comments are civil and free of libellous or hateful material. Also please stick to the topic under discussion.

- Please do not write in block capitals since this makes your comment hard to read.

- Please don't use the comments to advertise. However, our advertising department can be more than accommodating if emailed: [email protected] .

- If readers wish to report offensive comments, suggest a correction or share a story then please email: [email protected] .

- Lastly, read our Terms and Conditions and Privacy Policy

- Privacy Policy

- Editorial Code of Conduct

- Original Content

Jamaican Billionaire Michael Lee-Chin New AHPO Superyacht Docks In Portland

- Click to share on X (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Devi Seitaram Author

The billion-dollar superyacht was spotted traveling to Portland, where it docked close to the residence of one of Jamaica’s richest men- Lee-Chin.

Chin, who owns the National Commercial bank and a range of related companies, is often given idol status by Jamaican entertainers like Vybz Kartel , who once sang, “me waan get a billion dollar like Mr. Lee Chin.”

The self-made billionaire is just one of 13 black billionaires in the world, and he’s a big deal in Jamaica because of this.

The luxury yacht is docked in Port Antonio, Portland, and is pretty impressive. A video shows the 377-foot yacht sailing while a helicopter seems to land on a helipad right on the deck of the vessel.

According to recent reports, the superyacht AHPO recently completed sea trials and was finally delivered to Chin this week. With his superyacht docked in Jamaican waters, it presented new inspiration for Jamaican people as the business magnate is one of the first black billionaires listed by Forbes’ in 2001 and often referred to as the wealthiest Jamaican.

Michael Lee-Chin’s fortune is mostly his 60% stake in National Commercial Bank Jamaica. His philanthropic acts include his $30 million donation to the Royal Ontario Museum and many other charitable acts in Jamaica.

Like every other billionaire, the tycoon has been described as a “yacht connoisseur.” The AHPO was built by the German Lurssen shipyard and was designed by the famous Nuvolari Lenard studio.

The vessel comes with six decks, including a gym and a beauty salon, as well as a spa, swimming pool, and jacuzzi.

The 70-year-old billionaire who is private about his life also seems keen to entertain as the luxury vessel has a dancefloor with a piano and comes equipped with a movie theater.

There are seven luxurious suites on board for guests to get a good night’s sleep. Other functionalities include Wi-Fi connectivity and a premium underwater lighting system.

The shipyard says the yacht has eco-friendly features, including a Dynamic Positioning capability that helps “preserve delicate marine environments” and a heat recovery system for heating the swimming pool.

Meanwhile, Jamaicans took to Twitter to comment on the news of the yacht in Jamaica.

“Lee Chin yacht a motivate me,” one person tweeted.

“For perspective, the largest private yacht in Jamaica is 92+ft. Lee Chin’s vessel is 377 ft! That’s longer than an NFL football field or a soccer field.”

The billionaire previously owned the ‘Quattroelle’ valued at $250 million prior to owning the AHPO. According to the Jamaica Observer, that vessel was 283 ft long and was one of the most impressive yachts at the annual Monaco Yacht Show.

Quavo Responds To Chris Brown With “Tender” Diss Track

Chris Brown Reignite Quavo Beef On “Freak” Over Karrueche Tran

J. Cole Apologize For Dissing Kendrick Lamar, DJ Akademiks Loses His Mind

Kai Cenat and Adin Ross Flew To Jamaica With Rvssian For Carnival

Get our latest stories in your inbox

- December 14, 2021

Lee-Chin’s new billion-dollar yacht docks in Portland

Photo: @HalsallDoug/Twitter

70-year-old Jamaican Billionaire Michael Lee-Chin has had his new billion-dollar yacht doing the rounds on social media after the 377-foot Apho was seen in the waters on the east coast of the island.

The superyacht is a culmination of a collaboration with world-famous shipyard Lurssen Yachts and with the prestigious Nuvolari Lenard design studio. The masterpiece is equipped with six decks, a beauty salon, gym, swimming pool, and jacuzzi. The luxury yacht also boasts an entertainment section, that comprises a dancefloor, piano, and a movie theatre.

Lee-Chin has been a prominent name in business over the last few decades, not only in Jamaica but in the wider region. His fortune mostly comes from a majority stake in the National Commercial Bank of Jamaica as well as other investments which include his ownership of Portland Holdings, an investment company based in Ontario, Canada. In 2001, Michael Lee-Chin became one of the first black men to be listed on Forbes’ annual billionaires’ list back in 2001.

Unknowing to most, the Jamaica-Canadian tycoon is a fond admirer of yachts and is a repeat client of the German shipyard.

One of the most striking features of his latest project is the underwater lights feature that creates a mesmerizing atmosphere in the evening. The yacht was also built to be eco-friendly, including features like Dynamic Positioning capability that aids to preserve at-risk marine elements.

The yacht will eventually become available for charting early next year.

Related Stories

- April 11, 2024

Vietnamese real estate tycoon given death sentence for role in $12.5B fraud

Oj simpson dies at 76 following battle with cancer.

- April 9, 2024

TikTok nears launch of photo sharing app to challenge Instagram

“why do my eyes hurt” searches spike on google following total eclipse.

- April 8, 2024

Social media reacts to Total Eclipse

Join our newsletter

Copyright © 2020 Sleek Jamaica Media

- ENTERTAINMENT NEWS

- EVENT AND PARTY PICTURES

- GENERAL NEWS

Jamaican Billionaire Michael Lee-Chin New APHO Superyacht Docks In Portland

The billion-dollar superyacht was spotted traveling to Portland, where it docked close to the residence of one of Jamaica’s richest men- Lee-Chin.

Chin, who owns the National Commercial bank and a range of related companies, is often given idol status by Jamaican entertainers like Vybz Kartel , who once sang, “me waan get a billion dollar like Mr. Lee Chin.”

The self-made billionaire is just one of 13 black billionaires in the world, and he’s a big deal in Jamaica because of this.

The luxury yacht is docked in Port Antonio, Portland, and is pretty impressive. A video shows the 377-foot yacht sailing while a helicopter seems to land on a helipad right on the deck of the vessel.

According to recent reports, the superyacht Apho recently completed sea trials and was finally delivered to Chin this week. With his superyacht docked in Jamaican waters, it presented new inspiration for Jamaican people as the business magnate is one of the first black billionaires listed by Forbes’ in 2001 and often referred to as the wealthiest Jamaican.

Michael Lee-Chin’s fortune is mostly his 60% stake in National Commercial Bank Jamaica. His philanthropic acts include his $30 million donation to the Royal Ontario Museum and many other charitable acts in Jamaica.

Like every other billionaire, the tycoon has been described as a “yacht connoisseur.” The Apho was built by the German Lurssen shipyard and was designed by the famous Nuvolari Lenard studio.

The vessel comes with six decks, including a gym and a beauty salon, as well as a spa, swimming pool, and jacuzzi.

The 70-year-old billionaire who is private about his life also seems keen to entertain as the luxury vessel has a dancefloor with a piano and comes equipped with a movie theater.

There are seven luxurious suites on board for guests to get a good night’s sleep. Other functionalities include Wi-Fi connectivity and a premium underwater lighting system.

The shipyard says the yacht has eco-friendly features, including a Dynamic Positioning capability that helps “preserve delicate marine environments” and a heat recovery system for heating the swimming pool.

Meanwhile, Jamaicans took to Twitter to comment on the news of the yacht in Jamaica.

“Lee Chin yacht a motivate me,” one person tweeted.

“For perspective, the largest private yacht in Jamaica is 92+ft. Lee Chin’s vessel is 377 ft! That’s longer than an NFL football field or a soccer field.”

The billionaire previously owned the ‘Quattroelle’ valued at $250 million prior to owning the Apho. According to the Jamaica Observer, that vessel was 283 ft long and was one of the most impressive yachts at the annual Monaco Yacht Show.

Search Irie Dale

NEW VIDEO ----- LADEN ------ SOUL & PAIN

NEW VIDEO -- TEEJAY----DRIFT

BYRON MESSIA - TALIBANS -- EXPLICIT ADULTS ONLY

BURNA BOY -- LAST LAST

TEE JAY ft TOMMY LEE SPARTA (EXPICIT)

BURNA BOY -- BABY -- ft. NICKI MINAJ, LIL WAYNE & NASTY C

SEAN PAUL - LIGHT MY FIRE ft. GWEN STEFANI AND SHENSEEA

ELEPHANT MAN - COOL REMINDER NEW VIDEO

BLOOD CLXXT -- BABY CHAM & BOUNTY KILLER --- NEW VIDEO -- (EXPLICIT)

DJ Khaled - TSKMN ft. Skillibeng, Buju Banton, Capleton, Bounty Killer, Sizzla

DEXTA DAPS --WIFI

KOFFEE -- TOAST

SHAGGY ft. CHRONIXX 'BRIDGES'

KRANIUM -- GAL POLICY

Michael Lee-Chin, one of the world’s Black billionaires, sells megayacht for $362 million

Michael Lee-Chin, a Jamaican-Canadian billionaire and philanthropist , has reportedly sold his megayacht, AHPO, to professional hockey player turned billionaire businessman Patrick Dovigi for a whopping $362 million.

The sale of the 378-feet Lurssen superyacht, built as a replacement for the Quattroelle, has brought the Jamaican-Canadian businessman a gross profit of $62 million from the latest transaction, excluding the costs that were incurred during the time that he owned the yacht.

Michael Lee-Chin has been on a selling spree since March 2020

Lee-Chin purchased the six-deck luxury vessel for $300 million in 2021 but has been on a selling spree since March 2020. In September 2022, he sold CVM Television Limited to Verticast Media Group for an unspecified amount.

He also sold his 250-acre Reggae Beach property in St. Mary to MJR Real Estate Holdings Limited for around $50 million.

The Jamaican-Canadian billionaire has also put his luxurious mansion, Coconut Walk Private Estate, up for sale for $35 million . The estate boasts a stunning beachfront location and sits on almost 75,000 square feet of prime real estate.

Lee-Chin purchased the estate for $12.5 million in 2018, and if sold at the present asking price, he will pocket a profit of almost $22.5 million.

Michael Lee-Chin’s net worth has decreased by $600 million since 2020

Despite the pandemic’s adverse effects on the global economy, Lee-Chin still ranks among the wealthiest black billionaires worldwide.

According to Forbes , with a fortune of $1.4 billion, he holds the 2,054th position on the list of the world’s wealthiest individuals.

The Jamaican-Canadian billionaire accumulated his $1.4 billion fortune through investments in financial companies such as National Commercial Bank Jamaica and AIC Limited.

The sale of the AHPO superyacht to Dovigi demonstrates Lee-Chin’s business acumen in the luxury scene as he continues to dispose of some of his assets.

Given the uncertainties surrounding the global economy, his decision to sell off his assets could be a strategic move. However, his net worth has decreased by $600 million since 2020, going from $2 billion to $1.4 billion.

Omokolade Ajayi

Omokolade Ajayi is a financial reporter at Billionaires.Africa. Previously, he worked as a journalist at Nairametrics. Omokolade is a seasoned financial analyst and reporter with in-depth knowledge of and expertise in equity markets, and financial and economic analysis. He has a degree in economics and is a certificate holder of the CFA Institute’s Investment Foundation Program.

Herbert Wigwe invests $3.51 million in Lagos-based lender, Access Holdings

Kenyan banker gideon muriuki receives $2.1 million in remuneration in 2022, you may also like, nigerian businessman tony elumelu’s uba reports $468.8-million profit in 2023, el-sewedy family’s investment in electrical equipment group rebounds above $1 billion, nigerian banker segun agbaje leads gtco to $470-million profit in 2023, discovery health, linked to south african tycoon adrian gore, distributes over $32 million via..., christo wiese-backed shoprite joins retailers investing $125 million in startups every five years, egyptian billionaire ghabbour family loses $21.5 million in 19 days.

The world’s premier source of news on Africa’s billionaires and UHNWIs.

- Privacy Policy

- Terms of Use

- North Africa

- Horn of Africa

- West & Central Africa

- East Africa

- Southern Africa

Get the daily email to stay informed about African billionaires and UHNWIs. Get informed and entertained, for free.

Latest News

@2024 – Billionaires.Africa. All Rights Reserved.

- Listen Live

Latest News

Jamaicancanadian billionaire michael lee-chin mega yacht sold for us$362 million .

After announcing months ago that his luxurious yacht was up for sale, Michael Lee-Chin finally got an offer he did not let pass. Based on numerous reports, the AHPO mega yacht was sold for US$362 million, which equates to a US$62 million profit for the billionaire.

The buyer of the super yacht is Pro Hockey billionaire turned businessman Patrick Dovigi. Moran Yacht & Ship represented both the seller and the buyer on the sale of AHPO, which was arranged by both sides of the deal. US$355 million was the asking price for the Lürssen superyacht measuring 378 feet.

In addition to the vessel’s massive structure, it features many breathtaking amenities, including a gigantic IMAX cinema, a duplex owner’s suite, a Turkish Hammam, two helipads, and a winter garden.

The vessel can accommodate a large group of nearly twenty people with over 20 crew presenters. Aside from the eight staterooms on the yacht, it also has a large gym fully equipped for full-body exercises. The stunning superyacht was renamed Lady Jorgia following the completion of the brokerage deal.

RELATED: Lee Chin’s Ahpo Superyacht Selling for US$355 Million

According to reports, Michael Lee-Chin purchased the A hpo mega yacht in December 2021.

Months ago, it was revealed that the Jamaican\Canadian billionaire was looking to auction off some of his prized possessions.

RELATED: Lee Chin now valued at US$1.5 Billion by Forbes

RELATED: Michael Lee-Chin Shares Message Encouraging Risk-Taking to Achieve Success – See Post

Comments are closed.

Request your favourite song!

Login as a presenter.

Get Involved!

Coming Soon!

Guest Shows

Complete the form, including an upload of a short demo mix, and we'll be in touch!

Please let us know what genres you play/specialise in?

Hip Hop R&B/Soul Dancehall Reggae/Dub Afrobeats/Afropop Dubstep Rare Groove

Please upload and provide a sample audio file (upto 10mb/.mp3), or provide URL(s) to online media such as YouTube links.

We Are TGM Radio…

By now you probably realize you have discovered a very special website. Behind this site thrives an innovative, original, and fresh radio station that will be run by dozens of hosts with a passion for radio.

TGM Radio is the brainchild of Dane Thompson, a London entrepreneur who set out to realize his lifelong dream in an industry that has standardized on big-name hosts and celebrities.

The idea of delivering radio over the Internet led Dane to envision a new and different kind of radio station, one that would offer its listeners a variety of original programs with great entertainment value. What he had in mind, however, was a mainstream radio station that offered a variety of light, entertaining programs in the form of live streaming and on-demand listening.

All new hosts are encouraged to produce their own material and play however they want. This will create a relaxed, creative environment that brings hosts together and lead to a shared effort.

At TGM Radio Our programs will be of the highest quality. We’ll find you the best radio hosts for our station, so that what you’re listening to always sounds good. TGM Radio programming will have the best music (past and present), the latest hits from charts local and international, news and local traffic & weather.

Our aim is to Provide a continuous broadcast community radio and online. Give hosts the freedom, and opportunity to express their diverse voices through radio. Create contemporary sound and music and promote it to new audiences. Develop the capacity of the station to enable it to flourish.

TGM Radio welcomes you onboard and urges you to get ready for a musical journey.

Privacy Policy

At TGM Radio, accessible from https://tgmradio.com/, one of our main priorities is the privacy of our visitors. This Privacy Policy document contains types of information that is collected and recorded by TGM Radio and how we use it.

If you have additional questions or require more information about our Privacy Policy, do not hesitate to contact us. Our Privacy Policy was generated with the help of GDPR Privacy Policy Generator from GDPRPrivacyNotice.com

General Data Protection Regulation (GDPR)

We are a Data Controller of your information.

Team Gorilla Music Ltd legal basis for collecting and using the personal information described in this Privacy Policy depends on the Personal Information we collect and the specific context in which we collect the information:

- Team Gorilla Music Ltd needs to perform a contract with you

- You have given Team Gorilla Music Ltd permission to do so

- Processing your personal information is in Team Gorilla Music Ltd legitimate interests

- Team Gorilla Music Ltd needs to comply with the law

Team Gorilla Music Ltd will retain your personal information only for as long as is necessary for the purposes set out in this Privacy Policy. We will retain and use your information to the extent necessary to comply with our legal obligations, resolve disputes, and enforce our policies.

If you are a resident of the European Economic Area (EEA), you have certain data protection rights. If you wish to be informed what Personal Information we hold about you and if you want it to be removed from our systems, please contact us.

In certain circumstances, you have the following data protection rights:

- The right to access, update or to delete the information we have on you.

- The right of rectification.

- The right to object.

- The right of restriction.

- The right to data portability

- The right to withdraw consent

TGM Radio follows a standard procedure of using log files. These files log visitors when they visit websites. All hosting companies do this and a part of hosting services' analytics. The information collected by log files include internet protocol (IP) addresses, browser type, Internet Service Provider (ISP), date and time stamp, referring/exit pages, and possibly the number of clicks. These are not linked to any information that is personally identifiable. The purpose of the information is for analyzing trends, administering the site, tracking users' movement on the website, and gathering demographic information.

Cookies and Web Beacons

Like any other website, TGM Radio uses 'cookies'. These cookies are used to store information including visitors' preferences, and the pages on the website that the visitor accessed or visited. The information is used to optimize the users' experience by customizing our web page content based on visitors' browser type and/or other information.

For more general information on cookies, please read "What Are Cookies" .

Our Advertising Partners

Some of advertisers on our site may use cookies and web beacons. Our advertising partners are listed below. Each of our advertising partners has their own Privacy Policy for their policies on user data. For easier access, we hyperlinked to their Privacy Policies below.

https://policies.google.com/technologies/ads

Privacy Policies

Third-party ad servers or ad networks uses technologies like cookies, JavaScript, or Web Beacons that are used in their respective advertisements and links that appear on TGM Radio, which are sent directly to users' browser. They automatically receive your IP address when this occurs. These technologies are used to measure the effectiveness of their advertising campaigns and/or to personalize the advertising content that you see on websites that you visit.

Note that TGM Radio has no access to or control over these cookies that are used by third-party advertisers.

Third Party Privacy Policies

TGM Radio's Privacy Policy does not apply to other advertisers or websites. Thus, we are advising you to consult the respective Privacy Policies of these third-party ad servers for more detailed information. It may include their practices and instructions about how to opt-out of certain options.

You can choose to disable cookies through your individual browser options. To know more detailed information about cookie management with specific web browsers, it can be found at the browsers' respective websites.

Children's Information

Another part of our priority is adding protection for children while using the internet. We encourage parents and guardians to observe, participate in, and/or monitor and guide their online activity.

TGM Radio does not knowingly collect any Personal Identifiable Information from children under the age of 13. If you think that your child provided this kind of information on our website, we strongly encourage you to contact us immediately and we will do our best efforts to promptly remove such information from our records.

Online Privacy Policy Only

Our Privacy Policy applies only to our online activities and is valid for visitors to our website with regards to the information that they shared and/or collect in TGM Radio. This policy is not applicable to any information collected offline or via channels other than this website.

By using our website, you hereby consent to our Privacy Policy and agree to its terms.

The superyacht market is so hot that a billionaire is flipping his luxury vessel at a profit of $55 million. Longer than a football field, it was purchased for $300 million and was delivered in 2021.

[ AHPO listing on Moran Yachts ]

You may also like

Tom Cruise, while vacationing on a 263 feet long superyacht, spotted a burning yacht. The real-life hero immediately sailed toward it and rescued the five victims just as their vessel sank into the Mediterranean waters.

As soon as he got sanctioned, Russia’s second-richest man hurriedly got his $300m superyacht to the safe waters of Dubai. The humungous vessel now dwarfs all boats in the emirate and marvels onlookers with its massive six decks.

Not a helipad or a garage for luxury cars, but this genius American scientist’s support vessel has a fully functional biology lab, a portable MRI machine, and 3D printers. Aptly named Gene Chaser, instead of socialites and celebrities, the advanced vessel hosts full-time scientists.

Forget a private jet or a villa – The former Prime Minister of Qatar actually owns this $300 million megayacht – The 436 feet long vessel has one of the largest spa’s on a yacht, a pirate-themed underwater viewing room for the kids, and even a hairdressing saloon.

Delta unveils super yacht design for worldwide cruising

Designed by an Instagrammer this ultra luxurious 300 feet yacht concept comes with an infinity pool, helipad, two jacuzzis and a lot more

It’s been more than 60 days since Eric Schmidt bought the Alfa Nero superyacht from the Antiguan government. Yet the 269-feet-long vessel has not even moved a single inch, here is why the ex-Google CEO has been so patient.

Longer than a FIFA soccer field, the Qatari royal family’s yacht is so big that it can be mistaken for a cruise ship – The $400 million vessel is built for utmost comfort and privacy, its unique stabilization system offers a smooth journey even in rough seas.

Floating staircases, wine cellar, a stunning pool to die for – Take a look at the 180 feet Vida superyacht

Canadian billionaires lead the way as superyachts arrive in Monaco for F1 grand prix

The absence of Russian superyachts means Michael Lee-Chin's and Lawrence Stroll 's vessels are the largest this year

Author of the article:

You can save this article by registering for free here . Or sign-in if you have an account.

Article content

Canadian billionaires Michael Lee-Chin, who is also Jamaican, and Lawrence Stroll are leading the way with their massive superyachts arriving in Monaco ahead of the Formula One Grand Prix.

Topping the list of largest superyachts is the 377-foot Ahpo, reportedly owned by Lee-Chin. The investor’s net worth is around $1.8 billion, Forbes reported .

The yacht, designed by Nuvolari Lenard studio, is said to have six decks, a full gym, beauty salon, spa, swimming pool, jacuzzi, dance floor and movie theatre, according to the publication autoevolution .

Enjoy the latest local, national and international news.

- Exclusive articles by Conrad Black, Barbara Kay, Rex Murphy and others. Plus, special edition NP Platformed and First Reading newsletters and virtual events.

- Unlimited online access to National Post and 15 news sites with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles including the New York Times Crossword.

- Support local journalism.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

Don't have an account? Create Account

View this post on Instagram A post shared by NUVOLARI 🔹️ LENARD (@nuvolarilenard)

Get a dash of perspective along with the trending news of the day in a very readable format.

- There was an error, please provide a valid email address.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

A welcome email is on its way. If you don't see it, please check your junk folder.

The next issue of NP Posted will soon be in your inbox.

We encountered an issue signing you up. Please try again

Coming in second place at 317 feet long is the Faith, owned by Canadian fashion entrepreneur Lawrence Stroll, whose son Lance drives for the Aston Martin F1 team. Lawrence Stroll’s net worth is $2.9 billion, Forbes reported .

Feadship superyacht FAITH in the South of France!🇫🇷 Anchored here last Friday in the South of France and spotted recently in Villefranche-sur-Mer is one of the largest Feadships delivered to date, the 97m Faith, launched as Project Vertigo in 2016. pic.twitter.com/QZBAcP2EcY — Yacht Informer (@yachtinformer) May 23, 2022

The yacht came with a US$200 million price tag. It can host up to 18 guests and has nine staterooms, according to Yacht Bible . It has indoor and outdoor fireplaces in the private owner’s deck, a movie theatre, gym, a wine cellar and a wellness area.

The nearly 100-year-old annual race is expected to see some showers over the next couple of days, though it’s not expected to deter the floating party scene. More than 80 super yachts, at a combined length of 4.5 kilometers (2.8 miles), are already clustered off the tiny city-state in the French Riviera, with more likely en route.

The Yachts have arrived in Monaco… 🇲🇨🛥 #MonacoGP #F1 #yachtlife pic.twitter.com/1RDD048ZCF — Corinthian Sports (@CorSportsLtd) May 27, 2022

The superyacht world was thrown into turmoil following Russia’s invasion of Ukraine and the sanctions placed on billionaire Russian oligarchs.

More than a dozen yachts worth over US$2.25 billion have already been seized. The seizures have sent the luxury vessels racing across oceans to locales that aren’t as likely to impose or enforce sanctions. Some have logged more than 5,000 nautical miles since the start of the invasion in February.

One of the biggest superyachts, Eclipse, owned by Russian billionaire Roman Abromavich, is 533 feet and would have towered over Lee-Chin’s vessel; however, it was notably absent in Monaco.

One of the first yachts seized, Dilbar , owned by another Russian billionaire Alisher Usmanov, would have also towered over the other vessels in Monaco, at 512 feet. It was impounded by German authorities while it was undergoing repairs, Page Six reported in March. Since then, other yachts and even private jets owned by Russians with connections to President Vladimir Putin have been seized.

The absence of Russian superyachts pushed the two Canadians into the lead for largest yacht — although the country with the most was Greece, closely followed by the United States and France. Russia did not make Bloomberg’s superyacht leaderboard .

With additional reporting by Bloomberg

Our website is the place for the latest breaking news, exclusive scoops, longreads and provocative commentary. Please bookmark nationalpost.com and sign up for our daily newsletter, Posted, here .

Postmedia is committed to maintaining a lively but civil forum for discussion. Please keep comments relevant and respectful. Comments may take up to an hour to appear on the site. You will receive an email if there is a reply to your comment, an update to a thread you follow or if a user you follow comments. Visit our Community Guidelines for more information.

'Extreme caution': U.K. review of trans health care could have lessons for Canada

Poilievre attacks trudeau for not reading intelligence briefing notes, breaking 'with liberalism itself', chris selley: poilievre promises the conservative faithful all their canadian dreams will soon come true, terry glavin: trudeau just doesn't think chinese interference is anything to be angry about.

A female billionaire is sentenced to death in largest reported financial fraud case in Vietnam

5 spring sunglasses guaranteed to elevate your eyewear game.

Trends! Colours! Shapes! Price points!

Canadian clothing and fashion brands: They're local and spectacular

Supporting well-known brands and hidden local gems

Advertisement 2 Story continues below This advertisement has not loaded yet, but your article continues below.

The best online deals in the Canadian retail space right now

Casper, Shopbop, Best Buy and Sephora, to name a few

Here are the 5 best drugstore makeup dupes

Putting drugstore products to the test.

What your mom actually wants this Mother’s Day

The perfect gift for any type of mom — from the pickleballer to the hostess

This website uses cookies to personalize your content (including ads), and allows us to analyze our traffic. Read more about cookies here . By continuing to use our site, you agree to our Terms of Service and Privacy Policy .

You've reached the 20 article limit.

You can manage saved articles in your account.

and save up to 100 articles!

Looks like you've reached your saved article limit!

You can manage your saved articles in your account and clicking the X located at the bottom right of the article.

10 of the most impressive superyachts owned by billionaires

From a sailing yacht owned by a russian billionaire industrialist to the luxury launch of the patek philippe ceo, here are the best billionaire-owned boats on the water….

Words: Jonathan Wells

There’s something about billionaires and big boats . Whether they’re superyachts or megayachts, men with money love to splash out on these sizeable sea-going giants. And that all began in 1954 — with the big dreams of Greek shipping magnate Aristotle Onassis.

Onassis, keen to keep his luxury lifestyle afloat when at sea, bought Canadian anti-submarine frigate HMCS Stormont after World War II. He spent millions turning it into an opulent super yacht, named it after his daughter — and the Christina O kicked off a trend among tycoons. To this day, the world’s richest men remain locked in an arms race to build the biggest, fastest, most impressive superyacht of all. Here are 10 of our favourites…

Eclipse, owned by Roman Abramovich

Built by: Blohm+Voss of Hamburg, with interiors and exteriors designed by Terence Disdale. Launched in 2009, it cost $500 million (the equivalent of £623 million today).

Owned by: Russian businessman Roman Abramovich, the owner of private investment company Millhouse LLC and owner of Chelsea Football Club. His current net worth is $17.4 billion.

Key features: 162.5 metres in length / 9 decks / Top speed of 22 knots / Two swimming pools / Disco hall / Mini submarine / 2 helicopter pads / 24 guest cabins

Sailing Yacht A, owned by Andrey Melnichenko

Built by: Nobiskrug, a shipyard on the Eider River in Germany. The original idea came from Jacques Garcia, with interiors designed by Philippe Starck and a reported price tag of over $400 million.

Owned by: Russian billionaire industrialist Andrey Melnichenko, the main beneficiary of both the fertiliser producing EuroChem Group and the coal energy company SUEK. Though his current net worth is $18.7 billion, Sailing Yacht A was seized in Trieste on 12 March 2022 due to the EU’s sanctions on Russian businessmen.

Key features: 119 metres in length / 8 decks / Top speed of 21 knots / Freestanding carbon-fibre rotating masts / Underwater observation pod / 14 guests

Symphony, owned by Bernard Arnault

Built by: Feadship, the fabled shipyard headquartered in Haarlem in The Netherlands. With an exterior designed by Tim Heywood, it reportedly cost around $150 million to construct.

Owned by: French billionaire businessman and art collector Bernard Arnault. Chairman and chief executive of LVMH, the world’s largest luxury goods company, his current net worth is $145.8 billion.

Key features: 101.5 metres in length / 6 decks / Top speed of 22 knots / 6-metre glass-bottom swimming pool / Outdoor cinema / Sundeck Jacuzzi / 8 guest cabins

Faith, owned by Michael Latifi

Built by: Similarly to Symphony above, also Feadship. With exteriors designed by Beaulieu-based RWD, and interiors by Chahan Design, it cost a reported $200 million to construct in 2017.

Owned by: Until recently, Canadian billionaire and part-owner of the Aston Martin Formula 1 Team , Lawrence Stroll. Recently sold to Michael Latifi, father of F1 star Nicholas , a fellow Canadian businessman with a net worth of just under $2 billion.

Key features: 97 metres in length / 9 guest cabins / Glass-bottom swimming pool — with bar / Bell 429 helicopter

Amevi, owned by Lakshmi Mittal

Built by: The Oceanco shipyard, also in The Netherlands. With exterior design by Nuvolari & Lenard and interior design by Alberto Pinto, it launched in 2007 (and cost around $125 million to construct).

Owned by: Indian steel magnate Lakshmi Mittal, chairman and CEO of Arcelor Mittal, the world’s largest steelmaking company. He owns 20% of Queen Park Rangers, and has a net worth of $18 billion.

Key features: 80 metres in length / 6 decks / Top speed of 18.5 knots / On-deck Jacuzzi / Helipad / Swimming Pool / Tender Garage / 8 guest cabins

Odessa II, owned by Len Blavatnik

Built by: Nobiskrug, the same German shipyard that built Sailing Yacht A . Both interior and exterior were created by Focus Yacht Design, and the yacht was launched in 2013 with a cost of $80 million.

Owned by: British businessman Sir Leonard Blavatnik. Founder of Access Industries — a multinational industrial group with current holdings in Warner Music Group, Spotify and the Grand-Hôtel du Cap-Ferrat — he is worth $39.9 billion.

Key features: 74 metres in length / 6 guest cabins / Top speed of 18 knots / Intimate beach club / Baby grand piano / Private master cabhin terrace / Outdoor cinema

Nautilus, owned by Thierry Stern

Built by: Italian shipyard Perini Navi in 2014. With interiors by Rémi Tessier and exterior design by Philippe Briand, Nautilus was estimated to cost around $90 million to construct.

Owned by: Patek Philippe CEO Thierry Stern. Alongside his Gulstream G650 private jet, Nautilus — named for the famous sports watch — is his most costly mode of transport. His current net worth is $3 billion.

Key features: 73 metres in length / 7 guest cabins / Top speed of 16.5 knots / Dedicated wellness deck / 3.5 metre resistance pool / Underfloor heating / Jet Skis

Silver Angel, owned by Richard Caring

Built by: Luxury Italian boatbuilder Benetti. Launched in 2009, the yacht’s interior has been designed by Argent Design and her exterior styling is by Stefano Natucci.

Owned by: Richard Caring, British businessman and multi-millionaire (his wealth peaked at £1.05 billion, so he still makes the cut). Chairman of Caprice Holdings, he owns The Ivy restaurants.

Key features: 64.5 metres in length / Cruising speed of 15 knots / 7 guest cabins / Lalique decor / 5 decks / Oval Jacuzzi pool / Sun deck bar / Aft deck dining table

Lady Beatrice, owned by Frederick Barclay

Built by: Feadship and Royal Van Lent in 1993. Exteriors were created by De Voogt Naval Architects, with interiors by Bannenberg Designs. She cost the equivalent of £63 million to build.

Owned by: Sir David Barclay and his late brother Sir Frederick. The ‘Barclay Brothers’ had joint business pursuits including The Spectator , The Telegraph and delivery company Yodel. Current net worth: £7 billion.

Key features: 60 metres in length / 18 knots maximum speed / Monaco home port / Named for the brothers’ mother, Beatrice Cecelia Taylor / 8 guest cabins

Space, owned by Laurence Graff

Built by: Space was the first in Feadship’s F45 Vantage series , styled by Sinot Exclusive Yacht Design and launched in 2007. She cost a reported $25 million to construct.

Owned by: Laurence Graff, English jeweller and billionaire businessman. As the founder of Graff Diamonds, he has a global business presence and a current net worth of $6.26 billion.

Key features: 45 metres in length / Top speed of 16 knots / Al fresco dining area / Sun deck Jacuzzi / Breakfast bar / Swimming platform / Steam room

Want more yachts? Here’s the handcradfted, homegrown history of Princess…

Become a Gentleman’s Journal member. Find out more here.

Become a Gentleman’s Journal Member?

Like the Gentleman’s Journal? Why not join the Clubhouse, a special kind of private club where members receive offers and experiences from hand-picked, premium brands. You will also receive invites to exclusive events, the quarterly print magazine delivered directly to your door and your own membership card.

Further reading

The best webcams to up level up your Zoom meetings

All you need to know about Kismet, the new £2.5m a week gigayacht

The best slope-worthy ski gear on the planet

- International edition

- Australia edition

- Europe edition

Meet the oligarchs: the Russian billionaires whose jets, yachts and mansions are now in the crosshairs

Some of Russia’s super rich are finding their assets in the west under threat of sanctions from the US

For a growing number of Russia’s richest and most powerful men, now would be a very bad time to take their private jets and superyachts to their mansions in the United States.

Yesterday, the White House announced it would expand the list of Russian oligarchs subject to full blocking sanctions – the highest level of restrictions – as it ramps up punishment against Russia for its invasion of Ukraine. Some of the newly named oligarchs overlapped with a list of Russian elites on whom the European Union imposed sanctions earlier this week, although there were some notable differences.

The federal government won’t just stop at freezing these targets’ assets, but will seize them, Joe Biden announced in his State of the Union address on Tuesday.

In charge of appropriating these assets will be KleptoCapture , a newly announced justice department taskforce, with support from the treasury department, FBI, IRS and other federal agencies. Under US law, the justice department may use civil forfeiture to confiscate the proceeds from foreign crimes, including corruption, when they are found in the United States.

Their efforts will complement those of a transatlantic taskforce announced over the weekend between the United States, France, Germany, Italy, the United Kingdom, Canada and the European Commission.

“We are joining with our European allies to find and seize your yachts, your luxury apartments, your private jets. We are coming for your ill-begotten gains,” Biden said.

The Feds may have their work cut out. US regulations are lax when it comes to requiring disclosures of real estate transactions by foreign individuals, making the country a prime destination for Russian’s uber-rich looking to snap up prime properties without scrutiny.

Other favorite toys of oligarchs like planes and boats are commonly registered through shell companies. And many of those luxury craft have begun traveling toward extradition-free territories such as the Maldives, according to Bloomberg News .

Here’s an introduction to the Russian oligarchs now joining the US sanctions list – as well as a few others who haven’t been targeted yet, but have notable US ties.

Alisher Usmanov

Russians know Alisher Usmanov as one of Vladimir Putin’s “favorite” oligarchs. The country’s richest man until 2015, Usmanov owns a majority stake in Russia’s second-largest phone network, MegFon, and a large stake in the iron and steel giant Metalloinvest.

But few Americans know that Usmanov also helped give us Facebook. The billionaire began investing in the social network in 2009, when Zuckerberg’s firm was having trouble accessing funding in the wake of the financial crisis. Usmanov ultimately poured over $900m into the firm, owning as much as 10% of the company before selling his stake in 2014 and netting himself billions. He was also a major investor in Apple, Twitter, LinkedIn, Groupon and Zynga.

Usmanov was subjected to sanctions by the EU on Monday, and on Wednesday German authorities seized his $600m megayacht , the Dilbar – which boasts the world’s largest yacht-based indoor swimming pool. On 3 March he was among those added to the sanctions list by the US. The oligarch still has a $200m private Airbus A340.

The Rotenbergs

Long before brothers Arkady and Boris Rotenberg became two of Russia’s wealthiest tycoons, they were teenage Vladimir Putin’s judo training buddies, a role they continued into adulthood. Clearly they were good at it, because after Putin became president he rewarded the brothers with the control of large state-owned enterprises and lucrative contracts, netting them a massive fortune.

The Rotenbergs have since built a huge family empire of international investments under a web of shell companies, which has made Arkady’s son Igor a billionaire in his own right. Despite Arkady and Boris getting US sanctions after Russia’s 2014 invasion of Crimea, the brothers “continued actively participating in the US art market by purchasing over $18 million in art in the months following the imposition of sanctions”, according to a US Senate report . Rotenberg-linked shell companies continued making transactions in the US financial system worth over $91m long after the sanctions, according to the report.

In addition to Arkady and Boris, Igor and five additional family members were added to the US sanctions list this week.

Igor Shuvalov

Russia’s deputy prime minister from 2008 to 2018, Igor Shuvalov is now the chairman of VEB, the Russian development bank that finances major infrastructure projects, including the Sochi Olympics. He has claimed to be one of Russia’s cleanest officials, telling media he transferred all his wealth to Russia in 2013, and only kept it offshore before that to avoid spoiling his kids . But an investigation by the anti-corruption activist Alexei Navalny found that Shuvalov, through a shell company, bought two London luxury apartments in 2014 for $11.4m and has used a secret private jet to fly his wife’s corgis around the world because, as one of his staffers explained, “it’s not that comfortable in business class”.

He won’t be able to fly his corgis as many places now that he’s on the US and EU’s sanctions lists.

Yevgeniy Prigozhin

Legend has it Yevgeniy Prigozhin began his rise to power selling hot dogs , shortly after getting released from prison for robbery. The wiener venture was apparently a smash hit, and within years he had opened high-end restaurants that counted Russia’s leader among their clientele, earning him the nickname of “Putin’s chef” and catapulting him into the inner circles of Russia’s elite.

Americans might be more familiar with another one of Prigozhin’s businesses: the Internet Research Agency, which employed a troll army that began by supporting Russia’s 2014 invasion of Crimea, before turning its efforts to influencing the 2016 US presidential election in favor of Donald Trump. Prigozhin and the Internet Research Agency were indicted by a US grand jury in 2018 for interfering with the election, and he was added to an FBI wanted list in 2021.

He’s now on both the US and EU sanctions lists for running disinformation campaigns to support Russia’s invasion of Ukraine.

Sergey Chemezov

A former KGB officer who befriended Vladimir Putin in the 1980s while living in the same apartment building, Sergey Chemezov rose through Russia’s public and private sector in Putin’s wake, and in 2007 was appointed as CEO of Russia’s state-owned defense giant Rostec, a position he still holds today. Chemezov was sanctioned by the US in 2014 amid Rostec’s role as a supplier for Russia’s invasion of Crimea, and Washington is targeting him again, now with his family members.

According to investigative reports and allegations from the jailed activist Alexei Navalny, Chemezov’s relatives have used shell companies to accumulate eye-watering assets , including superyachts and luxury villas around the world. But Chemezov says he’s clean, telling Russian media in 2019: “I do not accumulate wealth. I don’t stuff money in the corners. I don’t have yachts or airplanes.”

Nikolai Tokarev

Another former KGB officer who served alongside Putin and Chemezov, Nikolai Tokarev took over former Soviet state assets as Putin built his political power, and in 2007 became the head of the state-controlled oil giant Transneft. The oligarch has used his position at Transneft to build a business and real estate empire, which reportedly includes sponsoring an extremely fancy palace that’s said to be personally used by Putin. Tokarev was hit by US and EU sanctions this week.

Vladimir Potanin

Reportedly the second richest man in Russia, the banker, metals mining tycoon and former deputy prime minister Vladimir Potanin was among a small circle of oligarchs who met with Putin last week as the invasion of Ukraine began.

Potanin has played a big role in American arts: he has been a board member of New York’s Guggenheim Museum for two decades, until he stepped down on Wednesday. He has also given millions to the Kennedy Center in Washington, which carved his name into a wall. He is also known to have owned property in New York City , which came to light during a divorce fight that could cost him $7bn.

Potanin isn’t currently under US sanctions, which is good news for his three megayachts and two private jets (that we know about).

Leonid Mikhelson

Russia’s richest man in 2016, Leonid Mikhelson is the founder and chairman of natural gas producer Novatek, a close friend of Putin’s, and a business partner of Gennady Timchenko, a billionaire who has been under US sanctions since 2014.

Mikhelson loves art: along with his $200m art collection, he was on the board of trustees at New York’s New Museum from 2013 to 2017, and has sponsored exhibitions at the Art Institute of Chicago and London’s Tate Modern. His ostentatious superyacht, the Pacific, can reportedly accommodate two helicopters.

But his other assets may be harder to trace. In 2017, the Panama Papers revealed that Mikhelson had used an intricate system of shell companies to secretly register a $65m Gulfstream private jet in the United States, which in most cases requires US citizenship or permanent residency.

The tycoon is not currently subject to sanctions, though his company Novatek is.

Petr Aven is the head of Alfa Group, a commercial bank subject to US sanctions that helped him amass an estimated $5.5bn fortune. A well-known collector of classical Russian paintings, Aven has lent works from his collection – reportedly worth $200m – to New York’s Museum of Modern Art and the Neue Galerie. Aven reportedly has never bought a plane or yacht, and told the FT “all my money goes in to art.” That is, of course, if you don’t count the millions he spent transforming an 8.5-acre plot in England into a “KGB-proof” mansion , complete with a bomb-proof panic room.

Last year, Aven filed a libel lawsuit against HarperCollins for a book it published about Vladimir Putin’s rise, Putin’s People.

Aven was sanctioned on Monday by the EU, which described him as “one of Vladimir Putin’s closest oligarchs” and one of “approximately 50 wealthy Russian businessmen who regularly meet with Vladimir Putin in the Kremlin”. He has not yet been placed under sanctions by the US or UK.

Mikhail Fridman

Petr Aven’s business partner, Mikhail Fridman, is Alfa Group’s founder and a Ukrainian-born Russian oligarch. Fridman has made substantial investments in the United States, which include spending a reported $1bn in 2011 to buy up distressed properties across the east coast, telling the Wall Street Journal at the time, “The American market is the most well-regulated and liquid market in the world. It has the best protection for investor rights.”

Through Fridman’s investment group, LetterOne, the billionaire also sank $200m into Uber , and $50m into the telecom startup FreedomPop. Fridman also caused a stir in 2018 when he spoke alongside Aven at a closed-door dinner hosted by the Atlantic Council, a major US foreign policy thinktank, in what critics saw as an unofficial Kremlin mission to protest against US sanctions.

Last week, Fridman became one of the first oligarchs to speak out against the invasion of Ukraine, calling it a “tragedy” and writing that “war can never be the answer.” Nonetheless, Fridman was subjected to sanctions on Monday by the EU, which named him as “a top Russian financier and enabler of Putin’s inner circle”. Like Aven, he has not yet been placed under sanctions by the US or UK.

The oligarch has a son, Alexander, who is reportedly attending NYU’s Stern business school, after a stint in Moscow selling hookah .

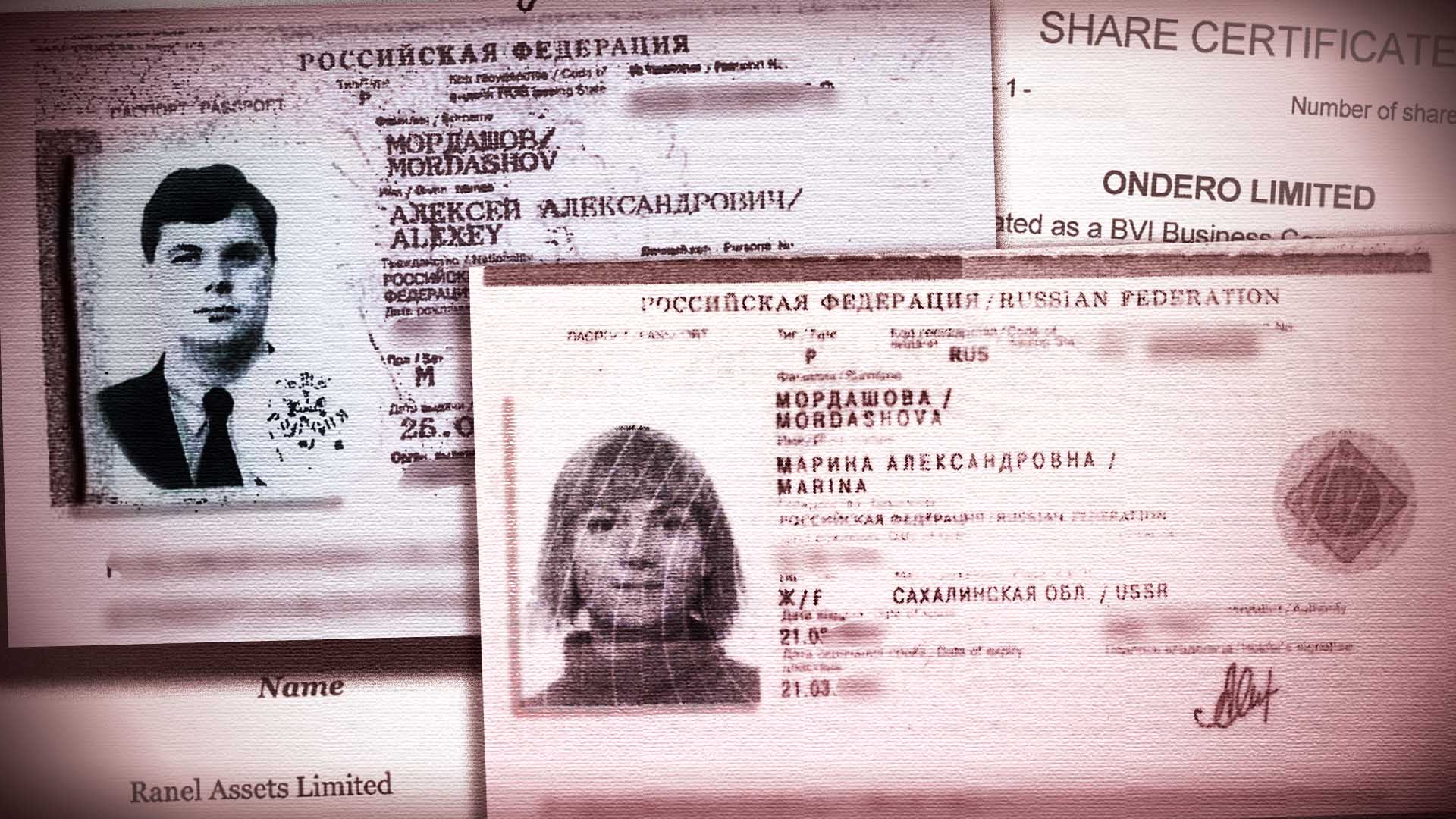

Alexei Mordashov

Currently Russia’s richest man, Alexei Mordashov owns a third of Tui, Europe’s biggest tourism firm, and gained his billions as the chief executive of Russia’s largest steel and mining firm, Severstal. He is also a large shareholder of the Bank of Rossiya, which has opened up branches across Russia-occupied Ukrainian territory in recent years.

Over the last two decades, the billionaire has also poured money into the United States, investing heavily through Severstal in steel companies in the midwest before selling them for $2.3bn in 2014.

Mordashov has been hit with sanctions by the EU, but the US hasn’t taken action yet. They would be interested in his Bombardier Global 6000 private jet and multiple superyachts, including the $500m Nord, which Senator Bernie Sanders noted on Tuesday had been “sailing in the Seychelles region for more than 10 days” in a Twitter thread about Russian offshore wealth.

Roman Abramovich

Roman Abramovich, the longtime owner of Chelsea FC, has been described by a member of the UK parliament as a “ key enabler ” of Putin’s regime, which Abramovich has long denied. An orphan raised by his grandparents in Siberia, Abramovich pulled himself up by his bootstraps the old-fashioned way: wriggling into the inner circles of government and then profiting hugely by selling previously state-owned assets that he acquired after the fall of the Soviet Union.

The billionaire owns one of the world’s most outlandish yachts, complete with an onboard submarine and three helicopters. He has also owned a number of ultra-expensive properties in the United States, including a trio of buildings in New York City’s Upper East Side worth more than $90m combined, which he transferred to his third wife, Darya Zhukova, in 2018.

Abramovich is not currently under western sanctions. Earlier, the British prime minister, Boris Johnson, told the House of Commons that Abramovich was “already facing sanctions” though later said he “misspoke”.

This article was amended on 7 March 2022 to clarify that Leonid Mikhelson was on the New Museum’s board from from 2013 to 2017

Most viewed

PANDORA PAPERS

The oligarch’s accountants: how pwc helped a russian steel baron grow his offshore empire.

Longtime PwC client Alexey Mordashov was hailed as Russia’s richest man in 2021. The Pandora Papers reveal his ties to murky transactions with companies linked to a key Putin associate.

L ess than two decades ago, Forbes magazine crowned Russian steel magnate Alexey Mordashov — along with Oprah Winfrey and a Red Bull co-founder — one of the “new arrivals” in the world of billionaires. He was 37 and little known. His bio in the magazine said: “self made.”

Leaked files now reveal how, since then, the world’s second-largest accounting firm helped Mordashov become, by 2021, Russia’s richest man — with a net worth that Forbes estimated at $29 billion.

PwC has been by the steel tycoon’s side since he made his first billion dollars in the early 2000s, a highflier among the dozens of Western accounting and law firms that have eagerly served the oligarchs who have flourished during the Putin era.

PwC helped a holding company tied to Mordashov set up and administer more than 65 shell companies in the British Virgin Islands and other secrecy jurisdictions, according to the Pandora Papers trove obtained by the International Consortium of Investigative Journalists.

The Pandora Papers and other leaked documents analyzed by ICIJ show that Mordashov used this web of offshore companies to invest in European companies and, inside Russia, expand beyond the steel industry and take big stakes in the coal, logging and media industries.

The secret records also show these offshore companies engaging in transactions that moved large sums of money around the world in murky and suspect ways. These include at least four transactions involving companies linked to one of Russian President Vladimir Putin’s closest associates — deals that raise questions about Mordashov’s claims that he doesn’t have deep ties to Putin.

The Pandora Papers, a leak of more than 11.9 million confidential financial records obtained by ICIJ, describe how the Cypriot unit of PwC helped Mordashov build the offshore infrastructure of his business empire.

The advisers also helped him and his life partner, Marina Mordashova, register companies to own a 213-foot sport yacht and a Bombardier luxury jet. And in moments of crisis — such as the waves of sanctions that Western nations have imposed on powerful Russian people and companies since 2014 — PwC assisted the couple in restructuring ownership of their shell companies.

Most of the companies are affiliated with Unifirm Ltd., Mordashov’s holding company based in Cyprus — a favorite offshore hub for wealthy Russians.

Mordashov is one of a growing number of Russian oligarchs who have been sanctioned by the European Union and the United Kingdom in response to Russia’s invasion of Ukraine, which began on Feb. 24.

Like many other Russian oligarchs, the war and the sanctions have driven down his net worth. As of April 5, when Forbes published its latest annual rankings of billionaires, the magazine put Mordashov’s net worth at $13 billion — down by nearly $16 billion from last year. That dropped him to No. 5 on the list of Russia’s richest people.

The magazine ranked Vladimir Lisin, another steel tycoon, at No. 1 among Russian billionaires, with a net worth of $18.4 billion. Some observers speculate, however, that Putin — who keeps his true net worth under wraps — is actually Russia’s wealthiest man.

Mordshov’s main company, Severstal, is one of the country’s largest steel producers. It prides itself on making steel for armored vehicles and submarines for the Russian military. But Mordashov has repeatedly denied being close to Putin.

“I’m a private entrepreneur, have nothing to do with government,” he said in a 2018 interview with Bloomberg TV.

Mordashov did not respond to ICIJ’s questions for this story.

PwC is one of the elite global companies that play a crucial role in enabling the ultra-wealthy and politically connected to multiply their riches and avoid scrutiny. A 2020 ICIJ investigation showed how the firm worked for Isabel dos Santos, the daughter of Angola’s kleptocratic former president, disregarding red flags in her companies’ accounting as she made millions from deals approved by her father. PwC’s chairman, Bob Moritz, said he was “shocked and disappointed” by revelations that his firm advised companies owned by dos Santos.

Post-Soviet Russia has long been a favorite market for PwC.

In the years before the war in Ukraine, PwC reported that its Russian unit had worked with more than 2,000 Russian businesses, including 124 major companies whose total revenues accounted for nearly half of Russia’s GDP. Among them: Gazprom, the energy giant dubbed Putin’s “geopolitical tool;” Sberbank, Russia’s biggest state-owned bank; and Sibur, a petrochemical giant partly-owned by Kirill Shamalov, who is Putin’s former son-in-law, according to media reports.

In response to Russia’s invasion of Ukraine, PwC announced that the firm’s Russian unit will no longer be part of its global network and that its affiliates outside of Russia will “exit any work for Russian entities or individuals subject to sanctions.”

The Pandora Papers files show that PwC affiliates outside Russia have done as much as those inside Russia to help oligarchs close to Putin manage and shield their wealth.

- Contact ICIJ

Do you have a story about corruption, fraud, or abuse of power?

PwC’s Singapore unit was the auditor for the investment fund of Kirill Androsov, a former Putin aide, as well as for a London-based oil company in which Androsov’s fund had invested, the leaked files show.

PwC audited part of the real estate business of billionaire Oleg Deripaska,a Putin ally investigated for alleged financial crimes in Belgium, Spain, Greece and the U.S. In 2017, months before Deripaska was sanctioned by the U.S., PwC’s Cypriot unit helped him and his two children use the Mediterranean nation’s “golden visa” system to acquire Cypriot passports — and EU citizenship rights — by investing $3 million in the country’s real estate, according to a government report obtained by ICIJ partners at the Organized Crime and Corruption Reporting Project.

Deripaska denied wrongdoing and was not charged with any misconduct. His lawyer did not reply to questions from ICIJ.

In 2021, a PwC manager told a Cypriot government committee that, over the last decade, the firm had helped 217 rich foreigners become European citizens through the “golden visa” scheme, but denied that the firm had any involvement with “political figures,” according to a committee report.

We, as the public, rely on these professionals to be the gatekeepers and to do the right thing. They should vet their clients. — financial crime expert David P. Weber

David P. Weber, an accounting professor and financial crime expert at Salisbury University in Maryland, said accounting professionals have an obligation to make sure that they’re not helping clients who are involved in questionable business dealings or benefiting from relationships with corrupt governments.

“We, as the public, rely on these professionals to be the gatekeepers and to do the right thing,” Weber said. “They should vet their clients.”

PwC did not respond to ICIJ’s questions.

In an emailed statement, a spokesperson for the firm wrote that “PwC is currently in the process of exiting relationships with sanctioned individuals, sanctioned entities and entities controlled by sanctioned individuals.”

He added that the work PwC performs for its clients is “in line with all applicable laws, regulations and PwC’s own internal standards.”

‘The Tank’

Mordashov, the son of millworkers from the northern city of Cherepovets, rose to become the chief executive of Severstal at 31. He has an unflinching style, and some people call him “The Tank.”

In 2003, the young billionaire incorporated a holding company in Cyprus, later named Unifirm, that sits atop his web of offshore companies.

PwC advisers in the Cyprus office coordinated with Trident Trust, a company-formation agent in the British Virgin Islands, to help open Unifirm’s shell companies and keep them running.

The arrangement ー involving a “sandwich” of BVI subsidiaries and a Cypriot parent company with operations in Russia and other European countries ー was common for Russian companies that wanted to slash their tax bills by exploiting agreements between the governments of Russia, Cyprus and the BVI.

At different stages, the subsidiaries held shares in companies that owned American steel factories, Russian television channels, a German tour operator and wood-processing plants.

In 2006, Mordashov grabbed international attention when he announced that he was attempting the first-ever acquisition of a foreign company by a Russian conglomerate — a deal blessed by Putin and celebrated by then-Finance Minister Alexei Kudrin.

Mordashov lost the bid to acquire the company, a Luxembourg-based steel manufacturer. But the ambitious plan bolstered his image as a U.K.-educated entrepreneur open to doing business with the West. At the time, he described reports that he was friendly with Putin as a “big exaggeration,” but several Western media outlets declared that he was careful to keep on the right side of Russia’s president.

ICIJ’s review of the Pandora Papers files indicates that offshore companies within Mordashov’s empire have shuffled tens of millions of dollars to companies linked to a member of Putin’s inner circle: Sergey Roldugin, a cellist and longtime Putin friend.

ICIJ’s Panama Papers investigation, in 2016, identified Roldugin as a player in a clandestine network operated by Putin associates that moved at least $2 billion through banks and offshore companies. The associates frequently used questionable loans that were made without collateral and had no payment schedule.

The leaked records show that in 2007, one of the Mordashov group’s shell companies, Levens Trading, made a $6 million loan to a British Virgin Islands company owned by Roldugin. The $6 million loan from Mordashov’s company to Roldugin’s BVI company was later forgiven for $1, a document in the records indicates.

Under several contracts for “consultancy services” in 2009 and 2010, two shell companies gave $30 million to an entity controlled by Aleksandr Plekhov, an associate of Roldugin’s, in exchange for information about the “possibilities to invest into the Russian Federation” and the “peculiarities of tax and foreign currency legislation of Cyprus.” The Pandora Papers reveal that those shell companies were part of Mordashov’s Unifirm group.

Weber, the forensic accounting expert, reviewed at ICIJ’s request documents outlining the $6 million loan and the contracts worth $30 million. He said the use of the same directors for multiple companies, the low interest rate and the vague language of the consultancy agreements raise questions about the legitimacy of the transactions.

In late 2010, Dulston Ventures, another Mordashov shell company in the Unifirm group, wired $830,000 to a Roldugin-linked firm that ICIJ’s Panama Papers investigation identified as the lynchpin of the entire Putin financial network.

Details of the transaction, whose purpose appears to be a payment related to a 2008 loan agreement, are included in the FinCEN Files, a leak of more than 2,600 confidential banking records filed by bank compliance officers and obtained by BuzzFeed News, an ICIJ partner.

The FinCEN Files also provide details of another transaction that caught compliance officers’ attention and involved Mordashohv’s conglomerate, Severstal.

Over the course of two weeks in July 2013, a U.K.-based shell company, Stylemax Co. LLP, sent four wire transfers totaling about $1.2 million to Severstal in Russia, a bank report says. A compliance officer at BNY Mellon, the correspondent bank that processed the wire transfers, later flagged the transactions as “suspicious” because the U.K. company reported annual sales of only $24,000 in 2012.

An ICIJ analysis of U.K. registry records and leaked files found that Stylemax’s ownership had changed hands and that the company had belonged to individuals whom international investigators linked to at least three high-profile criminal cases.

Graham Barrow, a U.K.-based anti-money-laundering expert, said Stylemax appears to be a “general purpose passthrough account” for moving funds.

“The only reason you’d use an account like Stylemax is to disguise the source of those funds,” Barrow told ICIJ. It’s a “ ‘classic’ laundering account,” he said.

The leaked files don’t provide information about Stylemax’s relationship with Severstal or the purpose of the wire transfers.

A Severstal spokesperson said Mordashov “has always been conducting his activities in Russia and abroad strictly following Russian and international laws.”

- Recommended reading

OFFSHORE SECRECY

Pandora papers shed light on $1.4 billion russian sanctions mystery, mar 22, 2022.

RUSSIA ARCHIVE

List of oligarchs and russian elites featured in icij investigations, mar 20, 2022.

Putin image-maker’s role in billion-dollar cinema deal hidden offshore

Oct 03, 2021, pwc in the middle.

As Mordashov’s companies made deals with entities linked to Roldugin and received money from anonymous senders, the industrialist’s offshore empire grew, assisted by PwC advisers.

In a 2008 letter sent to Trident Trust , the offshore services provider, a PwC Cyprus manager said the accounting firm had been working with Mordashov for six years and vouched for him. “We know him to be a person of integrity, honesty and good character,” the manager wrote.

One of the Mordashov shell companies, which PwC helped administer, controlled U.S.-based Severstal Columbus Holdings LLC. The U.S. company, registered in Delaware, was part of Severstal’s North American unit, which owned steel plants in Maryland and other states.

Three of them, bought at the onset of the 2008 financial crisis, quickly became a burden for the Russian conglomerate. At the Sparrows Point plant, near Baltimore, Severstal suspended hundreds of jobs as workers complained about expired contracts and aging facilities.

In 2011, Severstal decided to sell the Sparrows Point plant and two more struggling American facilities to RG Steel, an American steel producer, but a legal dispute arose between the prospective buyer and seller.

RG Steel accused Severstal of failing to disclose outstanding debts to vendors and other accounting discrepancies, including a $538,000 valuation assigned to steel slabs and other inventory that RG Steel deemed worthless. As a result, RG Steel argued that the initial purchase price was inflated by $83 million. Severstal contended that the difference between RG Steel’s valuation and the initial purchase price was attributable to different accounting methods.

The companies decided to have PwC arbitrate the matter. In a confidential engagement letter examined by ICIJ, PwC reported, after a review of its work with both companies: “We are not aware of any situations that, in our view, constitute a conflict of interest or would influence our decision as Arbitrator.”

In the letter, PwC acknowledged that it had advised Severstal’s U.S. unit on some insurance claims. What the letter didn’t say, however, was that its Cypriot unit had been providing services for a decade to more than 60 shell companies tied to Mordashov.

GIVE TO HELP US INVESTIGATE!

Weber, the financial crimes expert, said PwC may have violated ethics rules on objectivity and independence if it did not disclose the entire scope of its work for the head of Severstal.

RG Steel “was entitled to know this,” Weber said.

In 2013, another firm replaced PwC as arbitrator after the PwC resigned “due to a conflict of interest involving RG Steel,” court records say. A former PwC partner took over the case at the new firm.

Months later, Severstal and RG Steel settled the matter. The Russian company agreed to pay $30 million to the American steelmaker, which had declared bankruptcy in May 2012, citing “deterioration” of the steel market.

‘The mother of his children’

In 2014, Russian forces invaded Crimea. Putin declared that it was part of Russia.

In response, the EU, the U.S. and other Western powers imposed financial restrictions on some banks close to the Kremlin. One of them was Bank Rossiya.

Mordashov’s Severgroup, which bought a stake in Rossiya in 2003, is still one of the bank’s shareholders, owning about 5.8%, according to the last available financial statement. The U.S. Treasury Department describes Rossiya as the “personal bank” of Putin’s inner circle.

In 2014, other bank shareholders included Roldugin, the cellist and godfather of Putin’s eldest daughter Maria Vorontsova; Yury Kovalchuk, dubbed Putin’s “personal banker;” and Svetlana Krivonogikh , a former hotel cleaner-turned-millionaire, who, according to an independent Russian news outlet, once had a romantic relationship with the president.

The bank dismissed the impact of sanctions on its business, saying the U.S. action, in particular, “has not had a substantial effect on the bank’s financial positions.”

None of Mordashov’s businesses were blacklisted in 2014.

The first blow to his business empire came in 2018, when the U.S. imposed sanctions on Russian individuals and companies, for their role in Russia’s “malign activity around the globe,” including interfering with the 2016 U.S. election, occupying Crimea and supporting Bashar al-Assad’s regime in Syria.

With a sanctions announcement impending, Mordashov told Bloomberg TV: “Am I preparing myself?” he said. “Not much, because I don’t know what I can do.”

The U.S. sanctions in 2018 hit his company Power Machines, which supplied gas turbines to a Russian joint venture operating in Crimea.

Mordashov was not sanctioned, but his offshore strategy changed, the Pandora Papers reveal.

About three months after U.S. sanctions were announced, a woman who has been described as his “life partner,” Marina Mordashova, became the owner of a company in the British Virgin Islands, Ranel Assets Ltd . The company’s declared purpose was “investment of earned income into financial instruments (deposits, options, forwards) in order to earn income in the form of interest.” Interest income is tax-exempt in the BVI, one of the world’s leading offshore havens.

PwC’s Cyprus unit helped Mordashova with the paperwork necessary to open Ranel Assets. A PwC officer in Cyprus listed himself as her contact person in the “supporting documentation” for her company, the leaked records show.

Marina Mordashova’s shares in Ranel Assets were worth about $40 million at the time, according to the files. The funds’ source was Mordashov, a document notes. “She is the mother of his children,” it says.